Today, traders are analyzing weak data from the US and hawkish comments provided by Minneapolis Federal Reserve Bank President Neel Kashkari. Like most of his colleagues, he said that the Fed was primarily focused on inflation control. He also added that underestimation of the existing high inflationary pressure was his greatest fear. Like other Fed's officials, Kaskari is ready to withstand some economic disturbance if it is necessary to cap inflation.

On Tuesday, the US published disappointing data on its services and manufacturing PMI. Meanwhile, new home sales dropped to multi-year lows. Therefore, market participants doubt that the Fed will remain stuck to aggressive monetary policy tightening. Traders have not taken a particular position yet. It is unknown whether the Fed will raise the benchmark by 75 basis points or by 50 basis points. That is why any report, including macroeconomic data or some dovish comments, may lead to the market reversal.

It is highly unlikely that on Friday, Jerome Powell will cool down investors' expectations of the monetary policy easing in 2023. His speech should support traders' expectations of the upcoming FOMC meeting.

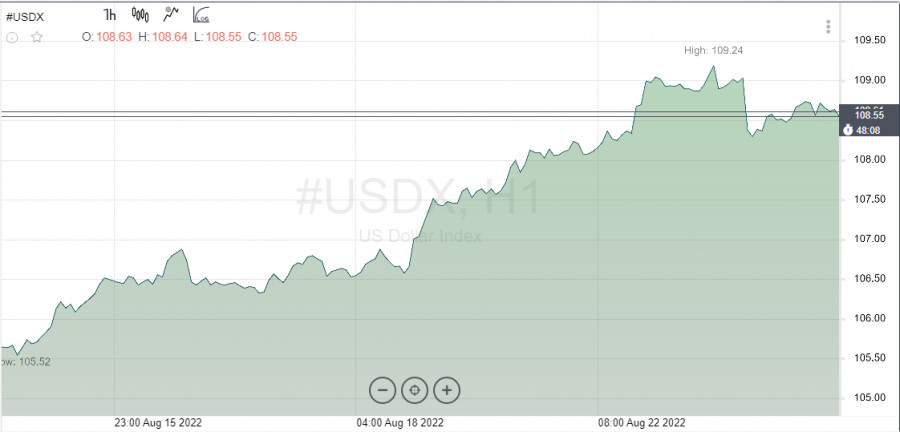

On Wednesday, the US dollar index dropped to 108.7, but managed to keep its upward momentum. Earlier, the indicator even jumped above its 20-year high since fresh hawkish comments provided by Neel Kashkari outweighed weak economic data.

The US dollar index has been rising for six days in a row. It may show the best weeklong performance since March 2020. Buyers see the next target at 121.0. However, to reach it, the US dollar index should break and consolidate above the high of 109.2 logged on July 14. Then, the indicator will hardly meet any obstacle until it approaches 120.5, the high of January 2002.

Against the backdrop, the euro looks even more vulnerable. It is highly affected by various problems and concerns about a recession in Europe.

Optimists may see hope in the speech provided by Fabio Panetta, member of the ECB's Executive Board. He thinks that recession may reduce inflationary pressure.

Notably, the ECB raised the key interest rate only once, returning it to the zero level. At the same time, the Fed is ready to continue hiking interest rates even amid an economic slowdown. This fact is making the euro/dollar pair extremely vulnerable.

Strategists at Nomura downgraded their forecasts for the euro. They suppose that the euro/dollar pair will settle several patterns below the parity level. At the moment, they expect a drop to 0.9750.

Not so long ago, the euro broke the parity level. However, the lack of short positions led to a rebound to 1.0300. Nevertheless, the currency will hardly consolidate above this level. That is why today, it declined once again.

At the beginning of the week, the euro was under the pressure caused by the gas issue. The prices jumped just after Russia announced its decision to halt gas supplies for three days due to maintenance. Curiously, at the moment, European countries are actively buying gas in an attempt to fill up their storage facilities before winter.

Most economists suppose that the eurozone is entering recession because of a sharp rise in energy prices.Although energy prices have soared by 50% in August, the euro has been trading within one range. Since the euro hit parity, the volume of short positions slumped.

Meanwhile, European governments have started to share electricity costs with consumers. Firms will have to gradually reduce production, while supply lines are suffering due to the lack of transport opportunities on the Rhine River, which has been crushed this year.In the short term, the US dollar is likely to be among the best performers. However, in the long term, it may face some problems. Analysts at JP Morgan are skeptical about a further rise in the greenback. The US dollar behavior significantly depends on the Fed's decision. The regulator is expected to slacken the pace of the key interest rate hike.

In the last several quarters, the regulator has been conducting a surprisingly hawkish policy. As a result, the US dollar has also been strong. However, this could not last forever.

JP Morgan reported signs of the inflation peak. September could become the last month when the Fed will raise the benchmark rate by 75 basis points. Then, the regulator is likely to slacken the pace of tightening. Notably, the US will publish another inflation report before the September meeting.