The US financial market was closed yesterday due to a holiday – Martin L. King Day. Meanwhile, the European market traded in the positive zone amid expectations that the ECB may raise its key interest rate by 20 basis points by the end of this year, and not by 17, as was expected a week earlier.

By setting the direction of monetary policy for the world's central banks, the US regulator is still confused about the likely dates for the start of raising interest rates, keeping investors worried and forcing them to listen to any Fed rhetoric. However, the market started to be optimistic again after J. Powell announced in the Senate at the beginning of this month that not three, but already four rate hikes were possible this year. As a result, market participants completely focused all their attention on the results of the January meeting of the Central Bank, believing that it will definitely announce the date of the first rate hike this year.

Previously, many believe that the latest inflation data for December will force J. Powell to take this step, and, more importantly, raise rates at the March meeting. However, the latest inflation figures are forcing us to correct our opinion.

What is the reason for these expectations and what can the Fed really afford to do?

It is clear that high inflation forces the regulator to act, and it will have to raise the cost of borrowing. In the current situation, it does not matter when – in March or in July. The main thing is that the Fed simply cannot allow Treasury yields, which are already slowly moving up since the end of last year, to soar due to America's current economic situation, which is far from healthy due to the lingering problems caused by the 2008-09 crisis and the consequences of COVID-19.

The economic situation in the US is extremely difficult. High public debt, both internal and external, looms over the current economic problems. The decision to raise rates and actually raise them by 0.25% four times this year will lead to a noticeable increase in government bond yields, and in turn, this will increase the cost of servicing government debt, which is extremely dangerous in modern conditions, as it can lead to default with all the ensuing consequences.

Therefore, the Fed will try to delay the increase in rates, conducting verbal interventions, thereby restraining the inflating of financial bubbles in the stock market. It continues to hope that the inflation rate will slow down and stabilize, and the establishment of supply chains with the end of the pandemic will lead to overstocking of the market and a decrease in inflationary pressure. So, in this situation, it is better for the Central Bank to choose a strategy of observation rather than action.

We believe that the Central Bank will be restrained at the January meeting, but Powell is more optimistic, pointing to signals about a possible stabilization of inflation in the country. We believe that this behavior will be perceived by investors as a signal of a low probability of a rate hike in March and will cause a new wave of demand for risky assets. It is possible that the outcome of the meeting will lead to a steady rally in the stock markets with a simultaneous weakening of the US dollar.

Forecast of the day:

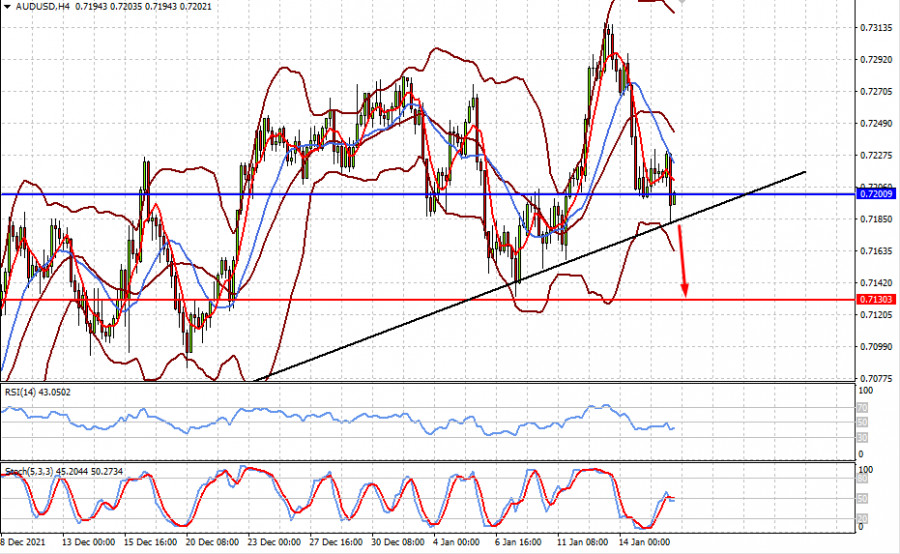

The AUD/USD pair is trading at the level of 0.7200, below which it will decline to 0.7130.

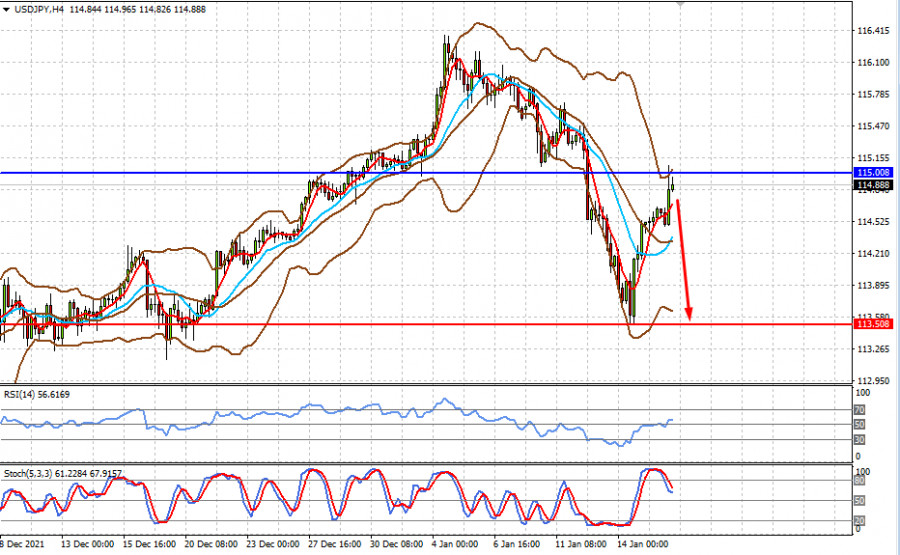

The USD/JPY pair rose amid the Central Bank of Japan's decision to leave monetary policy unchanged. The pair's failure to rise above the level of 115.00 could be a basis for a downward reversal towards 113.50.