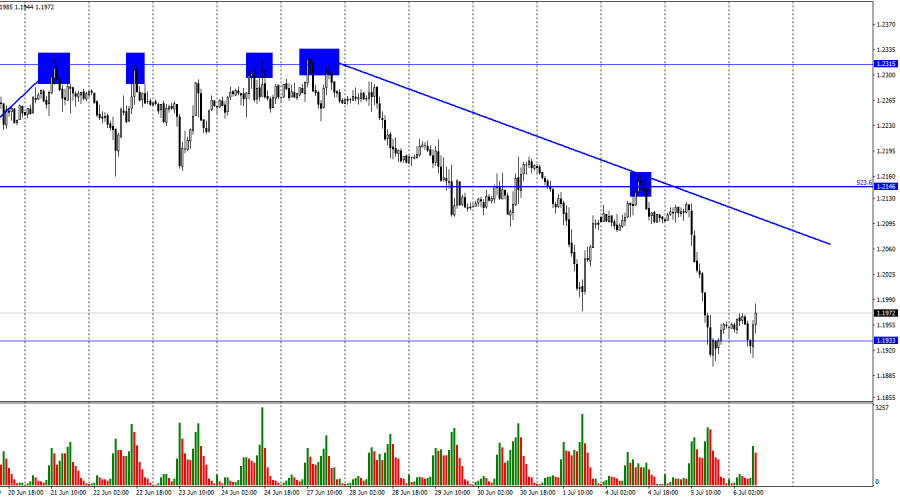

On Tuesday, the GBP/USD pair rebounded from 1.1933 on the hourly chart, so yesterday's decline did not continue today. There have been two rebounds from the level of 1.1933, giving the British some hope for a slight increase in the direction of the downward trend line, which characterizes the "bearish" sentiment of traders. Let me remind you that focusing on the signals, trend channels, and lines on the 4-hour chart is currently preferable. Yesterday morning, it appeared that the report on business activity in the United Kingdom's services sector was responsible for the recent decline of the British pound. From my perspective, this is impossible, as the report itself is not significant enough to cause such movements. A short time later, it was revealed that the Bank of England had published a report stating that the outlook for the global economy had recently deteriorated significantly and that an increase in energy prices had accelerated inflation worldwide.

The Bank of England intends to conduct annual stress tests for commercial banks to assess the potential effects of future interest rate hikes and a potential recession. Andrew Bailey, the Governor of the Bank of England, stated that there is now a great deal of economic uncertainty, and the regulator will closely monitor any changes to respond promptly. The Bank of England report also stated that despite unfavorable economic conditions, most households and businesses must deal with a growing financial burden and rising prices. However, the Bank of England recognizes that rising energy costs, supply chain issues, and a possible recession will negatively impact the balance sheets of most businesses. From my perspective, traders needed to obtain this information. It is abundantly clear that the Bank of England is awaiting a slowdown in economic growth, will continue to raise interest rates, and is preparing for the worst. When inflation begins to decline is uncertain. And I do not comprehend why the pound fell yesterday, given that the same recession risks exist in the United States.

