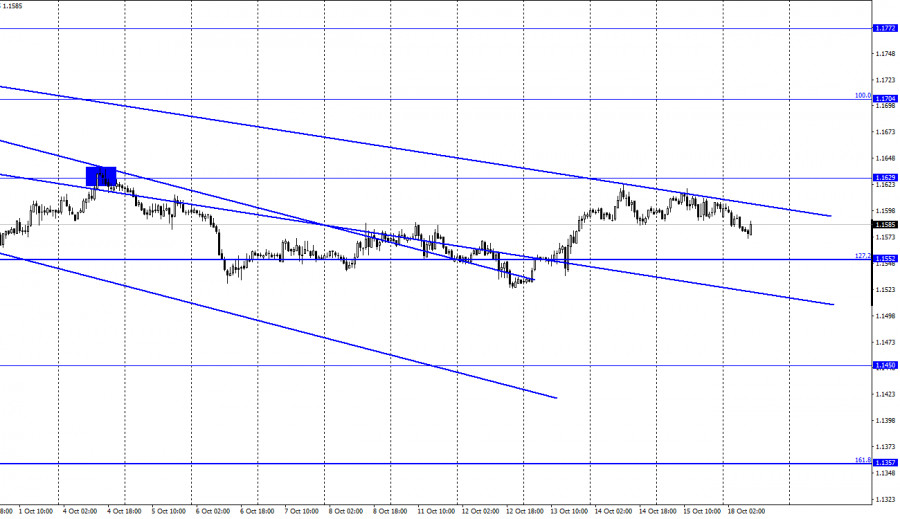

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency on Friday and began a weak process of falling towards the corrective level of 127.2% (1.1552). This process continued tonight, and only at the European session was a reversal made in favor of the EU currency and a new growth started in the direction of the level of 1.1629. However, the downward trend corridor still holds the pair's quotes inside itself, so the pair's further growth is questionable. Fixing quotes above the corridor will increase the chances of continued growth. A new pullback will work again in favor of the beginning of the fall in quotes. On Friday, there was no information background for the euro, and it was very weak for the American one. The volume of retail trade at the end of September amounted to +0.7%. A month earlier, it was +0.9%. Thus, this indicator is constantly in the range from -1.6% to +0.9%.

Therefore, almost any value from this range is normal for traders. The consumer sentiment index from the University of Michigan has dropped to the lowest values in the last ten years. However, with this value, it would be logical to see the pair's growth and not its fall. Thus, I am inclined to the opinion that there was no reaction to these reports on Friday at all. Traders are now paying more attention to other factors rather than a weak information background. The 4-hour chart shows that the general trend was "bearish" until recently. The dollar rose in price in pair with the euro. However, the events that have been observed in the United States over the past month (battles in Congress, lack of mutual understanding between Democrats and Republicans) have played more against the dollar, not in its favor. Nevertheless, the dollar was growing for some reason. And such a reason may be the expectation of a tightening of the Fed's monetary policy, which may happen as early as November.

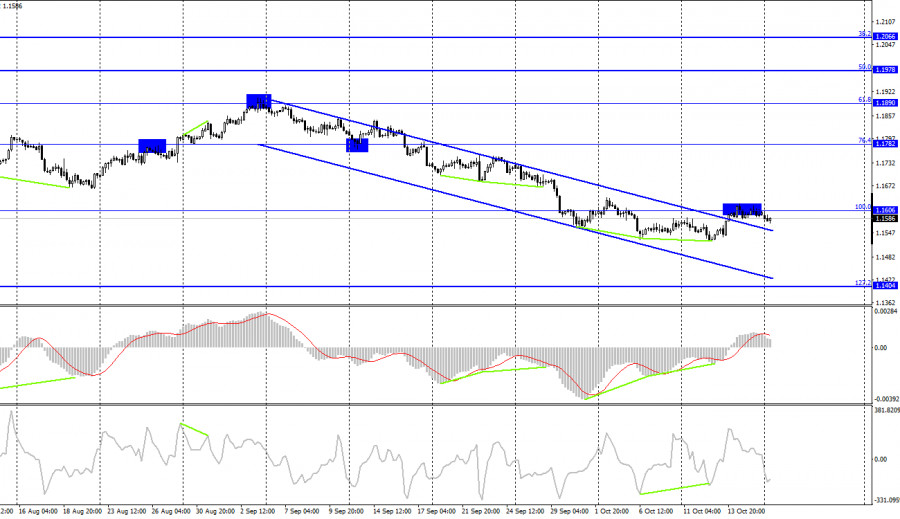

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.1606), but there was no closing above it. The hourly chart and the descending corridor on it are of no small importance now. Closing over this corridor will work in favor of continuing growth in the direction of the corrective level of 76.4% (1.1782). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the European Union:

US - change in industrial production (13:15 UTC).

On October 18, there will not be a single report in the European Union. In the United States, the calendar of economic events contains only one relatively weak report on industrial production. Thus, the influence of the information background on traders today will again be very weak.

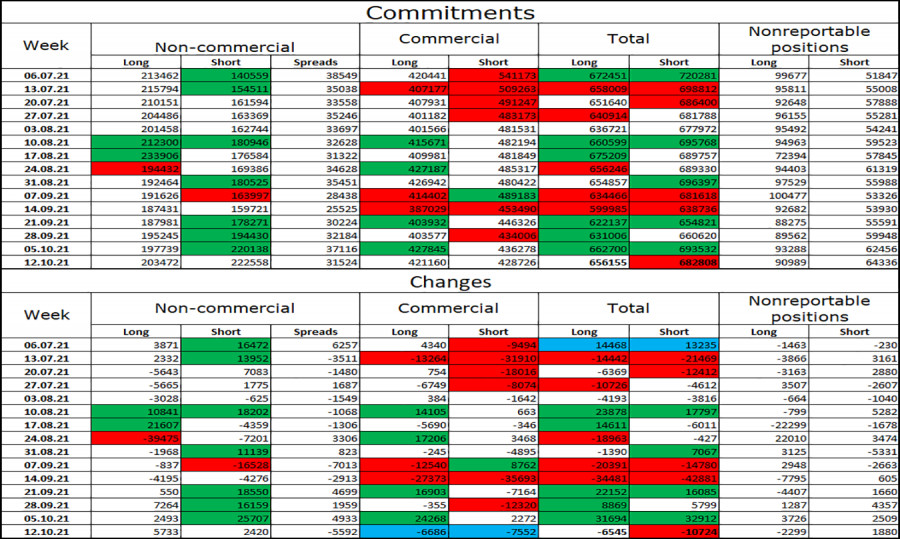

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders practically did not change. Speculators have opened 5,733 long contracts on the euro and 2,420 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 203 thousand, and the total number of short contracts - to 222 thousand. Over the past few months, the "Non-commercial" category of traders has tended to eliminate long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may resume.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively. Fixing the pair's rate above the descending corridor on the hourly chart will allow you to buy it with targets of 1.1629 and 1.1704. I do not recommend selling the pair now since the probability of further growth is higher, and there are still no signals to sell.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.