The last two weeks have seen a weakening of the dollar and the growth of European currencies. The EUR/USD pair moved away from five-year lows and rose by more than 350 points, settling in the area of the 7th figure. At the same time, the bulls could not overcome the resistance level of 1.0760, which corresponds to the upper limit of the Bollinger Bands indicator on the daily chart and the Kijun-sen line on the W1 timeframe. Situational support for the dollar was provided by the core inflation index PCE – it came out at 4.9%, that is, at the forecast level. This fundamental factor can hardly be classified as positive, because the de facto most important inflation indicator has been slowing its growth for the second consecutive month. But the fact that it is still at a high level (in the area of 39-year highs) enabled the EUR/USD bears to organize a small counterattack. As a result, the pair ended the trading week under the resistance level of 1.0760.

In general, dollar bulls have lost their former confidence. Looking at the weekly chart, we will see that for a month and a half (from the beginning of April to mid–May), the pair was within a pronounced downward trend - in six weeks, the price decreased by almost 700 points. The dollar strengthened its position mainly due to the growth of anti-risk sentiment, as well as against the background of aggressive rhetoric from Federal Reserve members, who vied with each other to announce the active pace of interest rate hikes. The European Central Bank, in turn, showed an indecisive position. This combination of factors enabled EUR/USD traders to come close to the support level of 1.0340. The last time the price was in this area was in 2017. However, here the downward momentum began to fade gradually. The bears did not dare to storm this price line without additional information support. After a pause, bulls seized the initiative, especially since the information background also changed, and not in favor of the greenback.

For example, dollar bulls were alerted by the minutes of the Fed's May meeting. The members of the central bank made it clear that they do not rule out the option of revising their aggressively hawkish position. After several (most likely three – including the May increase) rounds of interest rate hikes, the Fed may take a pause to re-assess the state of the economy in the context of further actions. The text of the document contains an unambiguous phrase that is worth quoting in its entirety: "a faster curtailment of accommodation leaves the central bank "in a convenient position" so that the members can assess later this year what further adjustments are needed."

It should be noted here that the widely announced 100-point rate hike following the results of the two subsequent meetings (in June and July) has already been partially taken into account in prices. Therefore, such restrained rhetoric of the Fed minutes disappointed EUR/USD bears. Thanks to this fundamental factor, the price overcame the 1.0700 milestone and settled in the area of the 7th figure.

The external fundamental background also does not contribute to the strengthening of the greenback. The last week of May was marked by a certain fracture: the craving for risk has increased, and the demand for a safe dollar has decreased. In particular, the US stock market closed again with growth on Friday: The Dow Jones rose 1.76%, the S&P 500 gained 2.47%, and the NASDAQ Composite index rose 3.33%. The reason for optimism was US President Joe Biden's recent statement that the White House is considering the possibility of lifting some duties on Chinese imports. He promised to consult on this issue with the head of the Ministry of Finance Janet Yellen (who is a supporter of partial "amnesty") and make an appropriate decision. And although not everyone in the presidential administration supports this idea (in particular, US Trade Representative Katherine Tai opposes it), Biden's words provoked the growth of stock indices against the background of a general increase in risk appetite. The dollar, accordingly, was under pressure.

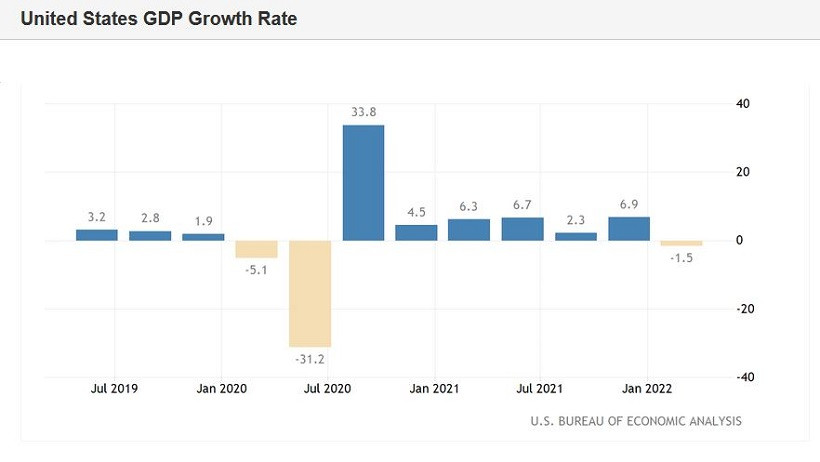

In addition, updated data on the growth of the American economy in the first quarter of this year were published last week. The indicator was revised downwards. According to the second estimate, the volume of US GDP decreased by 1.5%, while the initial analysis indicated a reduction of 1.4%. This is the worst result since the second quarter of 2020, when the coronavirus pandemic and the economic downturn caused by it led the economy into recession with the US economy falling by almost 32%.

This fact also put pressure on the greenback. According to some experts, signs of a slowdown in economic growth in the United States will force the Fed to reconsider its aggressive policy after two rounds of 50-point hikes. If the US economy also disappoints in the second quarter, Fed members may take a break in the process of tightening monetary policy. Actually, this assumption is consistent with the main theses of the aforementioned minutes of the Fed's last meeting.

The European Central Bank also provided support to EUR/USD bulls. On Monday, ECB President Christine Lagarde specified the expected scenario of tightening monetary policy. According to her, the ECB may increase the deposit rate to zero by the end of September, "after which further increases are possible." This means that the ECB will raise rates following the results of the July meeting, as well as in September, then assessing the dynamics of inflationary growth in the eurozone.

Thus, the EUR/USD pair is growing quite reasonably: the information background contributes to this. However, it is advisable to open longs only after bulls overcome the resistance level of 1.0760 (the upper limit of the Bollinger Bands indicator on the daily chart and at the same time the Kijun-sen line on the W1 timeframe). On Friday, EUR/USD bulls did not have enough strength to break through this barrier. If they fail to pass this level on impulse next week, short positions with 1.0700 and 1.0650 as targets will be prioritized.