The overall GBP/USD currency pair is steadily rising and is within the side channel on the 24-hour TF. Recall that even in the absence of good fundamentals, the pair can increase to a level of 1.2440. Naturally, such sudden growth appears unusual, but it is flat. On the 4-hour time frame, it appears as a strong trend rather than a flat. But once again, we think that the pound's rise is largely speculative. If we look at all the most recent statistics, the majority of them have nothing to do with the British pound at all. In both the United States and the European Union, banks have failed. In both the US and the EU, appropriate decisions were made to stabilize the banking sector. There have been no "resonant" or at least "hawkish" judgments by the Bank of England. Instead, it adopted the most submissive attitude. Core inflation in the UK is rising once more and has not stopped increasing. The British population is dissatisfied with the state of the economy and wants wages to rise, while the government thinks salaries should rise more slowly so as not to push inflation to a new level of growth. As you can see, despite 11 hikes in the BA rate, inflation has not been able to go below 10%. As a result, there are a few reasons for the pound to rise at this time.

In addition, we would like to draw attention to how quickly the value of the euro and the pound has increased. We have previously stated numerous times that the entire movement of the second half of 2022, for both the euro and the pound, appears to be unfounded and moving too quickly. The same image may now be seen, but it was already on the 4-hour TF. The Fed was forced to make the difficult choice to purchase about $300 billion in bonds, which will undoubtedly be printed and may cause the dollar to weaken. But how much additional pressure will this issue exert on the US dollar? After all, even with a 5% rate increase, the American economy is still doing well.

The Bank of England is no longer trying.

In general, Mr. Bailey reported nothing significant following the BA meeting. We repeatedly heard statements like, "Everything necessary will be done to lower inflation," and similar phrases. There is nothing new. Such claims have been made for almost a year now. However, as we can see, the outcomes of the three central banks varied marginally. And the British Central Bank is in the most challenging circumstances. The fever in Britain is still going strong. Perhaps this is not evident; after all, we are not discussing Zimbabwe, but rather a nation with one of the greatest levels of life in the entire globe. Nevertheless, issues are now visible everywhere. It's uncertain what to do about inflation. It's unknown how to handle widespread strikes and protests. It's also uncertain how to handle the ongoing political turmoil. Many people groaned stoically when Rishi Sunak, who is first and foremost a financier, assumed that Mr. Sunak would immediately correct the situation. However, it turned out that Mr. Sunak and his associates do not care about the British people and will raise taxes, cut spending, and do whatever they can to enhance the status of the nation's economy. The Labour Party, which has always given regular workers greater attention, has a strong chance of winning the upcoming parliamentary elections. And if the Labor Party wins, the nation's political course will alter once more. Over the past seven years, Britain has experienced many leadership changes. As a result, decisions that are at odds with one another are frequently taken. What value do Rishi Sunak's statements that he will pursue a path of reconciliation with the European Union and views the outcome of the 2016 referendum as a "mistake" have? If it was a "mistake," the UK paid a steep price for it.

Well, by raising the rate in March by just 0.25%, the Bank of England effectively declared victory over inflation. Someone would argue that such a choice is inevitable and that the price cannot be increased further. And if you consider the situation of the economy, they are likely to be correct. However, if after 11 rate hikes, it has barely fallen by 1%, inflation from 10% to 2% will not return even in 5 years.

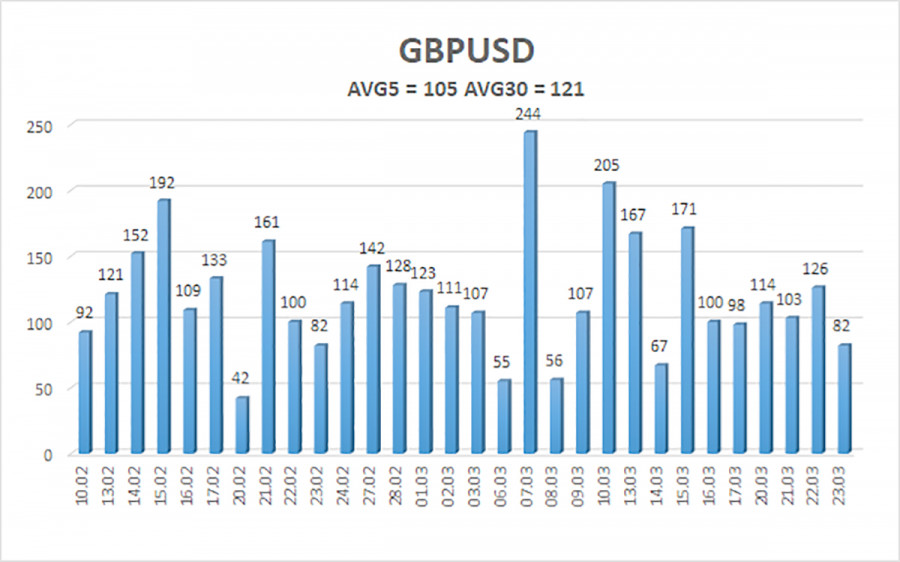

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 105 points. This figure is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Friday, March 24, with the levels of 1.2183 and 1.2393 acting as resistance. The Heiken Ashi indicator's upward reversal indicates that the upward movement has resumed.

nearest levels of support

S1 – 1.2207

S2 – 1,2085

S3 – 1.1963

Resistance levels that are closest:

R1 – 1.2329

R2 – 1.2451

R3 – 1.2573

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair has so far begun a mild downward reversal. Currently, long positions with targets of 1.2393 and 1.2451 can be taken into consideration if the Heiken Ashi indicator reverses its trend upward. If the price is fixed below the moving average with a target of 1.2085, short positions may be considered.

explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.