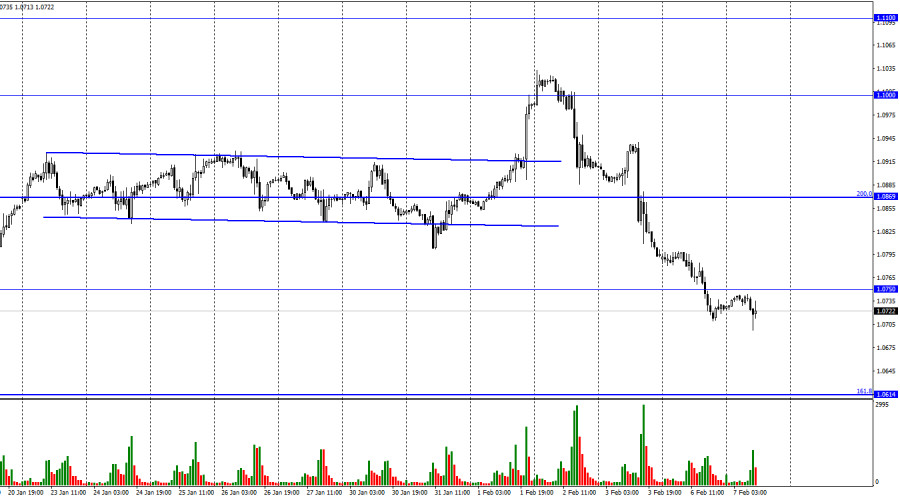

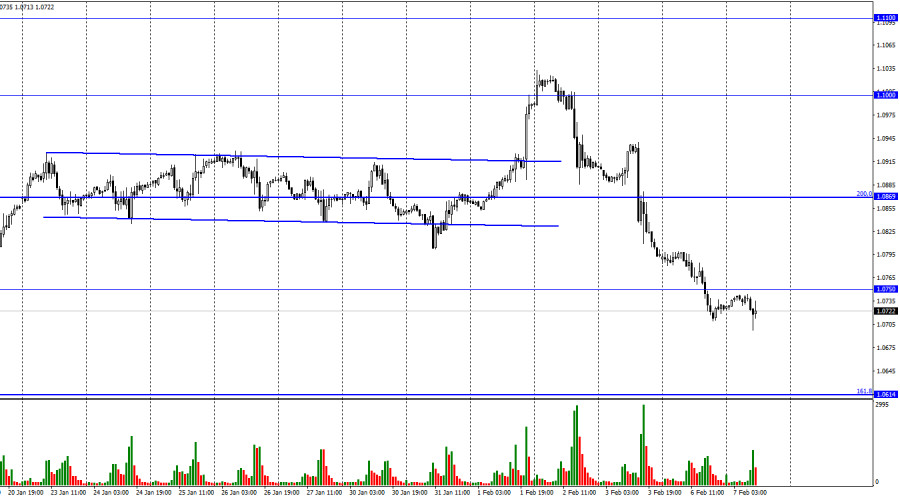

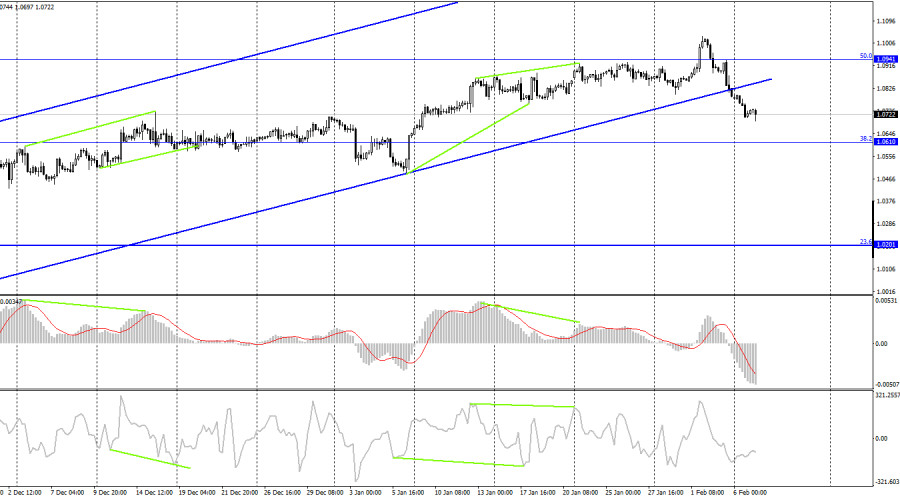

On Monday, the EUR/USD pair maintained its downward trend and fell below the level of 1.0750. As a result, the decline in quotes can now be carried out in the direction of the following Fibo level of 161.8% (1.0614). The EU currency will benefit from a fixation of the exchange rate over 1.0750 and some rise in the direction of the corrective level of 200.0% (1.0869).

The start of a new week was dull. You rapidly adjust to positive things. Numerous significant events occurred last week, contributing to a significant decline in the value of the euro. However, a new week has begun, there is no background information, and the euro is still declining. I don't think it's necessary to try to figure out why the euro fell on Monday and Tuesday. The reason can be as straightforward as the traders' new "bearish" attitude. Keep in mind how the euro has increased in value recently. After all, the European Union's currency hasn't always been supported by a solid knowledge base. However, since the atmosphere was "bullish," bull traders "dominated" the scene. Now that the situation is reversed, the market is dominated by bears.

