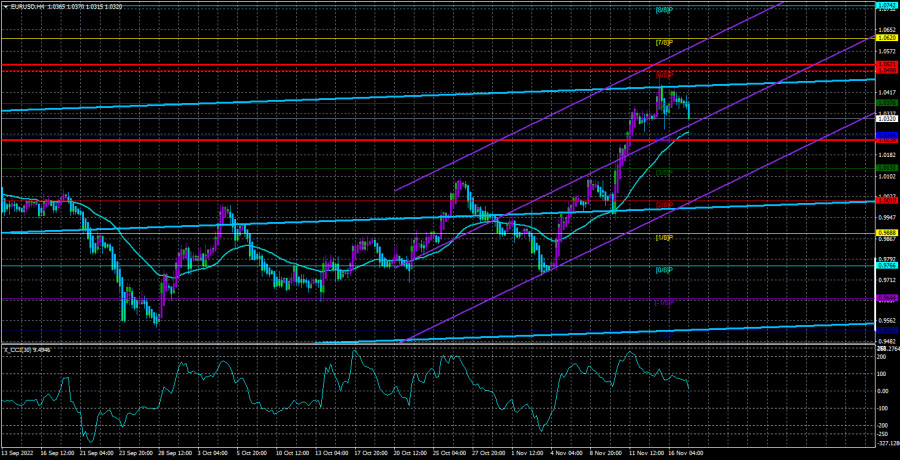

The EUR/USD currency pair fell 100-150 points on Tuesday evening. However, on Wednesday, it fully recovered these losses. Thus, it remains above the moving average line, and most technical indicators indicate an upward trend. Therefore, we recommend trading for an increase in the near future until sell signals begin to appear. And those may begin to appear, and there are several reasons for this.

First, the current growth can be called a good correction, but on the 24-hour TF, the movement still looks sluggish and weak. Of course, it may still need to be completed. Then sooner or later, it can become an independent trend. However, this has yet to happen. Second, the fundamental background is not so bad for the US currency now that it falls non-stop. Yes, the Fed has made it clear that it will begin to slow down the pace of monetary policy tightening, but it has already been tightened much more than in the European Union or the UK. And, most likely, everything will remain that way, even when the BA and the ECB stop raising their rates. Therefore, we still need to see why the pound and the euro can grow strongly for a long time. Third, the pair's growth in the last two weeks raises quite a lot of questions when there were formal grounds for such a movement, but they were not so strong that the euro currency grew and the dollar fell by 700 points. Recall that the ECB and the Fed synchronously raised their rates, and the only reason for the dollar's fall can be called the emergence of specific rhetoric by members of the Fed monetary committee to reduce the pace of the main rate hike. We believe this is not enough for the dollar to continue declining.

Someone's rocket fell in Poland.

"Fourth," we decided to put it in a separate paragraph since this is a very extensive topic that concerns geopolitics. The day before yesterday, a massive shelling of Ukrainian cities was carried out. More than 100 rockets were fired, and some of them hit the objects of the energy structure and, in particular, the substation that provided energy to the Druzhba oil pipeline, which is now the only one functioning for pumping hydrocarbons from Russia to Europe. The pipeline is currently not working, and Kyiv says it will be able to fix the problems within a few days. However, even these few days may be enough for traders to rush back to buy a "safe" dollar, expecting a new deterioration in relations between the West and the Russian Federation.

In addition, Ukraine and neighboring Poland suffered during the rocket attack. This happened for the first time since the beginning of the military conflict. In a small Polish town, the remnants of a downed missile, the missile itself, or a Ukrainian air defense missile, fell. In the first hours after the incident, many European leaders said the missile was Russian. The next day, several statements followed that "this is hardly a Russian missile." There were also several statements that "it doesn't matter whose rocket it is, Russia is still to blame." Then the rhetoric changed to "even if it is a Ukrainian air defense missile, they are still not to blame, as they defended themselves from the shelling."

Even the injured party, Poland, managed to change its rhetoric several times from "the Russians started shooting at us" and "we are calling an emergency meeting of NATO and demand an adequate response" to "it was hardly intentional" and "the missile is most likely Ukrainian." Therefore, as usual, none of the EU leaders will tell the truth, and if they do, who will know how it was? However, the Baltic states have already demanded protection from NATO and an adequate response to what is happening. We believe that because of this, relations between the West and the Russian Federation may deteriorate again (although much worse), leading to a new escalation of the conflict. Kyiv demands that NATO completely close the skies over Ukraine, and Germany and the United States have already announced new military aid packages. As we can see, there is still no "smell" of easing tension or peace talks.

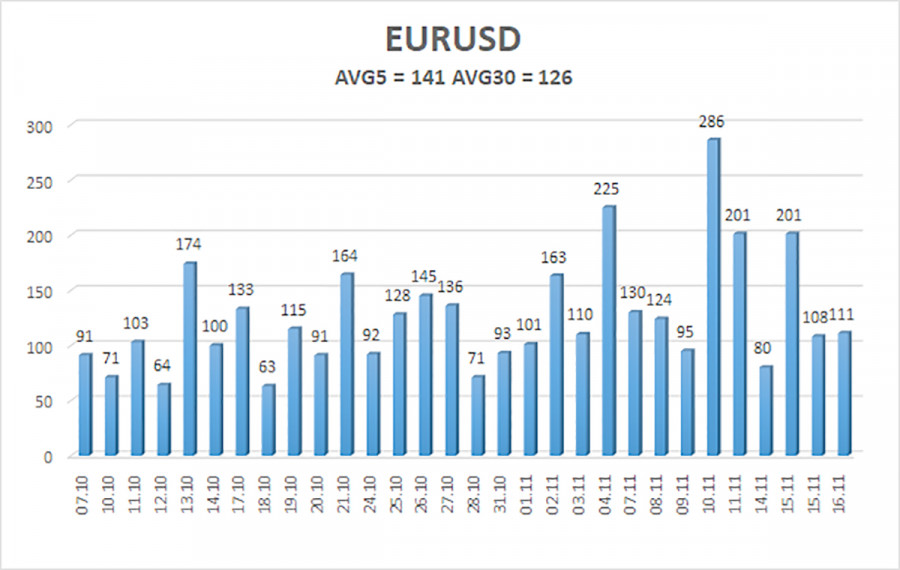

The average volatility of the euro/dollar currency pair over the last five trading days as of November 17 is 141 points and is characterized as "high." Thus, we expect the pair to move between 1.0238 and 1.0521 on Thursday. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

The nearest support levels:

S1 – 1.0254

S2 – 1.0132

S3 – 1.0010

The nearest resistance levels:

R1 – 1.0376

R2 – 1.0498

R3 – 1.0620

Trading Recommendations:

The EUR/USD pair has started to adjust. Thus, now we should consider new long positions with targets of 1.0498 and 1.0521 in the case of a reversal of the Heiken Ashi indicator upwards. Sales will become relevant by fixing the price below the moving average line with targets of 1.0132 and 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.