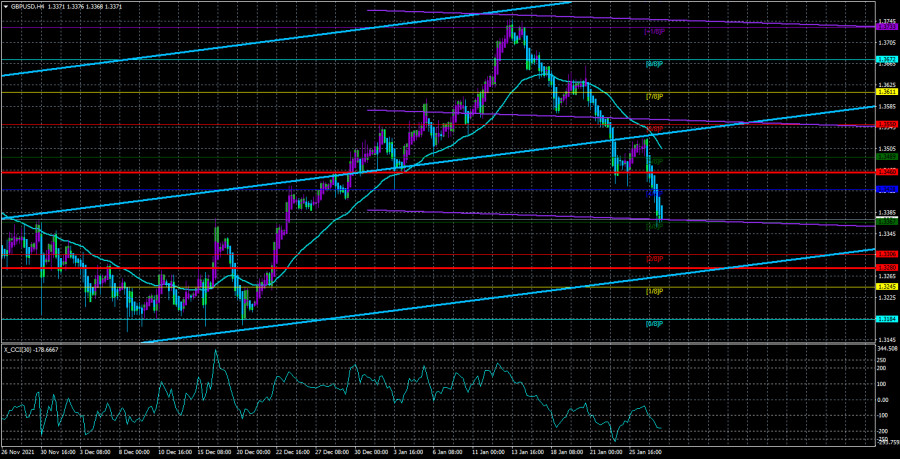

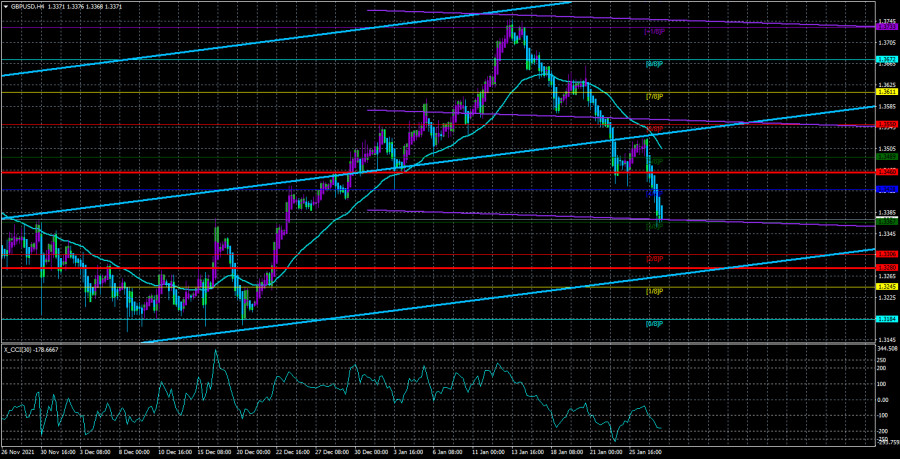

The GBP/USD currency pair on Wednesday evening and throughout Thursday fell as if knocked down. In principle, this is not surprising. We have already said that yesterday the Fed, if it did not surprise traders, at least made it clear that we should expect even more "hawkish" actions in 2022 than previously planned. Naturally, after such an announcement, traders rushed to buy the American currency, which led to the fall of the euro/ dollar and pound/dollar pairs. It should be noted that for the pound/dollar pair, everything is also going completely according to plan. This means that the fall of the pair was also expected by us. We said earlier that this is the nature of the pair's movement over the past 13-14 months: 500-600 points down, then 400-500 points up. This is how the pair continues to move in 2022. After it rose by 600 points rather unexpectedly and not quite justifiably, a new fall began, which is likely to end much lower than the previous local minimum - 1.3160. That is, if the euro currency simply "took acceleration" to overcome an important level, then the pound sterling adjusted to resume falling. And as a result, both pairs are moving in the same direction again. On the 24-hour TF, it is visible that the price has already consolidated below the Kijun-sen and Senkou Span B lines of the Ichimoku indicator, so now there are practically no obstacles to further fall of the pair. It should also be noted that the UK remains the number one supplier of various kinds of negative news, but at the same time all this news has not yet had a special impact on the pair's movement. They work more like a background.

The American economy grew by 6.9% in the fourth quarter.

A lot has been said about the UK recently. There is nothing to add to this yet. But this week there is something to talk about in the context of the American economy and the Fed's monetary policy. Yesterday, the GDP report for the fourth quarter was published and it turned out that the economy grew by 6.9% q/q. Experts expected to see no more than +5.3%, and we assumed that the real value may be lower than the forecast. The fact is that in winter the whole world was enveloped in a new "wave" of the pandemic, and the States traditionally remained in first place in the world in terms of the number of infections and deaths. Thus, such strong economic growth is something out of the ordinary. Although, on the other hand, it can be "inflationary". We know that officially there is no such term in the economy, but still hardly anyone will deny that the growth of the economy, as well as the growth of the stock market, could be provided by an increase in the amount of money in the economy itself. Here's a simple analogy: the US stock market or Apple shares (it doesn't matter) have been growing in the last two years. At the same time, they showed quite strong growth at a time when the whole was in an economic crisis. Strange correlation. But it ceases to be strange when it turns out how much money the central banks of the world have printed or created in their accounts to support the economy. As a result, it is not surprising that the economy is growing, the stock market is growing. Therefore, given high inflation (that is, rising prices for everything), GDP growth may be more caused by rising prices, rather than an increase in production and services. But anyway, the US economy still grew much stronger than expected, which provoked a new round of purchases of the US currency. And the British pound has already fallen by almost 400 points over the past two weeks. Now he can only rely on the meeting of the Bank of England, the results of which will be announced next week. There are rumors that the British regulator may also raise the key rate, already by 0.25%. But one way or another, we believe that the British pound can receive support only for a short period, and in the medium term it will continue to decline.