Based on the ECB and Fed interest rates, the euro has been increasing for a considerable amount of time. The Fed's rate of tightening had been expected to slow down for several months, while the ECB's strong tightening would continue. But as evidenced by the most recent meeting, the European regulator will not raise the rate indefinitely. The Eurozone's inflation is dropping, but not quickly enough. In the meantime, the rate has risen to 3%. Christine Lagarde stated that a further increase of 0.50%, followed by a 0.25% increase, and finally - emptiness and uncertainty. Bull traders leave the market as a result of this uncertainty. If the ECB increases the rate by 0.75% before pausing, it will be very similar to what the Fed will do in its upcoming sessions. So why would someone buy the euro if the ECB's stance is not "hawkish"?

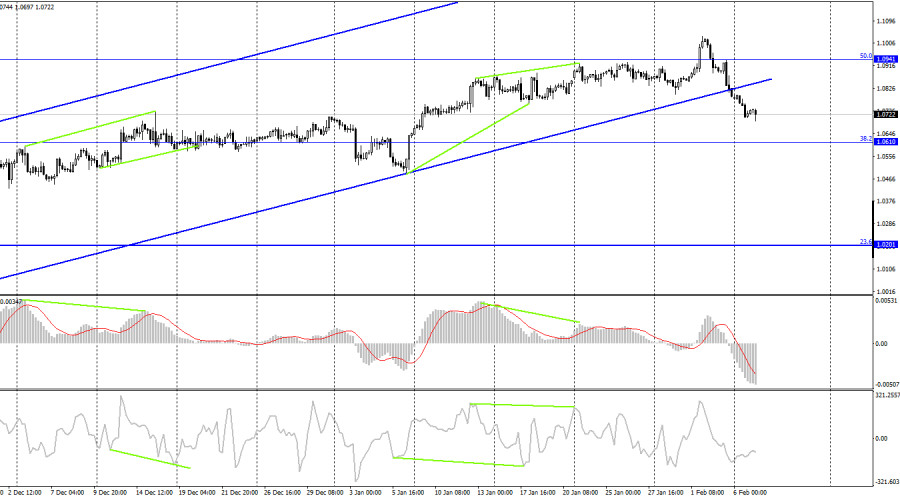

The pair is still declining on the 4-hour chart and has now passed under the bottom border of the upward trend corridor. Since the pair left the corridor where they had been since October, I believe this moment to be of utmost importance. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. Emerging divergences are currently undetectable by any indication.

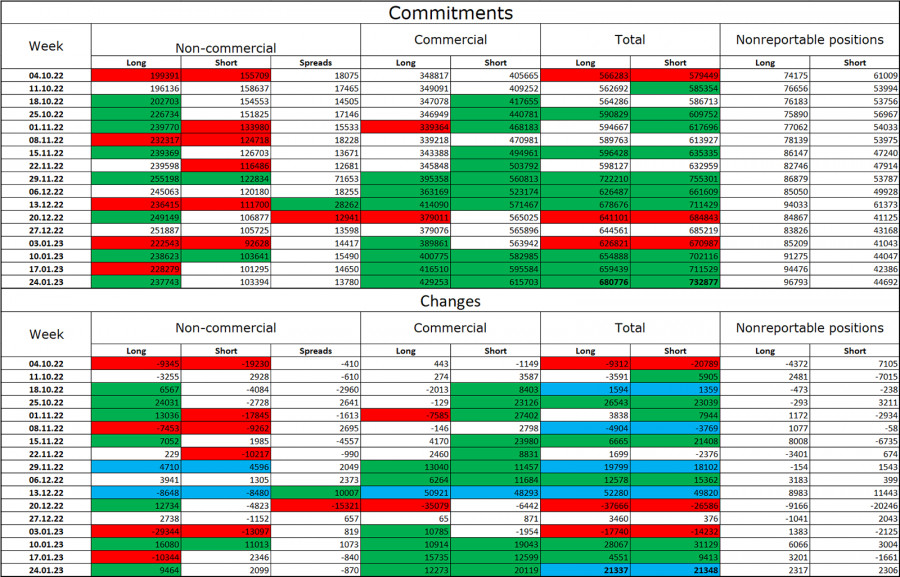

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now increasing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

The United States and the European Union's news calendar:

US – Speech by Mr. Powell, the Fed's chairman (17:40 UTC).

The lone event on the economic calendars for February 7 in the United States and the European Union is a speech by Fed President Jerome Powell. Today, the information backdrop may have a significant impact on traders' attitudes, but only in the evening.

Forecast for EUR/USD and trading advice:

On a 4-hour chart, I suggested selling the pair when it closed beneath the corridor. The targets are 1.0614 and 1.0750. Because the initial target has been met, the agreements can now be kept open. On the hourly chart, buying the euro is feasible when it recovers from the level of 1.0610 with a target of 1.0750.