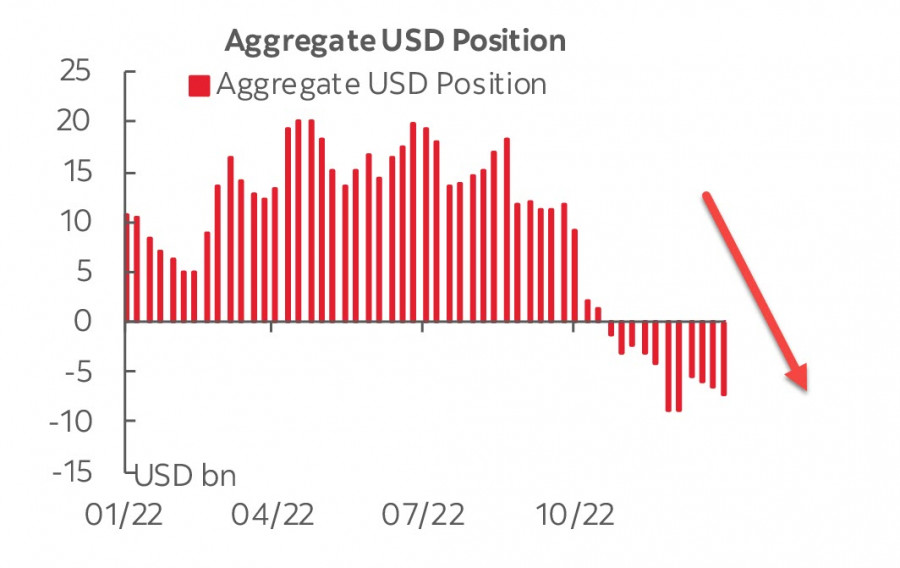

Speculative net positions on the U.S. dollar continue to fall. As it follows from the CFTC report, the total short position rose by 671 million to -7.283 billion, with the euro showing the largest growth.

Also take note of the growth in long positions in gold, over the week, the bullish performance increased by 1.3 billion and exceeded 30 billion. The growth in demand for the dollar correlates well with the decline in its demand, which can be interpreted as another signal that USD will continue to get weaker.

The Federal Reserve will meet on Wednesday. The markets expect the US central bank to raise the rate by 0.25%. So far, the Fed's goal is to reach the 4.75/5.00% range, and if in the fall, the markets expected that this level would be reached in February-March, now the forecast is different, three hikes of 0.25% are expected at the next meeting, as well as in March and May, at which point the cycle will be completed. Two consecutive declines of 0.25% are expected in the second half of the year. This is a less aggressive forecast than last fall, and therefore the demand for the dollar is objectively decreasing, since the rate forecast was priced into the dollar in those months when it was steadily strengthening. In favor of changing the scenario to a milder form, lower inflation, wage growth and stronger GDP growth in the 4th quarter than expected, against the labor market as a whole, which has not recovered from the pandemic.

The volatility of the currency market was minimal on Monday, nothing else to expect. Low volatility will continue after the announcement of the results of the Fed meeting.

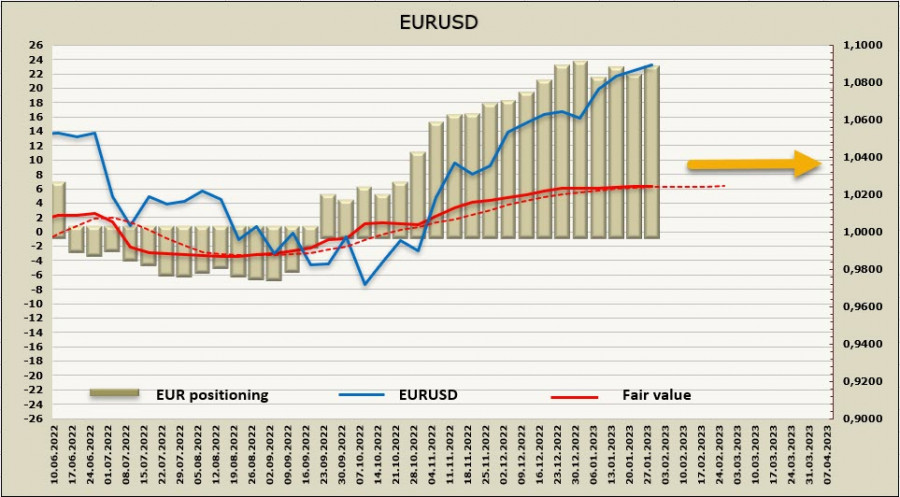

EURUSD

On Thursday, the ECB will announce changes in its monetary policy, a 50bp hike is expected, which is already fully included in the current euro exchange rate. Another 50bp hike is also expected for March. If European Central Bank President Christine Lagarde confirms the hawkish stance, then the euro will receive a boost for growth, but until Thursday, one should not expect any movements (unless, the Fed manages to surprise us on Wednesday).

