The AUD/USD currency pair continues to trade within the 1.6450–1.6530 price range, alternately bouncing off its boundaries. Sellers regularly attempt to pull the pair towards the 64th figure base, taking advantage of surges in the overall strengthening of the greenback. However, despite these efforts, the pair still demonstrates sideways movement, reflecting the indecisiveness of both AUD/USD bulls and bears. Nevertheless, the situation may change dramatically by the end of this week. Upcoming fundamental events could provoke increased volatility in the pair, pushing it out of its current range. The question is which way it will go.

So, in order: tomorrow, September 5th, the Reserve Bank will announce the results of its latest meeting. On Wednesday, September 6th, the report on Australia's GDP growth will be published, and on Thursday, September 7th, Philip Lowe is scheduled to speak – apparently, his last speech as the head of the RBA. All these events will have some impact on the AUD/USD pair.

Regarding the RBA, there is generally no intrigue, at least regarding the formal outcomes of the September meeting. In particular, the absolute majority of economists (32 out of 35) surveyed by Reuters express confidence that the Reserve Bank of Australia will keep the key interest rate at the current level, which is 4.10%. However, some of them do not rule out another round of tightening of monetary policy at one of the later meetings this year, in November or December. Nineteen out of 35 experts have suggested this scenario, clarifying that it will depend on the dynamics of inflation in August and September (as well as for the entire third quarter). If inflationary indicators start to pick up again, the RBA may raise the rate by another 25 basis points.

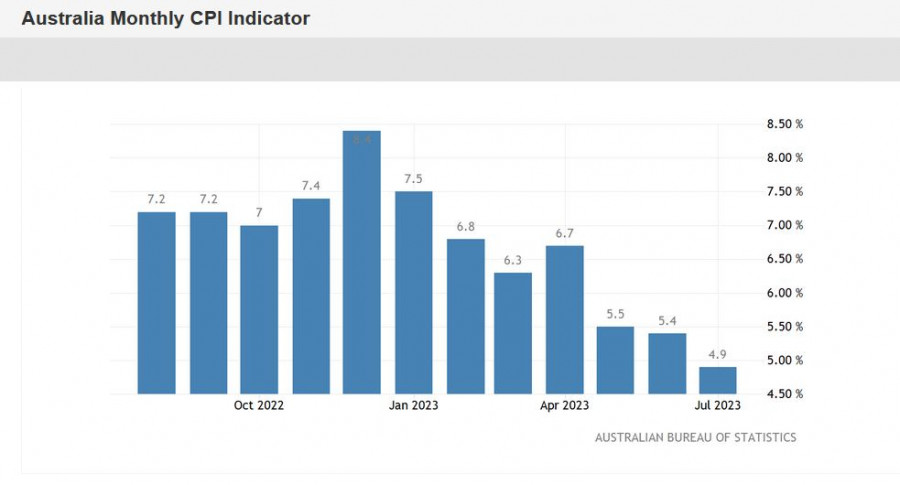

Furthermore, according to surveyed experts, the intrigue regarding the outcomes of the September meeting was dispelled after the publication of inflation data for July in Australia. It became clear that inflation continues to show signs of weakening, allowing the RBA to adopt a wait-and-see position.

According to the latest data, the Consumer Price Index rose by 4.9% compared to an expected increase of 5.2%. This indicator has been declining consistently for the third consecutive month, reaching a 17-month low in July. Considering such results and the soft rhetoric of the previous RBA meeting's minutes, it can be assumed that the regulator will adopt a wait-and-see position by the end of the September meeting, thereby exerting some pressure on the Aussie.

However, the central bank may tighten the tone of its accompanying statement. It is worth noting that Deputy Governor Michele Bullock stated last week that inflation in Australia is "still too high." In this context, she did not rule out further monetary policy tightening if key inflation indicators start to pick up.

Therefore, some intrigue still surrounds the September meeting of the Reserve Bank, but only in terms of the tone of the final communication.

The day after the RBA meeting on Wednesday, key data on Australian economic growth in the second quarter will be published. According to the majority of experts, the report will reflect a negative trend. For instance, the annual GDP growth is forecasted to be 1.7% (after a 2.3% growth in the first quarter). In quarterly terms, the indicator is expected to increase by 0.1% (according to some estimates, by 0.2%). If this report falls into the "red zone," supporters of the RBA's wait-and-see stance will have another (quite significant) argument. In such a scenario, the Aussie may come under additional pressure.

Additionally, the Australian dollar may react to the farewell speech of RBA Governor Philip Lowe, scheduled for Thursday, September 7th. As known, current Deputy Governor Bullock will take over as the head of the bank from September 18th. Undoubtedly, traders are more interested in her position than that of a "soon-to-be retiree." However, Lowe's comments may still trigger some volatility, as he might share insights into the sentiments prevailing within the RBA. This fundamental factor holds secondary importance but could influence the dynamics of AUD/USD.

From a technical perspective, the pair stands at a crossroads. On the daily chart, the price is positioned around the middle line of the Bollinger Bands indicator and the Tenkan-sen line. Short positions should be considered only after the pair firmly establishes itself below the aforementioned lines, namely below the 0.6450 target. In such a case, the Ichimoku indicator will form a bearish "Parade of Lines" signal. The primary target of the downward movement would be the 0.6370 level (lower Bollinger Bands line on the same timeframe). Long positions may be highly risky in any case due to the negative fundamental outlook for the Aussie.