Yesterday, the pound sterling started gaining in value just from early morning. Firstly, the rise was quite modest but then it accelerated. The increase was mainly caused by rumors about oil. The European Union has long been discussing the placement of embargo on Russian oil and gas. This fact is worrying investors, who know that Europe does not have other suppliers of energy resources. Such a decision may lead to stagnation in the European economy. Notably, on Monday, the EU opened negotiations on a new package of sanctions against Russia. Most officials said that the embargo would be the key topic of the talks and that the issue was almost settled. However, Europe has not unveiled the details of the sixth package of sanctions yet.

It is obvious that not all the EU members support the idea. Yesterday, the G7 countries made an announcement, which might allow the EU not to ban Russian oil supplies. The G7 countries were discussing the creation of a special cartel of oil buyers. US Treasury Secretary Janet Yellen emphasized that the purpose of the cartel is to set a price threshold for Russian oil. It means that the European Union will hardly place embargo on Russian oil as this contradicts the idea of oil prices regulation. Thus, Europe will have every chance to avoid a fully-fledged energy crisis.

However, the news will support the European currencies only for a short period of time as the G7 countries voiced only their intention without any details. Even Janet Yellen admitted that it was just a plan. Meanwhile, the Fed's policy is a real fact that has a considerable influence on the current situation. According to Jerome Powell, the regulator is going to raise the benchmark rate by 0.50% at the next meeting. It means that demand for the US dollar will continue rising. Today, traders may resume buying the greenback.

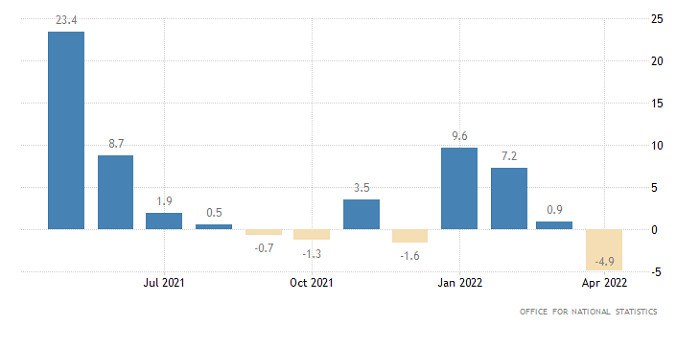

What is more, the pound sterling has a lot of reasons for a decline. Retails sales, which earlier increased by 0.9%, dropped by 4.9% on a yearly basis. Although economists had expected a slump of 8.4%, consumer activity, that is the main driver of the UK economic growth, has tumbled. There is no doubt that it is a result of record high inflation. A jump in consumer prices caused a considerable drop in sales. This, in turn, will lead to a decline in all other macroeconomic indicators, thus exerting pressure on the pound sterling.UK Retail Sales

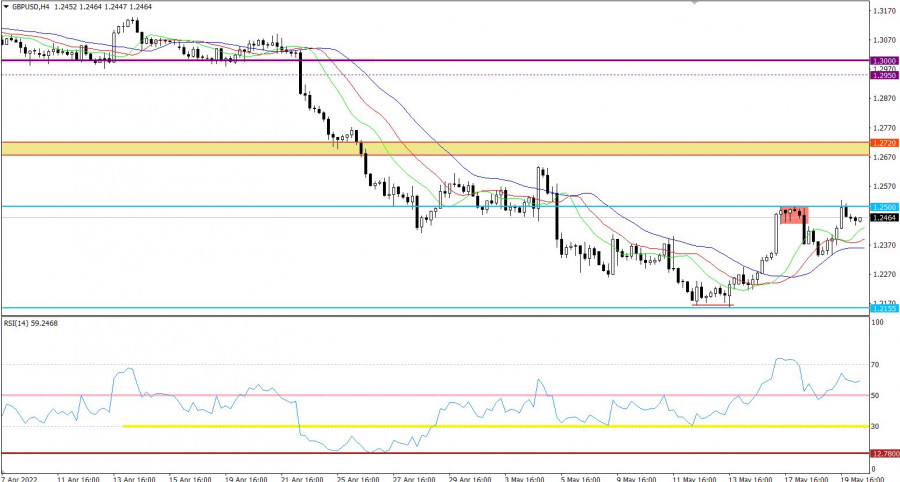

The pound/dollar pair failed to settle below 1.2300. The pair did not allow the US dollar to recoup losses and approached the resistance level of 1.2500.On the four-hour chart, the RSI technical indicator is moving in the upper area of 50/70, signaling bullish sentiment among traders. On the daily chart, the indicator is moving below the mid 50 line, thus pointing to zero signals about a further correction.

On the four-hour chart, the Alligator's moving averages are directed upward, thus reflecting a correctional movement. On the daily chart, the indicator is signaling about a slowdown in the downtrend. However, there is no signal about a change in market sentiment.

A slowdown in the correctional movement near the resistance level points to significant bearish pressure. Traders are opening more and more short orders, while the pair is approaching the control level. This action may lead to the price drop, thus allowing the greenback to recoup its losses.

The alternative scenario will become possible if the price returns to the resistance level of 1.2500. In this case, the pound/dollar pair will get a second chance to prolong its upward correction.

In terms of the complex indicator analysis, we see that technical indicators are signaling buy opportunities on the short-term and intraday periods amid the correctional movement. On the mid-term period, the indicator is still providing sell signals since the downtrend is still in force.