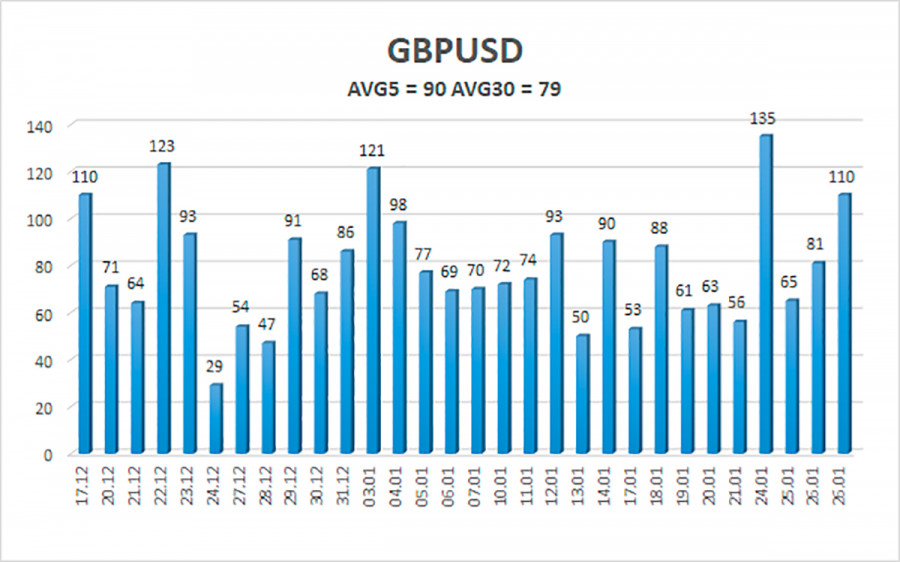

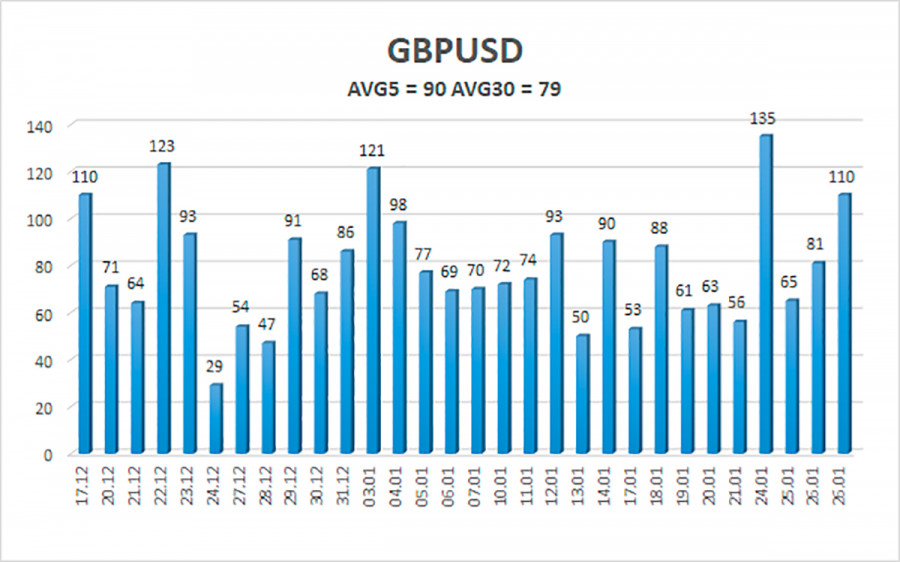

The average volatility of the GBP/USD pair is currently 90 points per day. For the pound/dollar pair, this value is "average". On Friday, January 28, thus, we expect movement inside the channel, limited by the levels of 1.3280 and 1.3460. A reversal of the Heiken Ashi indicator upwards will signal a round of upward correction.

Nearest support levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest resistance levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading recommendations:

The GBP/USD pair resumed its downward movement on the 4-hour timeframe. Thus, at this time, it is recommended to stay in sell orders with targets of 1.3306 and 1.3280 until the Heiken Ashi indicator turns up. It is recommended to consider long positions if the pair is fixed above the moving average line, with targets of 1.3550 and 1.3611, and keep them open until the Heiken Ashi indicator turns down.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.