The EUR/USD currency pair traded sluggishly and unwillingly for most of Wednesday. It is surprising because a day earlier, the pair unexpectedly went down by 120 points, and many felt that a new round of strengthening of the US currency had begun. We have also counted and are counting now. However, we wish to make a modest point now. By convention, we will not now consider the results of the Fed meeting. The results are announced late on Wednesday evening, and even later, a press conference with Jerome Powell begins. Thus, for example, the European market does not have the opportunity to work out all the new facts. The reaction to the findings of the most important central bank meeting can last for a day. Therefore, conclusions should be drawn no earlier than the middle of the next day. It's simple: the dollar has regularly shown varied dynamics soon after the Fed meeting. It may, for example, first go 100–150 points in one direction, then lose the same number and return to its old positions. And only after that does the market start trading with a new fundamental background.

Therefore, even technical analysis cannot answer the question in which direction the euro/dollar pair will move now. Moreover, it spent the last week and a half around the moving and between the Murray levels "3/8" and "4/8". From our point of view, the pair's slide will be resumed with any conference results. It is confirmed that there is simply no "bearish" or "dovish" in the list of available scenarios. The minimum rate will increase by 0.75 percent and the maximum - by 1.00 percent. Both alternatives are "bullish" or "hawkish" for the US dollar. Therefore, you should not rush to conclusions, and it is preferable to wait for the moment when the market digests all the information received completely and calms down.

Will the dollar strengthen further?

Since the conclusions of the meeting are already known, we will purposely not voice them and analyze what the long-term reaction of the market to them may be. Recall that, in essence, the dollar rose after each of the meetings in 2022. Maybe not immediately, but after a while, it still grew. It is the basic background, which might impact the pair for a long period. How could it be otherwise? What should traders and investors do if the Fed's rate is 2.5 percent and the ECB's rate is 0.5 percent? After all, the rate is not just some temporary instrument that looks to affect the economy somehow. The main bet is the starting point for all other bets. For example, on loans or deposits. If the rate climbs, loans become more expensive, but the profitability of bank deposits also increases. Since deposits did not deliver any return to their owners six months ago, the higher the rate, the more the desire of investors to entrust their wealth simply to the bank and obtain a peaceful, guaranteed reward.

At the same time, we want to stress that today this scenario is not yet fully fulfilled due to strong inflation, which negates the profitability of nearly every investment instrument. But inflation will start to fall sooner or later, and bank deposits will continue at the same rates, but the stock market is far from the fact that it will begin to recover rapidly enough that a certain part of the money will be transferred to it. Recall that there are not only "blue chips" and growth stocks on the stock market. Of course, it might be dubbed the "strategy of the century" to buy shares of Apple or Tesla, which have demonstrated enviable development in recent years and are the security of stable, major corporations. But there are some companies whose shares bring income to their owners through dividends, not growth. They can be reduced in price and not only perpetually expand. Thus, 1-2 percent payouts will not attract investors if you can get 3-4 percent guaranteed on a bank account. And of course, if the deposit rate in Europe is 1 percent, and in the USA, it is 4 percent, then to which banks will international investors carry their money? It is termed "capital flow." And the dollar can continue to strengthen owing to this cause alone.

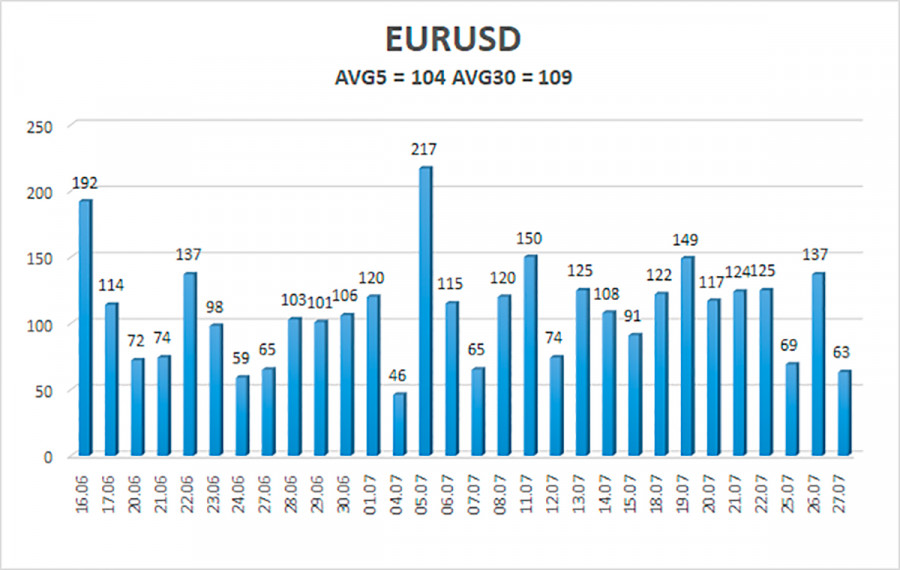

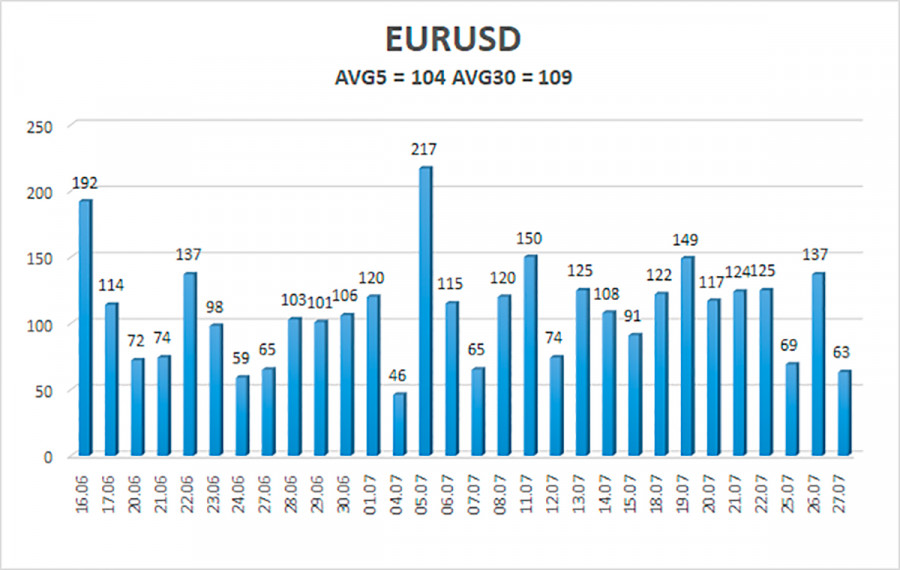

The average volatility of the euro/dollar currency pair over the last 5 trading days as of July 27 is 104 points and is described as "high." Thus, we expect the pair to trade today between 1.0024 and 1.0233. The reversion of the Heiken Ashi indication downwards signifies the continuance of the downward movement.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair is seeking to restart a long-term downturn. Thus, it is now possible to stay in short positions with objectives of 1.0010 and 1.0001 if the Heiken Ashi signal does not turn up. Purchases of the pair will become significant again when fixed above the moving average with goals of 1.0254 and 1.0376.

Explanations of the illustrations:

Linear regression channels – help determine the present trend. If both are directed in the same direction, then the trend is strong presently.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be undertaken currently.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the expected price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) implies that a trend reversal in the opposite direction is imminent.