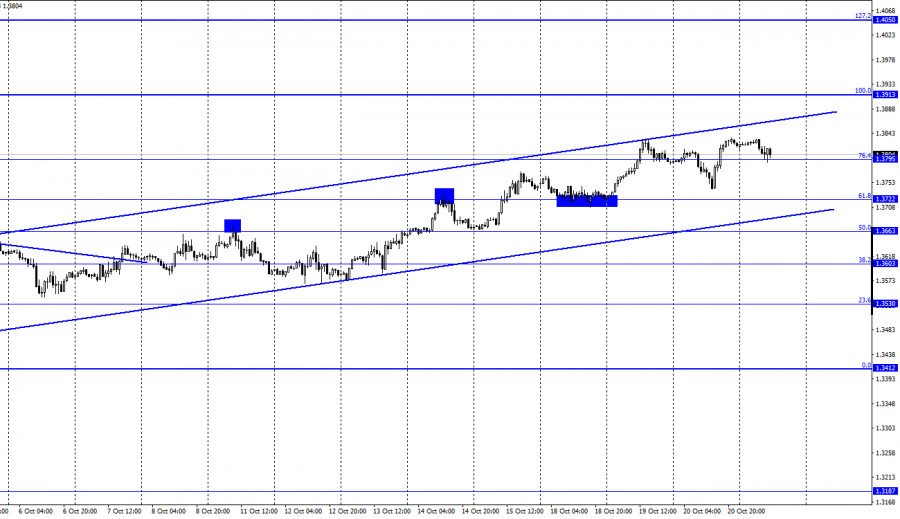

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the British and a new close above the corrective level of 76.4% (1.3795). Thus, the growth process can be continued toward the corrective level of 100.0% (1.3913), especially if there is a rebound from the 1.3795 level. Closing quotes below the level of 1.3795 will allow us to count on a slight drop in quotes in the direction of the level of 1.3722. The upward trend corridor continues to keep traders' mood bullish. Meanwhile, the information background for the pound remains both weak and important at the same time. There have been no important economic events and reports in the last few years.

On the other hand, a wave of the coronavirus pandemic is beginning (or continuing) worldwide. Most interestingly, this also applies to the UK, where the entire adult population has been vaccinated for a long time. However, people continue to get sick and die. According to the Johns Hopkins website, 1064 thousand people have fallen ill in the UK over 28 days, and 3.5 thousand have died. In terms of morbidity, Britain now ranks second in the world after the United States. Thus, as we can see, vaccination only reduces mortality rates and the number of complications of coronavirus disease. But it does not protect against infection.

Consequently, the British economy may also face problems in the form of a slowdown in growth in the near future. Lockdowns have already been introduced in some European countries. If the situation continues to deteriorate, then strict restrictions may be imposed in the richer countries of Europe. Also, this morning, it became known that the net loans of the British government amounted to 21 billion pounds in September, which is 5 billion more than in August. No other economic reports are scheduled for today. So far, traders are not paying attention to the situation with the coronavirus in the world, and they have nothing else to pay attention to yet. However, the US dollar may start to rise again if the situation worsens.

