While bitcoin and ethereum have corrected slightly, which is not causing any panic in the market but rather making them more attractive, cryptocurrency enthusiasts have faced a bumpy road to gaining acceptance from the US financial system. The Federal Reserve is expected to announce an even more cautious approach to regulating digital tokens.

Fed set to introduce tough cryptocurrency regulation

The acting chief of the Office of the Comptroller of the Currency said on Tuesday that federal agencies were close to releasing a joint statement describing the results of their "crypto sprint," a review the government had conducted earlier this year to get a better handle on virtual currencies. He also made it clear that the conclusions from the OCC, Federal Reserve, and Federal Deposit Insurance Corp. would be far from industry-friendly.

It is likely that such statements have become important for the cryptocurrency market, which has been unsure of its next direction. "The agencies are approaching crypto activities very carefully with a high degree of caution," Hsu said at a financial technology conference hosted by the Federal Reserve Bank of Philadelphia. Hsu also said that guidelines issued by the OCC at the end the Trump administration shouldn't be interpreted as encouraging banks to get into crypto. Hsu said the OCC is poised to provide clarity on the so-called interpretive letters.

ECB fears persist

Meanwhile, the European Union has also expressed its views on the cryptocurrency market and investors who are willing to go there, putting themselves at serious risk. The European Central Bank said the desire for higher yields amid rising inflation and falling interest rates has encouraged investors to take more risk, making a broader part of the market vulnerable. The ECB acknowledged that the popularity and relevance of cryptocurrencies had increased, and said that cryptocurrency markets were subject to "speculative bouts of volatility". This goes against general investment principles. The regulator was also concerned that the increasing use of leverage by crypto investors could eventually lead to large losses.

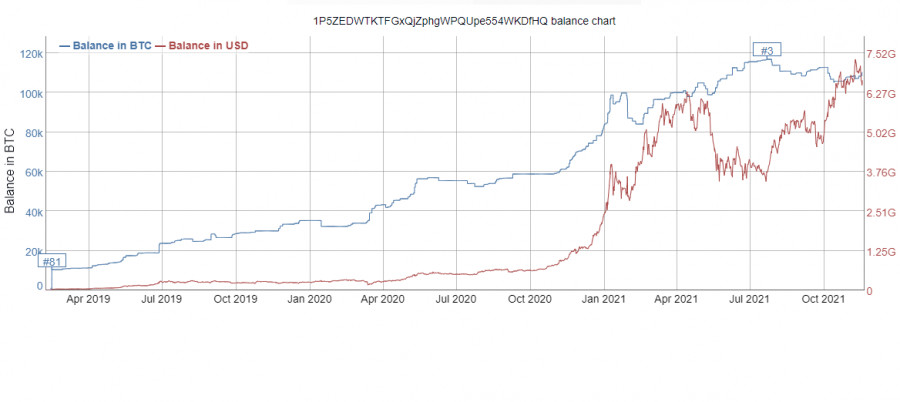

By the way, while the pressure on bitcoin persists, major players are building up long positions. One of the largest Bitcoin whales has bought 1,854 BTC ($111m) in two days. The address now holds 110,175 BTC and the owner has a total profit of $4.5bn.

Cryptocurrency regulations in India

The Economic Times reported that India will soon ban the use of cryptocurrencies for payments, but will allow and regulate trading in cryptocurrencies as an asset. The government is rumoured to be planning to introduce a cryptocurrency regulation bill during the winter session of Parliament, the details of which are still being finalized. The bill looks set to change course from earlier plans to ban cryptocurrencies in the country.

On Monday, the government held a meeting with representatives of the crypto industry. They seem to have found a common denominator on the issue. However, as the RBI notes, regulating cryptocurrency as an asset does not solve all the concerns of the authorities. However, it allows comparing fiat money and cryptocurrencies. "The trickiest part is defining the asset class," the RBI said.

Finally, attention should be drawn to Bitcoin: Reserve Risk. Bitcoin's decline has not increased risk for investors, but rather made it more attractive for investors who have long been waiting for a correction in the expectation of going lower before the next rally. Many crypto-enthusiasts are holding out hope that bitcoin will reach $100,000 later this year.

As for bitcoin

We should look for support at $58,160. As long as the trade is above that range, we can expect a move up to $62,400 and a move higher. This will open a direct way to return to the highs at $65,700 and $68,800. If we see a break-down of $58 160, most likely, the pressure on the trading instrument will increase and we will see a decline to $54,444 and $50,900.