Today's review of the GBP/USD currency pair will begin with a rather difficult relationship between the UK and the European Union, which was quite expected after the United Kingdom left the EU. When a husband and wife separate, very often everyone strives to cut off more jointly (and not only jointly) acquired property. During this unpleasant process, some reproaches, claims, and even insults are constantly heard. Approximately the same thing happens, of course, at a completely different, non-domestic level and after the divorce process between the European Union and the UK. Each of the parties believes that it was given fewer preferences after parting, in other words, deprived. At the same time, it's no secret that after Brexit, several unresolved issues remained between the United Kingdom and the European Union, in particular in the field of fishing and the movement of goods across the Northern Irish border. And then there was the problem of migrants arriving in the UK from France across the English Channel.

London is very unhappy and concerned about this situation, actually demanding that France return migrants to where they came from, that is, to the territory of the French Republic. However, this does not give any result yet, and the number of migrants seeking to enter the territory of the United Kingdom through the English Channel is steadily increasing. At the moment, there are more than 25,000 illegal migrants who have reached the UK in this way. Another acute problem between these countries remains fishing, or rather, the issuance of fishing licenses. The French believe that they are being deprived and London allocates fewer licenses than previously discussed. French fishermen tripled the protests and even blocked the tunnel under the English Channel for a while. In general, historically, the already difficult relationship between Britain and France has escalated again. I do not exclude that the contradictions between the EU and the UK create additional pressure on the pound sterling.

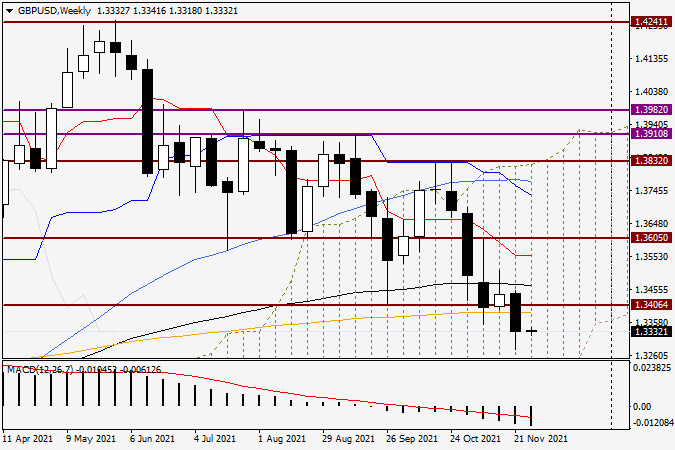

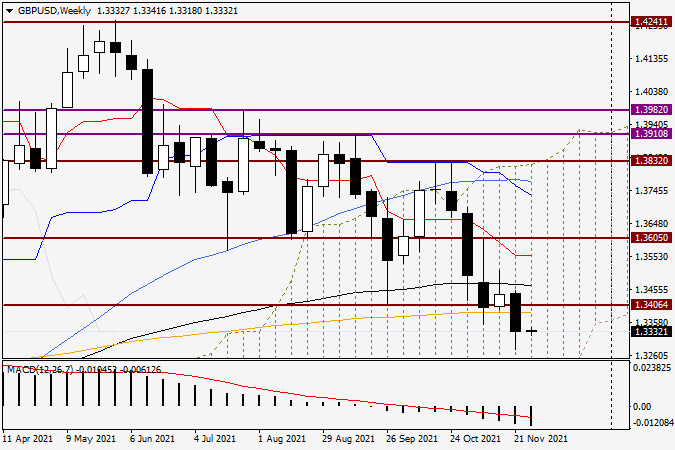

Weekly

Unfortunately for the bulls on the pound, but the "Briton", unlike the single European currency, suffered quite significant losses against the US dollar at the auction on November 22-26. As a result of the decline, GBP/USD fell below the significant support zone of 1.3400-1.3410 and ended trading last five days at 1.3332. At the same time, it should be noted that a strong technical level of 1.3360 was passed down, as well as the orange 200 exponential moving average. Although only one bearish candle has closed below all of the above, the quote is steadily approaching the lower boundary of the Ichimoku indicator cloud, the true breakdown of which will only further strengthen the bearish sentiment for GBP/USD. For a bull market for the pound/dollar pair, it is necessary to return a quote above the important psychological level of 1.3500, after which a true breakdown of the Tenkan red line, which runs at 1.3555, is carried out. At this point, these tasks seem extremely difficult, therefore, if we summarize the consideration of the weekly timeframe, the most likely scenario looks like a downward one.

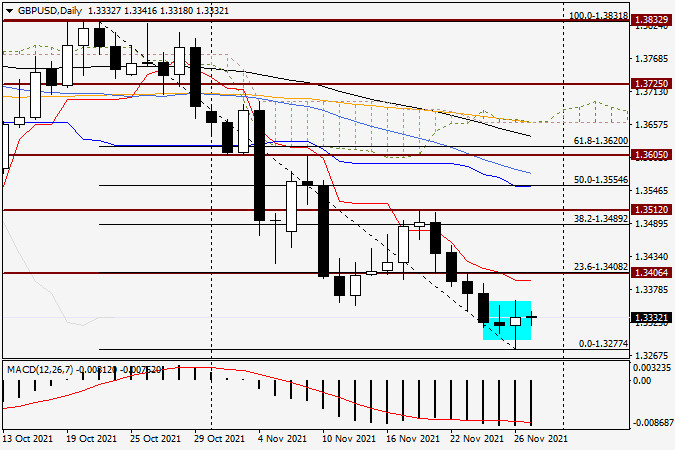

Daily

However, on the daily price chart, the last two highlighted candles indicate that the market is tired of the downward route and it is quite possible, if not a reversal, then a corrective pullback of GBP/USD to the broken support zone of 1.3400-1.3410. The probability of such a course of trading, or rather, for a possible corrective pullback, is also indicated by the level of 23.6 of the Fibonacci grid, stretched to a decrease of 1.3833-1.3277, which runs at 1.3408, as well as the red Tenkan line, located under the significant level of 1.3400. At the moment, I suggest waiting for a corrective pullback to the broken support zone of 1.3400-1.3410 and, in case of a reversal of bearish candlestick analysis patterns, consider options for selling the British pound sterling. So far, this is the main trading idea for GBP/USD. Tomorrow, taking into account the consideration of smaller schedules, some adjustments may be made.