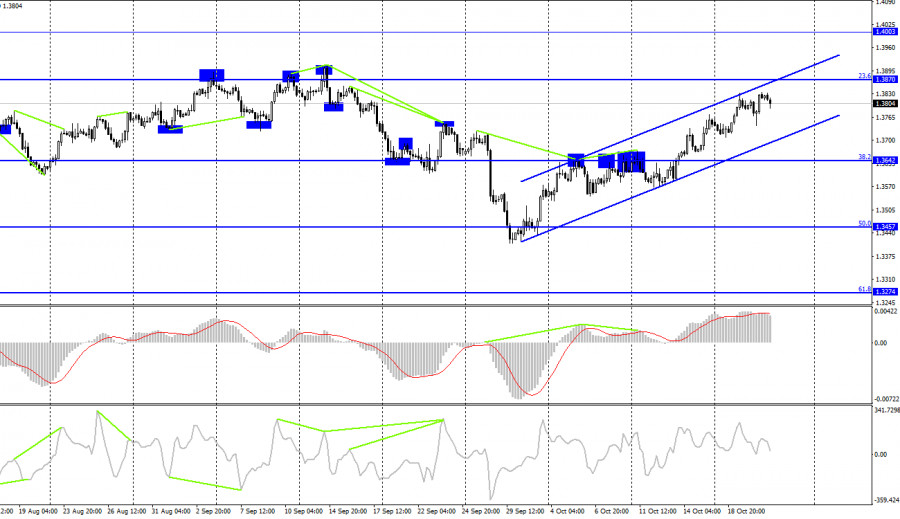

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed a rebound from the upper limit of the corridor and a reversal in favor of the US currency, but the fall did not last long. At the moment, the quotes continue the process of growth in the direction of the corrective level of 23.6% (1.3870), being inside the ascending corridor, which continues to keep the mood of traders "bullish." Closing under the ascending corridor will allow you to count on a long fall of the pound/dollar pair.

News calendar for the USA and the UK:

UK - the net amount of borrowed funds of the public sector (06:00 UTC).

US - Fed-Philadelphia manufacturing index (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

US - FOMC member Christopher Waller will deliver a speech (13:00 UTC).

One report has already been released in the UK on Thursday, and there will be no important reports in the US today. But there will be another speech by a member of the FOMC. The information background will be extremely weak today.

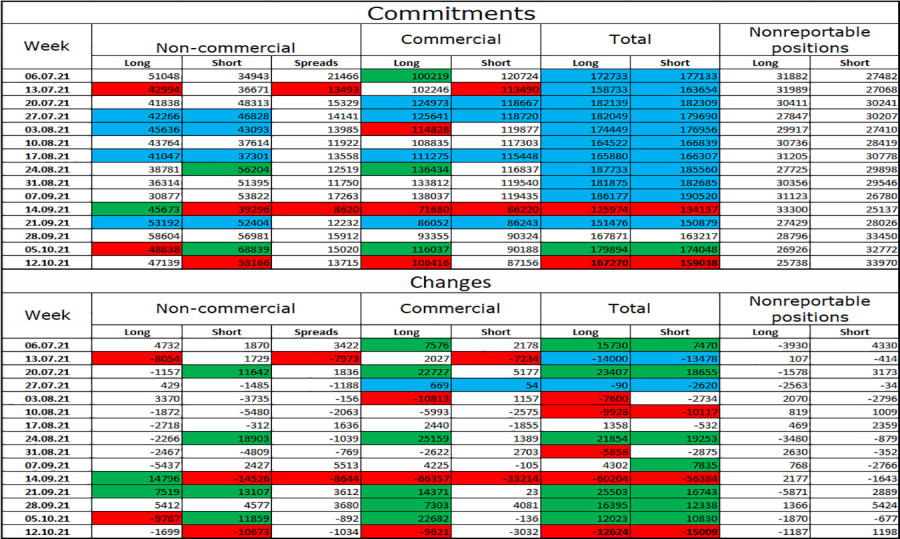

COT (Commitments of Traders) report:

The latest COT report from October 12 on the pound showed that the mood of the major players had become much more "bullish." In the reporting week, speculators closed 1,700 long contracts and 10,673 short contracts. Thus, the "bearish" mood has become much weaker. Nevertheless, the number of short contracts concentrated in the hands of speculators still exceeds the number of long contracts by 11 thousand. It still indicates a fairly strong "bearish" mood. Thus, we can expect a resumption of the fall of the British dollar in the near future. However, the current growth of the British dollar corresponds to the actions of speculators in the last week. And both upward trend corridors support the further growth of the British dollar.

Forecast for GBP/USD and recommendations to traders:

I recommend new purchases of the British when rebounding from the level of 61.8% (1.3722) or the lower boundary of the corridor on the hourly chart with targets of 1.3795 and 1.3913. I recommend opening sales if there is closure under the ascending corridor on the hourly chart with targets of 1.3603 and 1.3530.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.