Analyzing trades on Wednesday

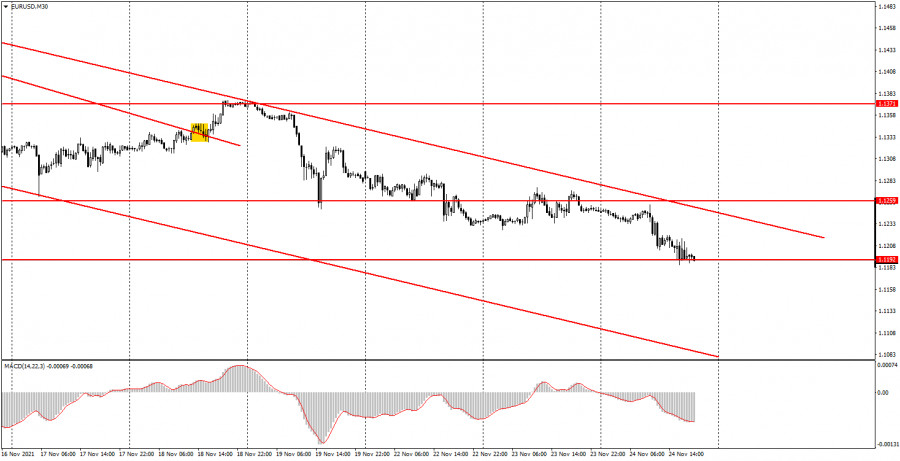

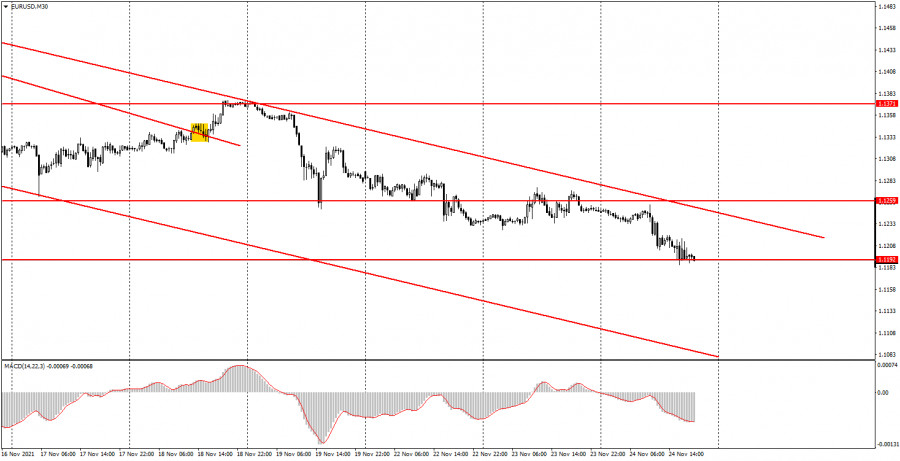

EUR/USD on 30M chart

On Wednesday, the EUR/USD pair continued to move steadily lower within the current downtrend. Let's recall how the pair traded just a month or two ago. Now the pair is demonstrating how a proper trend movement looks like and how trading should be. In our previous reviews, we have already discussed why the euro fell sharply lower and the US dollar advanced. Among the main reasons for this are the new pandemic wave in the EU, the ECB's refusal to raise the key rate next year, Christine Lagarde's ultra-soft rhetoric, and high expectations of the markets regarding the tightening of the Fed's monetary policy. All these factors have triggered a strong sell-off in the pair at some point. Maybe the downtrend is not very strong but still steady. Therefore, over the past 8-9 trading days, the pair went down by 400 pips. It declined by about the same amount over the previous two months. I would like to note the macroeconomic data published today. Although the data was rather important, markets paid almost no attention to it. There was a slight surge during the publication of the GDP report and the report on durable goods orders (first tick mark in the picture below).

