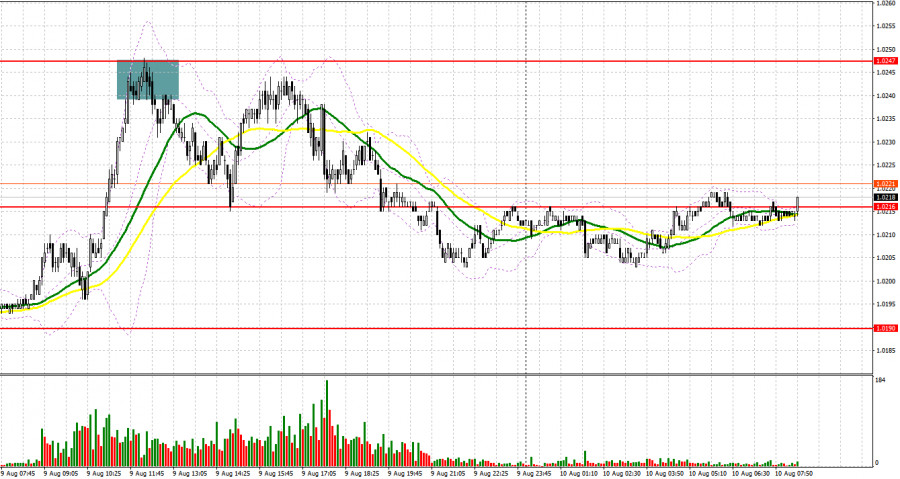

Yesterday, traders received just one signal to enter the market. Let us focus on the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the levels of 1.0211 and 1.0238 to decide when to enter the market. After the pair broke 1.0211, it failed to downwardly test this level. That is why traders did not receive a long signal. Bulls stopped after the pair climbed to 1.0238. Bears benefited from the situation and formed a false breakout. A sell signal brought about 20 pips. In the second part of the day, there were no signals to enter the market.

Conditions for opening long positions on EUR/USD:

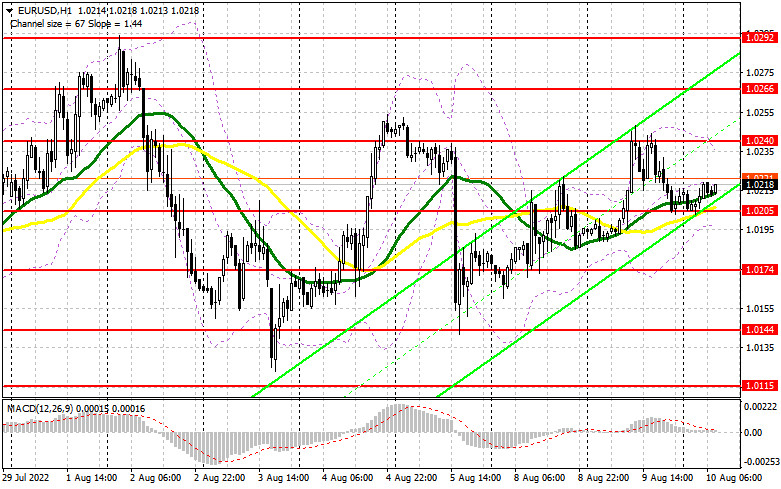

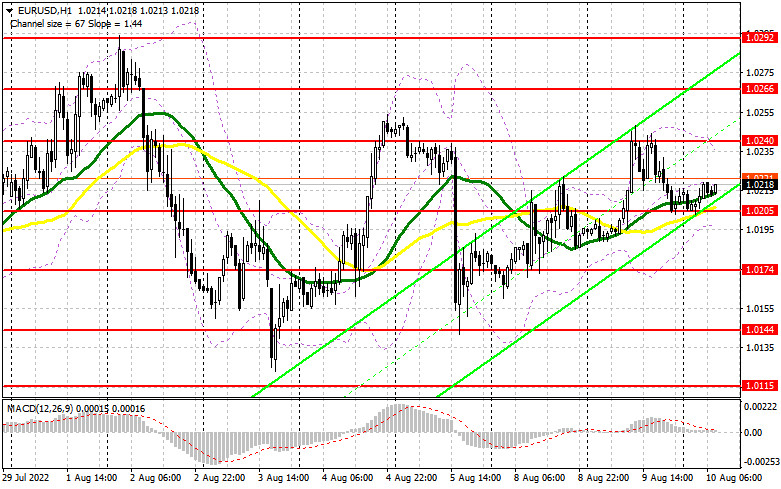

In the first part of the day, both Germany and Italy are going to disclose their inflation reports. Consumer prices may continue rising, thus exerting pressure on the European economy, which is on the edge of recession. It is obvious that the ECB has prepared for such an outcome. Even if the data meets the forecasts, the market situation is likely to remain the same.In the second part of the day, the US will also unveil its inflation figures, which will determine a further movement of the pair not until the week, but even until this month. Negative news will lead to the greenback's consolidation. If the pair declines to the nearest support level of 1.0205, only a false breakout of this level will give a buy signal with the target at the resistance level of 1.0240. A breakout and a downward test will affect sellers' stop orders, forming an additional buy signal with the target at 1.0266, where big traders may return to the market. The farthest target is located at this month's high of 1.0292, where it is recommended to lock in profits. However, the pair will be able to reach this level only amid clear signs of the US inflation slackening. If the euro/dollar pair declines and bulls fail to protect 1.0205, pressure on the pair will increase, allowing the price to decline to 1.0174 and then to the lower limit of the wide range located at 1.0144. If bulls fail to protect this level, the upward trend that began in July will stop. It will be better to go long after a false breakout of 1.0174 and 1.0082. It is also possible to buy the euro/dollar pair just after a bounce off 1.0115 or lower – from 1.0082, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Now, bears are expecting only a further rise in the US inflation that will lead to a slump in the euro/dollar pair. In the near future, they will hardly have any other reason for a decline in the pair. Under the current conditions, it will be better to enter the market after a false breakout of 1.0240. The pair climbed to this level in the first part of the day. Today, sellers should also take control over the middle level of the sideways channel located at 1.0205, where we see moving averages. A breakout of this level, settlement below it, and an upward test will give an additional sell signal that will affect buyers' stop orders. In this case, the pair may slide to 1.0174. However, sellers will hardly gain control over this level without the US fundamental data. If the price fixes below 1.0174, it will tumble to 1.0144, where it is recommended to lock in profits. The next target is located at 1.0115. However, it will become available only if the upward trend formed on July 14 ends. If the euro/dollar pair increases during the European session and bears fail to protect 1.0240, it will be wise to avoid sell orders until the price hits 1.0266. The fact is that bulls will expect a decline in the US inflation rate and a sharp rise in the pair. A false breakout of 1.0266 will give a new chance to enter the market. It is possible to sell the euro/dollar pair just after a rebound from the high of 1.0292 or even higher – from 1.0323, expecting a decline of 30-35 pips.

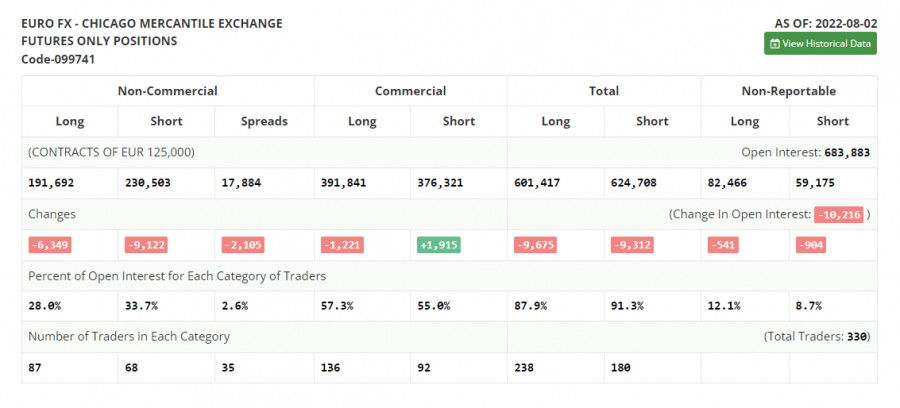

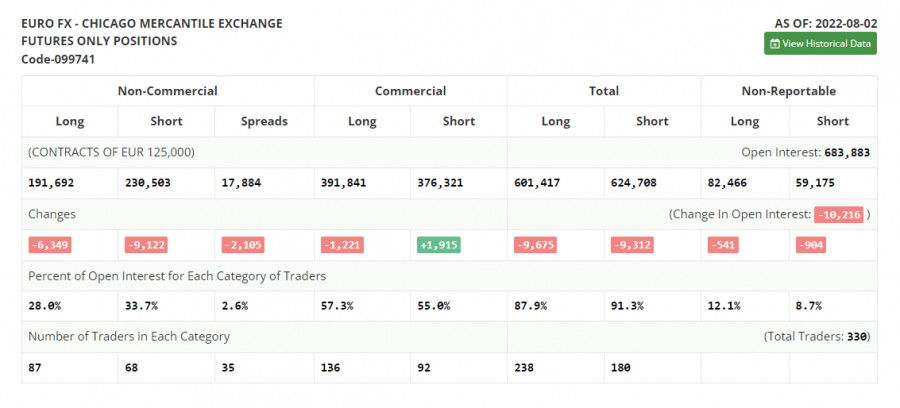

COT report

According to the COT report from August 2 ,the number of both short and long positions slumped. However, there was a bigger decline in the number of short positions. It reflects the gradual end of the bear market and an attempt to find the bottom after reaching the parity level. Last week, the economic calendar for the eurozone was almost empty. The US, on the contrary, unveiled many economic reports. The Nonfarm Payrolls report was quite positive. The strong labor market has once again shown the resilience of the US economy despite high inflation, recession risks, and aggressive rate hikes. A drop in long and short positions may be associated with a seasonal factor. In August, the market activity could become even lower. It is hardly surprising. The US will soon publish its inflation report. Traders will find out whether aggressive monetary tightening has helped the economy or not. If inflation starts to decline, it will be appropriate to open long positions on risky assets. The COT report revealed that the number of long non-commercial positions decreased by 6,349 to 191,692, while the number of short non-commercial positions contracted by 9,122 to 230,503. At the end of the week, the total non-commercial net position, although it remained negative, rose slightly to -39,811 from -41,584, which indicates the continuation of the bullish market. The weekly closing price increased to 1.0206 from 1.0161.

Signals of indicators:

Moving Averages

Trading is performed near 30- and 50-day moving averages, thus reflecting the market uncertainty.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair declines, the support level will be located at the lower limit of the indicator - at 1.0195. In case of a rise, the upper limit of the indicator located at 1.0240 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are a total number of long positions opened by non-commercial traders.

- Short non-commercial positions are a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.