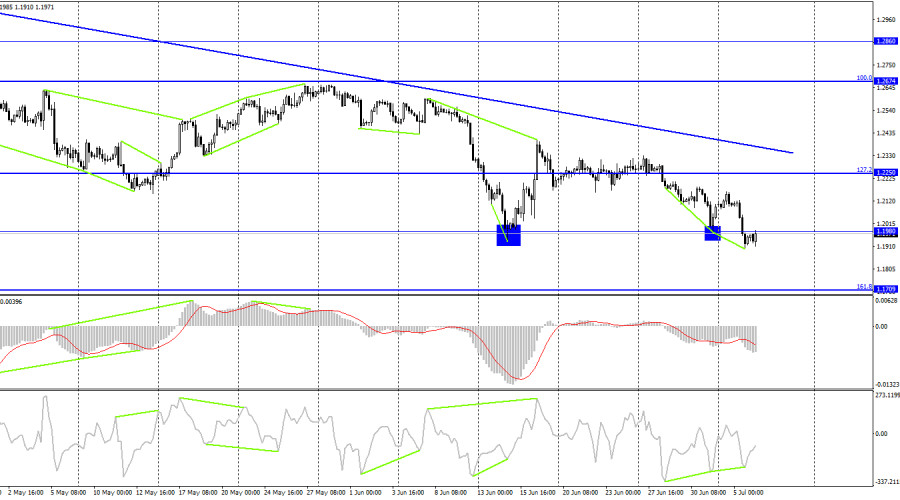

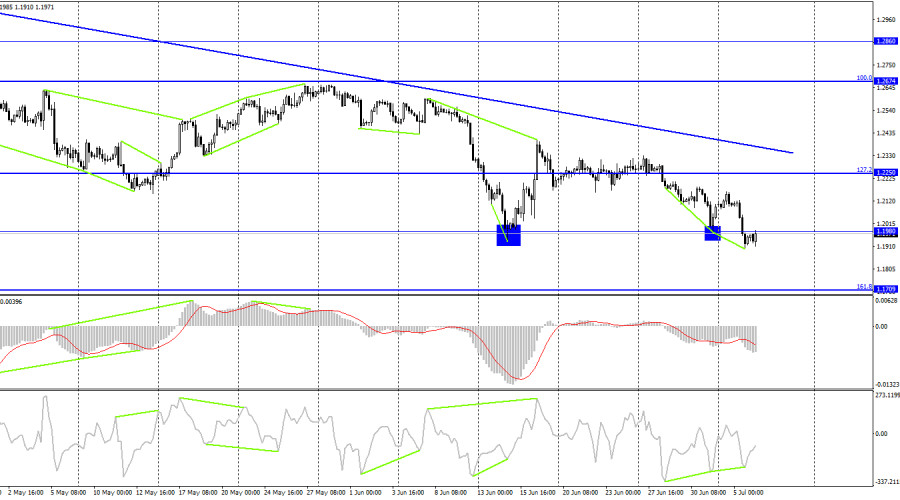

On the 4-hour chart, the pair executed a new reversal in favor of the US dollar and found support below the 1.1980 level. Consequently, the falling process can continue in the direction of the subsequent corrective level of 161.8% (1.1709). Nonetheless, the formation of a "bullish" divergence in the CCI indicator allows us to anticipate a reversal in favor of the British pound and growth in the direction of the Fibonacci level of 127.2%, or 1.2250. The sentiment of traders remains "bearish" in general.

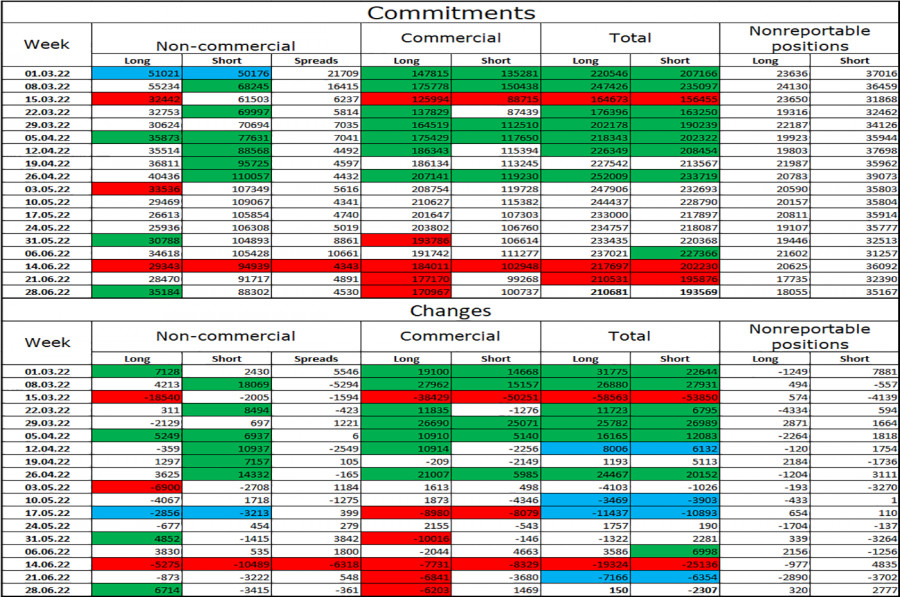

Report on Commitments of Traders (COT):

Over the past week, the sentiment of "Non-commercial" traders has become slightly more "bullish." The number of long contracts held by speculators increased by 6,714 contracts, while the number of short contracts decreased by 3,415 contracts. Thus, the general sentiment of the major players remained unchanged at "bearish," and the number of long contracts continues to outnumber short contracts by several factors. Most major players continue to shed pounds, and their mood has not changed significantly recently. Consequently, I believe the British pound could continue to decline over the next few weeks. A significant disparity between the number of long and short contracts may signal a trend reversal, but the context of the information is currently of greater importance to major players. And it continues to be against the Briton. To date, it makes no sense to dispute that speculators sell more than they purchase.

News calendar for the United States and the United Kingdom:

UK - index of business activity in the construction sector (08:30 UTC).

US - ISM Purchasing Managers' Index for the USA's non-manufacturing sector (14:00 UTC).

US - publication of FOMC protocols (18:00 UTC).

On Wednesday, the United Kingdom released a report on the construction industry's business activity, which was 52.6. It is now necessary to await the ISM index in the United States and the release of the FOMC protocol. I believe that the influence of today's informational context will not be significant.

GBP/USD forecast and trader recommendations:

On the hourly chart, I suggested selling the British pound when it rebounded from the level of 523.6% (1.2146) - with a target of 1.1933. This objective has been attained. New sales – under 1.1933 at the close, with a target of 1.1709. I suggest purchasing the British pound when the price closes above the trend line on the 4-hour chart, with a target of 1.2674.