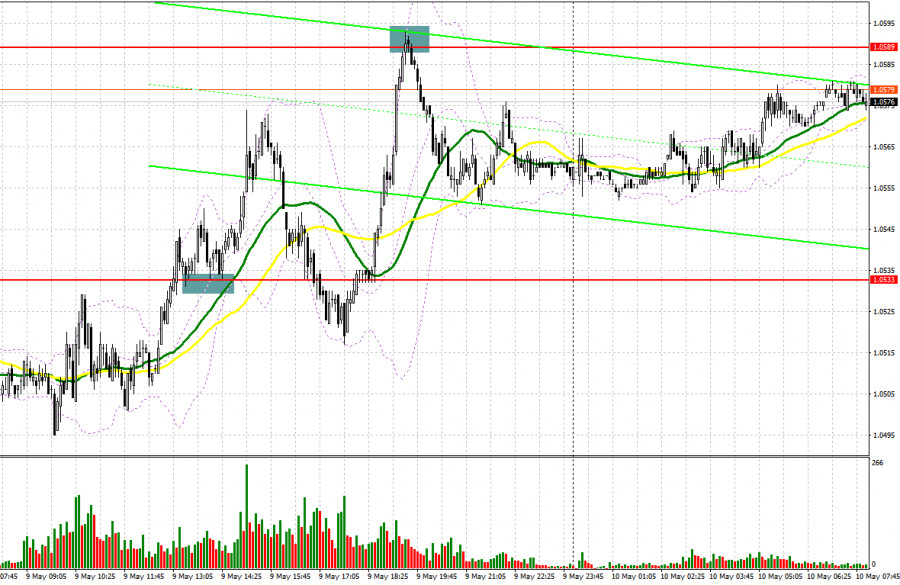

Yesterday was quite an interesting day for trading, and several signals were formed to enter the market. I suggest you take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.0533 and advised you to make decisions on entering the market from it. A move up followed by a breakthrough and consolidation above this range, as well as a test from the top down, all led to an excellent entry point into long positions. As a result, the pair went up about 60 points and hit the resistance at 1.0589. Forming a false breakout there in the second half of the day made it possible to get an excellent entry point for selling the euro, as well as pull out about 30 more points from the market.

When to go long on EUR/USD:

Yesterday's weak data on investor confidence in the euro area did not have a significant pressure on the euro, as all this was quite expected. The fact that the pair has been in a horizontal channel for quite a long time makes us think that the bulls are trying to find the bottom after a large sale of risky assets, which we have been observing since the beginning of this spring. In today's European session, there are reports on changes in the volume of industrial production in Italy and the index of sentiment in the business environment in Germany from the ZEW Institute. More important will be the index of sentiment in the business environment of the euro area.