The fact that the ECB started the growth cycle later than the Fed and the Bank of England, which means that the cycle of rate cuts will start later, is a factor that benefits the single currency. Meanwhile, the yield differential would add pressure on the euro, as the peak value of the ECB rate is lower. Until this uncertainty is overcome, the markets will not be able to choose the scenario of a strong movement in one direction or another.

Euro net long position is rising again, +1.159 billion weekly change, +18.283 billion overall bullish. The settlement price, however, has completely lost momentum, which does not make it possible to confidently predict the direction.

As I suggested in the previous review, the consolidation is developing below the technical level of 1.0940. In order to continue rising, it is necessary to strengthen the driver for growth, expressed in further divergence of monetary policies of the ECB and the Fed. Rumors that the ECB may slow down the rate hike have already been played out, so any certainty on this issue will serve as a driver. If the market decides that the ECB will continue to portray a hawkish stance, then we can expect the euro to consolidate above 1.0940, and an attempt to move to the next resistance zone of 1.1185/1275. However, if such a thing does not follow, then a pullback to the 1.0735/90 zone is possible.

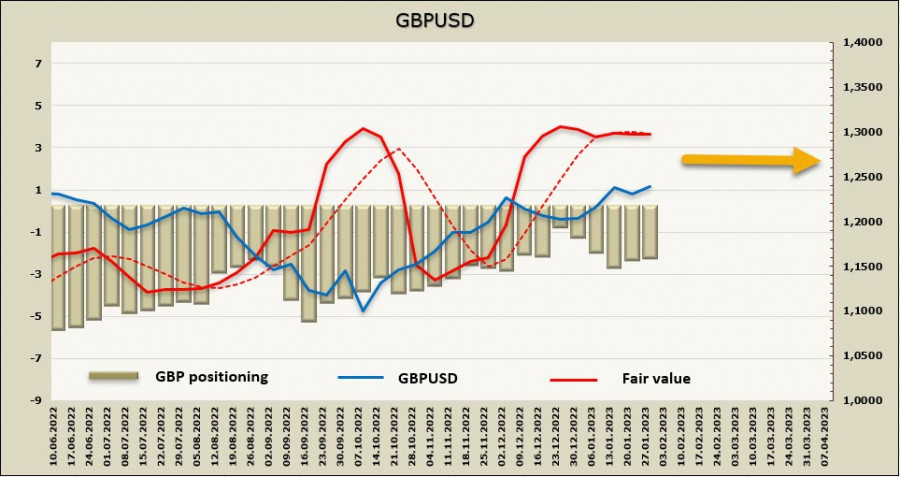

GBPUSD

The BoE will also announce changes in monetary policy on Thursday, the rate is expected to increase by 50bp to 4%. The markets fluctuate between increases of 25 and 50bp, slightly leaning towards a more aggressive step. In favor of the latter, there is persistent inflationary pressure, wage growth (6.41% YoY in November) and weaker forecasts for the depth of the upcoming recession. The updated forecasts are also expected to show an improvement in the economic outlook.

The peak forecast for the BoE rate decreased from 5.25% to 4.40%, which reduces bullish expectations for the pound.

Speculative positioning on GBP is practically unchanged, the net short position for the week decreased by only 51 million, to -1.845 billion, the bearish advantage remains. The estimated price has practically fallen into the horizon, which, as in the case of the euro, indicates the absence of an obvious direction.

The pair can not cross the resistance of 1.2444, the bulls clearly lack the intention to make a breakthrough, since there are few fundamental reasons for resuming growth. In the coming days, we expect continued consolidation, the driver is likely to come from the United States after the results of the Fed meeting on Wednesday and will strengthen on Thursday, when the BoE will hold its meeting.