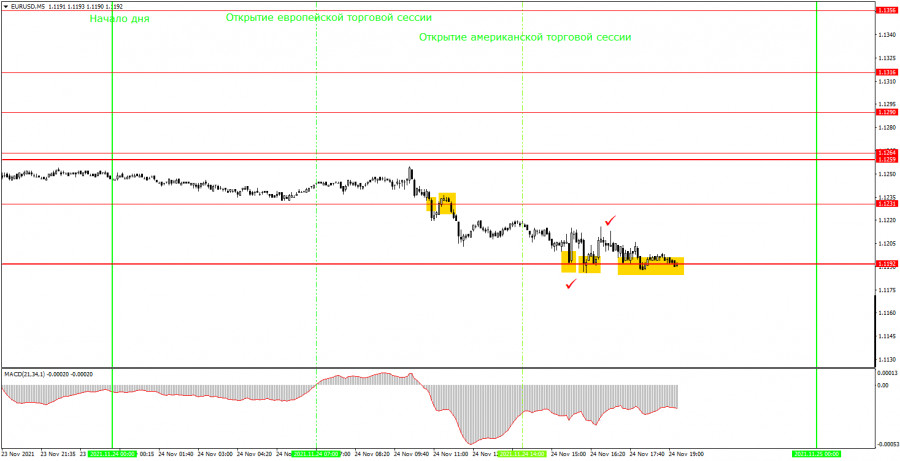

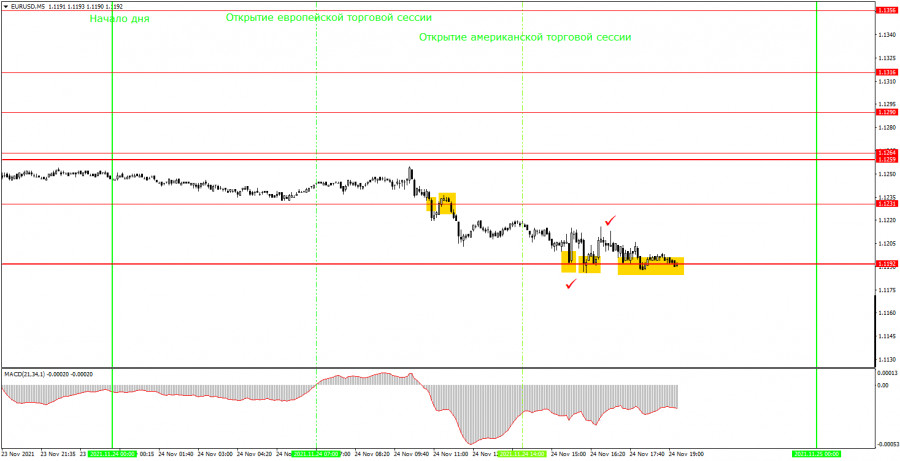

EUR/USD on 5M chart

On the 5-minute time frame, the technical picture was average on Wednesday. There was a downward movement, but it did not work out from the very beginning. Notably, a decline in the European currency was observed mainly in the first half of the day when there was no news either in the US or in the EU. In the second half of the day, the pair's downward movement was much more moderate. Now let's discuss the trading signals. The first sell signal was formed when the price broke through the 1.1231 level. Half an hour later, the signal was repeated as the price bounced off it from below. Therefore, novice traders had to open short positions at this moment. They should have been closed around the level of 1.1192 before the release of the US economic data as it could provoke a strong price fluctuation. So, we managed to earn 17 pips on the first trade. The first buy signal near the level of 1.1192 should have been ignored, since it was formed exactly at the time of the publication of the US GDP report. The second buy signal could be followed. Yet, it did not bring any profit as the price returned to the level of 1.1192 very soon where it spent the rest of the day. Nevertheless, the price still managed to rise by 15 pips which was enough to place a Stop Loss order at a breakeven point where positions were closed. Thus, today we managed to get the minimum profit.

Trading tips on Thursday

On the 30-minute time frame, the downtrend prevails. The downward movement is likely to continue. Therefore, selling the instrument should be a priority in any trading system before the pair settles above the channel. On the 5-minute time frame, the key levels for November 25 are located at 1.1192, 1.1231, and 1.1259 - 1.1264. There are simply no levels below since the price has not been there for about a year. Take Profit should be set at a distance of 30-40 pips. Stop Loss should be placed to a breakeven point as soon as the price passes 15 pips in the right direction. On the M5 chart, the nearest level could serve as a target unless it is located too close or too far away. If it is, then you should act according to the situation or trade with a Take Profit. On Thursday, ECB President Christine Lagarde will give a speech, and this is the only event to pay attention to during the day.

Basic rules of the trading system

1) The strength of the signal is determined by the time the signal took to form (a bounce or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on false signals (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only given that volatility is strong and there is a clear trend that should be confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trend lines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.