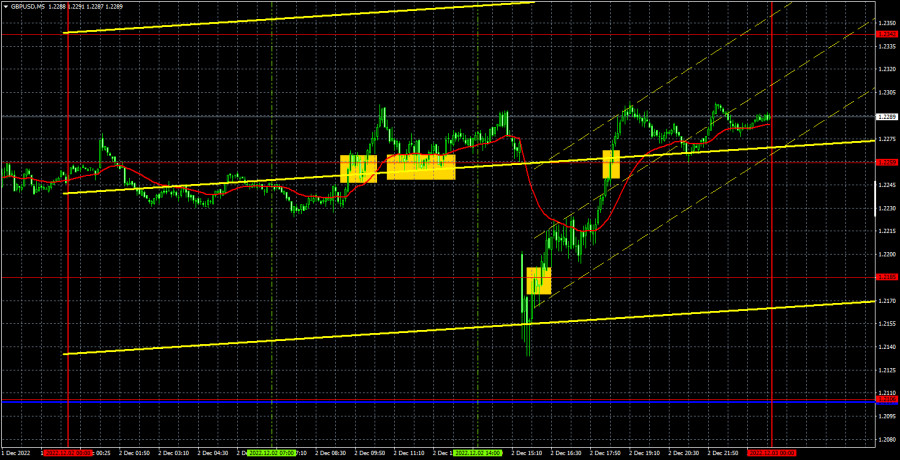

M5 chart of GBP/USD

GBP/USD also plummeted on Friday after the U.S. data and then sharply rose for no reason. Therefore, the pound showed almost identical movements to the euro. Everything we have mentioned in the article on the euro, is also true for the pound. It is also worth noting that the sterling is also not standing still, and is actively rising. The market continues to reduce positions on the dollar, which leads to the growth practically on a straight line, regardless of the macroeconomic statistics and fundamental background. Reminder: even the speech of Federal Reserve Chairman Jerome Powell last week was not dovish, so the pair should not rise at all. However, at the moment it can continue doing so for a long time. Fundamentals and macroeconomics are almost irrelevant now.

As for trading signals, the pound's situation was more interesting. Two buy signals near the level of 1.2259, both were false. In both cases the price went up 20 points, so Stop Loss orders should have been placed and there should be no loss. After that there was a buy signal near the level of 1.2185, which was quite dangerous to use, because strong US data had been released about half an hour before and it was more reasonable to expect the pair's decline, but not the rise. Nevertheless, those who opened a long position made a profit, as the quotes rose to 1.2259 and overcame that level. As a result, the day could even turn out to be profitable, in spite of the illogical movements.

COT report

The latest COT report on the British pound indicated increasing bearish sentiment for the second consecutive week. In the given period, the non-commercial group closed 5,000 BUY contracts and 4,000 SELL contracts. Thus, the net position of non-commercial traders decreased by 1,000. The net position is growing during the last months, but the sentiment of the big players is still bearish, and the GBP is rising against the USD, but it is very difficult to answer the question why it does so. We don't exclude the option in which the pound could sharply fall in the near future. Take note that both major pairs are moving almost equally now, but the euro's net position is positive and even implies that the upward momentum will end soon, while it is negative for the pound... The non-commercial group now has a total of 62,000 short positions and 28,500 long positions. The difference, as you can see, is very large.

As for the total number of open Buy and Sell, the bulls have the advantage by 13,000. We are still skeptical about the British currency's growth in the long term, although there are technical reasons for it, but the foundation or geopolitics obviously do not imply such a solid strengthening of the pound.

H1 chart of GBP/USD

The pair continues to trade very high and failed to start a downward correction on the one-hour chart. The most interesting thing is that the uptrend has resurfaced, but the trend line is no longer relevant, and there is no new trend line. Therefore, at this time, the pound can move in either direction with equal probability. On Monday, the pair may trade at the following levels: 1.1760, 1.1874, 1.1974-1.2007, 1.2106, 1.2185, 1.2259, 1.2342, 1.2429-1.2458. The Senkou Span B (1.1959) and Kijun Sen (1.2104) lines may also generate signals. Pullbacks and breakouts through these lines may produce signals as well. A Stop Loss order should be set at the breakeven point after the price passes 20 pips in the right direction. Ichimoku indicator lines may move during the day, which should be taken into account when determining trading signals. In addition, the chart does illustrate support and resistance levels, which could be used to lock in profits. On Monday, the UK is set to publish the index of business activity in the service sector, and traders will unlikely be surprised by its results. In America, the ISM Services Business Activity Index will be released, which has greater importance and weight in the eyes of traders.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.