Although the final data on the index of business activity in the manufacturing sector of the euro area came out slightly worse than the preliminary estimate, it still showed growth. From 58.3 points to 58.4 points. While the preliminary estimate showed an increase to 58.6 points. So the difference is insignificant, and it should not have affected the market in any way. Nevertheless, the single European currency gradually went up throughout the European session. Not too much, but nonetheless.

Index of business activity in the manufacturing sector (Europe):

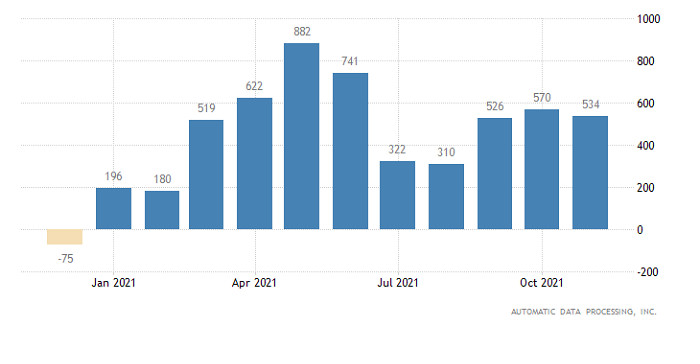

But as soon as the employment data in the United States were published, the direction of movement turned one hundred and eighty degrees. And this despite the fact that the data came out worse than forecasts. After all, they were expecting an increase in employment by 580,000, but it increased only by 534,000. But it turned out to be enough, especially since we are still talking about extremely high rates of employment growth. The fact is that, taking into account the growth rate of the population, as well as the level of economic activity, in order to maintain a stable unemployment rate in the United States, employment should grow by about 150,000 for the month. And here it is almost more than three times more. Moreover, since the beginning of this year, from month to month, employment has been growing much stronger than necessary. Of course, we can say that this is the recovery of the labor market after last year's failure, but the unemployment rate has long been below the Federal Reserve's target level. So we need to talk not about the recovery of the labor market, but about new records. This is the reason for the rather impressive growth of the dollar. And it is not surprising that, being impressed by such results, investors simply ignored the US index of business activity in the manufacturing sector, which, by the way, decreased from 58.4 points to 58.3 points. Although it should have grown to 59.1 points. With all due respect to business activity indices, they pale against the background of labor market data.

Employment change (United States):

European statistics today are unlikely to be able to help the euro. Rather, on the contrary. After all, the unemployment rate should remain unchanged, which means there is no reason for any fuss. Unlike the producer price index, which can grow from 16.0% to 18.3%. That is, inflation, which is already growing at a record pace, is likely to continue to grow. While the European Central Bank is actually inactive, market participants themselves rather came up with some signals and hints from the central bank regarding a possible tightening of monetary policy. Representatives of the ECB do not say anything like that directly. And all sorts of veiled messages can be interpreted as you like.

Producer Price Index (Europe):

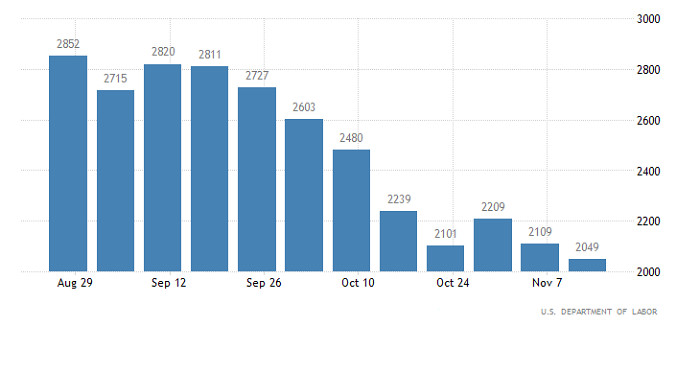

But US reports are likely to have even less impact on the market, since the data published in the United States on applications for unemployment benefits are expected to be multidirectional. So, the number of initial requests should increase by 46,000, but the number of repeated requests may decrease by 49,000. That is, they will offset each other, and investors will have nothing to focus on. However, there is a possibility that the dollar will continue to strengthen gradually, within the framework of the trend for its growth that began at the end of spring this year.

Number of repeated applications for unemployment benefits (United States):

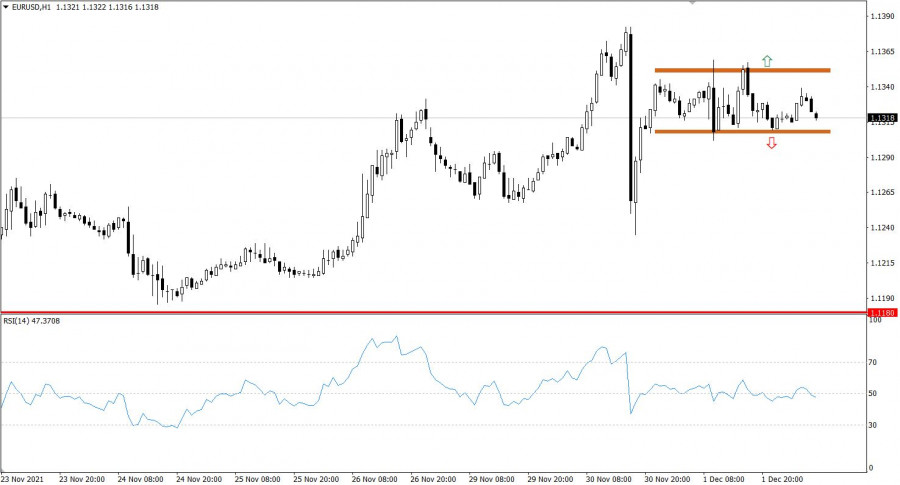

The EURUSD currency pair, despite a number of speculative fluctuations, is still moving along a sideways trajectory within 30 hours. This will most likely lead to a process of accumulation of trading forces, which will cause impulsive price changes in the market.

The technical instrument RSI in the hourly period confirms the stage of stagnation by the movement of the indicator along the line 50.

A downward trend remains on the daily chart, in the structure of which a correction cycle has emerged.

Expectations and prospects:

The horizontal channel in the 1.1300/1.1355 range is still relevant in the market. Traders are considering a strategy for breaking one or another border of the established range. This will help indicate the subsequent speculative move in the market.

Complex indicator analysis has a variable signal based on short-term and intraday periods due to sideways price movement. In the medium term, technical instruments are oriented towards a downward trend, signaling a sell.