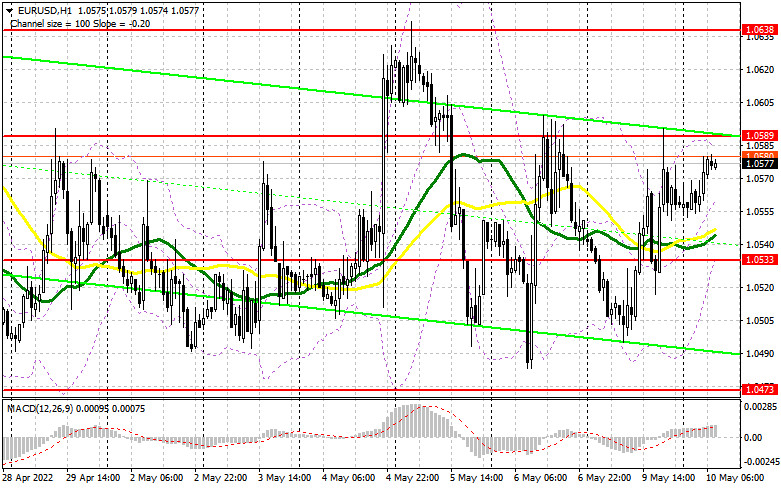

With good reports, the bulls will be able to show themselves and show something above 1.0589, which they are aiming for today. But a more important task is to protect the intermediate support at 1.0533, just below which there are a lot of bulls' stop orders, who are ready to fight with their last strength for the continuation of the upward correction. Moving averages also play on the bulls' side at the same level, so it will be quite difficult to fall below. Forming a false breakout at this level will lead to an excellent signal to buy the euro, counting on the recovery of the pair back to 1.0589. A breakthrough and test of this level from top to bottom, together with strong statistics on the eurozone, creates a new signal for entering long positions, opening up the opportunity to return to the 1.0638 area, where I recommend taking profits. A more distant target will be this week's high of 1.0691, but it will be possible to get to this level only after building a larger upward correction, based on the formal statements of the representatives of the Federal Reserve, which we will discuss in more detail in the forecast for the second half of the day. In case EUR/USD falls and there are no bulls at 1.0533, and this scenario also cannot be discounted, it is best to postpone long positions. The best option to buy would be a false breakout near the 1.0473 low. You can open long positions on the euro immediately for a rebound only from 1.0426, or even lower - in the region of 1.0394, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Bears lost control of the market yesterday and now you need to try very hard not to lose the downward trend at all. Their main task will be to protect the nearest resistance at 1.0589. In case of weak data on the eurozone, one can count on an unsuccessful attempt to grow higher. The optimal scenario for opening short positions would be forming a false breakout at 1.0589. This will bring back pressure on the pair with the goal of pushing it to the middle of the horizontal channel at 1.0533, which we have been at since the end of April this year.

In case we receive very weak statistics on the euro area, most likely in the first half of the day we will see an attempt to break through and settle below 1.0533. A reverse test of this level from the bottom up will provide an excellent signal to sell the euro, which will lead to removing a number of bullish stop orders and to the strengthening of the bearish trend with the prospect of updating the annual low of 1.0473, where I recommend taking profits. A more distant target will be the area of 1.0426. If EUR/USD moves up in the first half of the day and there are no bears at 1.0589, the bears will have serious problems. In this case, I expect a sharper upsurge. The optimal scenario would be short positions in forming a false breakout in the area of 1.0638. You can sell EUR/USD immediately on a rebound from 1.0691, or even higher - in the area of 1.0736, counting on a downward correction of 25-30 points.

COT report:

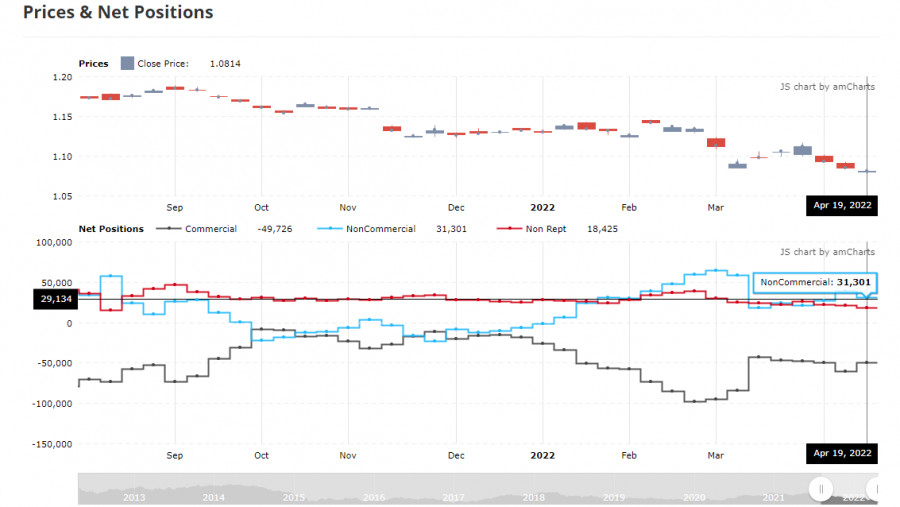

The Commitment of Traders (COT) positions for April 19 logged a sharp increase in short positions and a decline in long positions. Recent statements by representatives of central banks have led to a new active sale of risky assets, as it became clear to everyone that serious problems in the economies of developed countries cannot be avoided this year. And although the president of the European Central Bank in her speeches noted that the regulator plans to fully complete the bond purchase program by the end of the second quarter of this year, hinting at a rate hike in early autumn, this was not enough to support the euro. The more aggressive policy of the Federal Reserve turned out not to be as aggressive as many expected, which slightly weakened the demand for the US dollar and brought the market back into balance. Another concern is the threat of another economic paralysis due to severe quarantine restrictions in China against the backdrop of a new wave of Covid-19, which has already led to a massive disruption in the supply chains of European and Asian countries. The COT report shows that long non-commercial positions decreased from 221,645 to 221,003, while short non-commercial positions rose sharply from 182,585 to 189,702. It is worth noting that the euro's decline makes it more attractive to investors, therefore, longs being closed is not surprising. As a result of the week, the total non-commercial net position decreased and amounted to 34,055 against 39,060. The weekly closing price collapsed and amounted to 1.0814 against 1.0855.

Indicator signals:

Trading is above the 30 and 50-day moving averages, which again indicates the bulls' attempt to build an upward correction.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0533 will lead to a new fall in the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.