GBP/USD overview and trading tips

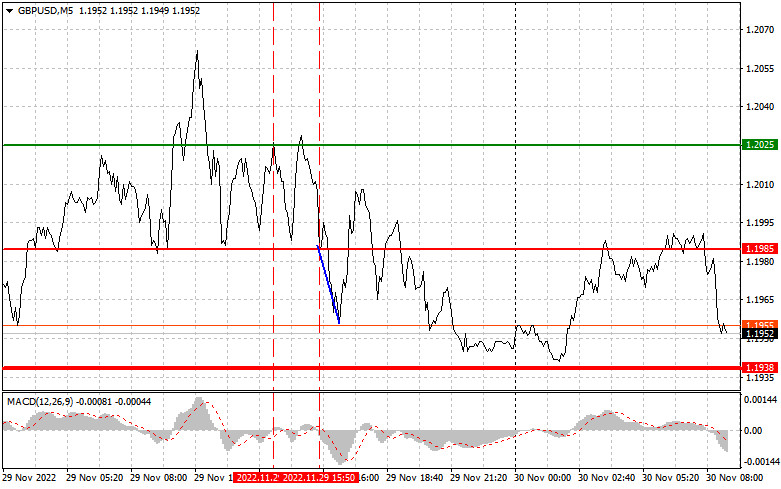

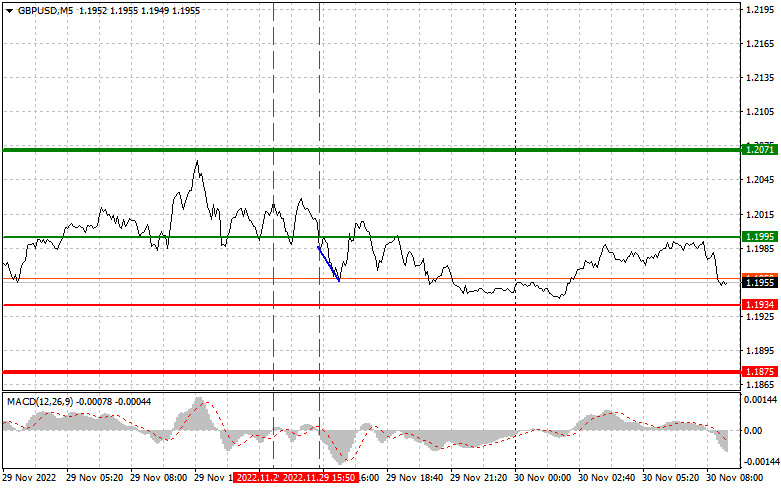

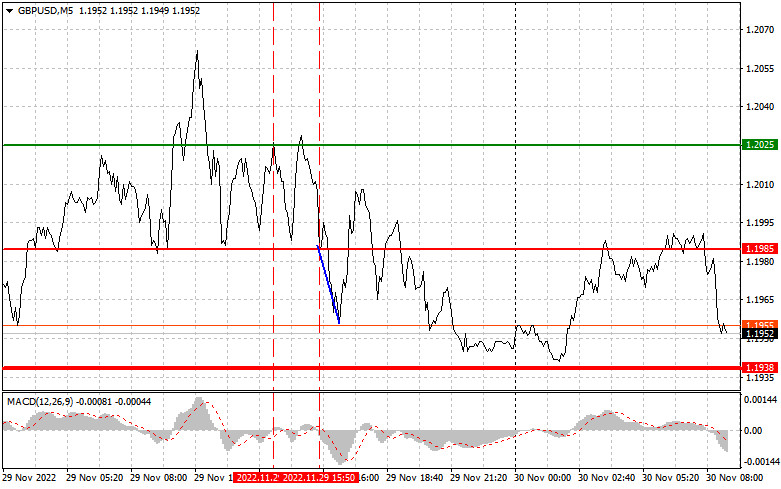

The pair tested the level of 1.2025 by the moment the MACD indicator had started to move up from the zero level. This confirmed the entry point for long positions. However, the pair failed to develop a proper uptrend, thus forcing traders to close their positions with losses. Closer to the middle of the New York session, the price tested the level of 1.1985 where the MACD had already been moving downwards from the zero mark, creating a sell signal. The decline was not that deep. Still, the price passed 30 pips ensuring that traders could win back losses and earn some profit.

Yesterday, the speech by BoE Governor Andrew Bailey had no effect on the market. The US data on the consumer confidence index, which exceeded the forecast, seemed to have more influence on the market sentiment. In the first half of the day, there will be no important reports that could support the British pound. So, traders will count on events in the second half of the day. These include the Nationwide House Price Index in the UK and the statement by MPC member Huw Pill. Yet, his comments will be of little importance to the market given yesterday's speech by Andrew Bailey. In the US, ADP nonfarm employment change for November and GDP for Q3 are due to be published in the afternoon. The GDP forecast is expected to be revised upwards. If so, the US dollar will advance. Another factor to support the greenback will be the positive data on pending home sales. The core event of the day will be the speech by Jerome Powell who may give hawkish hints this time. In this case, the US dollar will gain ground while the pound will weaken at the end of the month.

Buy signals

Scenario №1: it is possible to buy the pound today when the price hits the entry point of 1.1995 (a green line on the chart) with the upward target at 1.2071 (a thicker green line on the chart). I recommend closing buy positions at the level of 1.2071 and going short in the opposite direction, considering a retracement of 30-35 pips from this level. The pound may develop further growth only if Jerome Powell changes his stance to dovish. Note! Before going long, make sure that the MACD indicator is located above the zero mark or has just started to rise from it.

Scenario №2: you can also buy the pound when the price reaches the level of 1.1934 but make sure that the MACD is holding in the oversold area. This will limit the downside potential of the pair and will cause a bullish reversal. In this case, the quote may rise to the levels of 1.1995 and 1.2071.

Sell signals

Scenario №1: selling the pound is possible today after a retest of the 1.1934 level (a red line on the chart) which may lead to a rapid decline in the pair. The key downward target for sellers will become the level of 1.1875 where I recommend closing sell positions and going long in the opposite direction, considering a retracement of 20-25 pips from this level. The pound will come under pressure if the US data turns out to be strong. Note! Before going short, make sure that the MACD indicator is located below the zero level or has just started to decline from it.

Scenario №2: you can also sell the pound when the price hits the 1.1995 level but make sure that the MACD is holding in the overbought area. This will limit the upside potential of the price and lead to a downward reversal. In this case, the quote may move lower to the levels of 1.1934 and 1.1875.

On the chart:

The thin green line indicates the entry point for buying the instrument;

The thick green line indicates the estimated level for setting a Take Profit or closing trades manually as the pair is unlikely to move above this line;

The thin red line indicates the entry point for selling the instrument;

The thick red line indicates the estimated level for setting a Take Profit or closing trades manually as the pair is unlikely to move below this line;

When entering the market, it is essential to consider whether the MACD is located in the oversold or overbought area.

Important! Beginners on Forex should be very careful when making a decision to enter the market. It is recommended to stay out of the market ahead of important news releases to avoid sharp fluctuations of the price. If you decide to trade on the news, make sure you set stop-loss orders to minimize losses. Without setting a Stop Loss, you risk losing your entire deposit in no time, especially if you do not use money management and trade with large volumes.

Remember that you need to have a well-developed trading plan similar to the one above to be successful in trading. Spontaneous decision-making based on the current market situation is a losing strategy for an intraday trader.