Trade Analysis and Tips for Trading the Japanese Yen

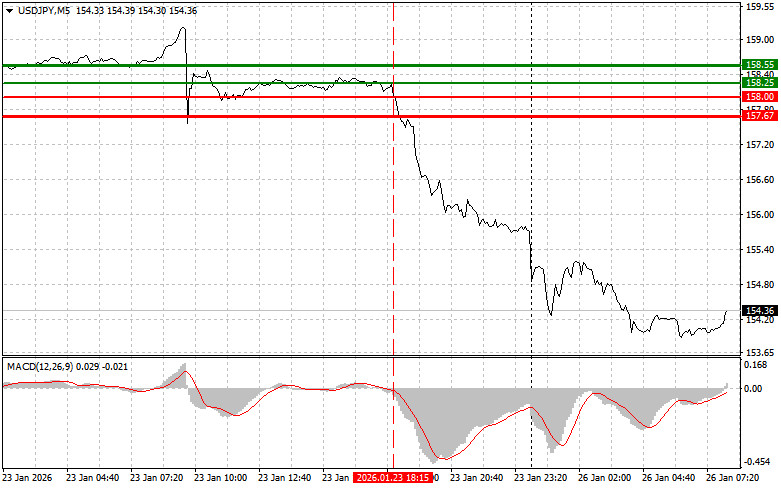

The test of 158.00 coincided with a period when the MACD indicator had moved significantly below the zero mark, which limited the pair's downside potential.

At the end of last week, Japan's Prime Minister Sanae Takaichi issued a warning to financial markets due to the weakening yen and the sharp rise in bond yields, stating that the government is ready to take action. This led to a sharp decline in the dollar and a strengthening of the Japanese yen. Investors, fearing intervention from the Bank of Japan, began to offload dollar assets, further increasing pressure on the American currency. A statement from a high-ranking official, such as the Prime Minister, is a strong signal for financial markets. It indicates that the Japanese government is concerned about the current situation and is prepared to use all available tools, including currency interventions, to stabilize the yen's exchange rate.

Attention is now focused on the Bank of Japan's and the government's further actions. Markets will closely watch for any signs that intervention is imminent. Further weakening of the yen or a sharp jump in bond yields could prompt more decisive actions by authorities, which, in turn, could lead to even greater yen strength and further volatility in financial markets. The situation remains tense and requires close attention from investors and analysts.

As for the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buy Scenarios

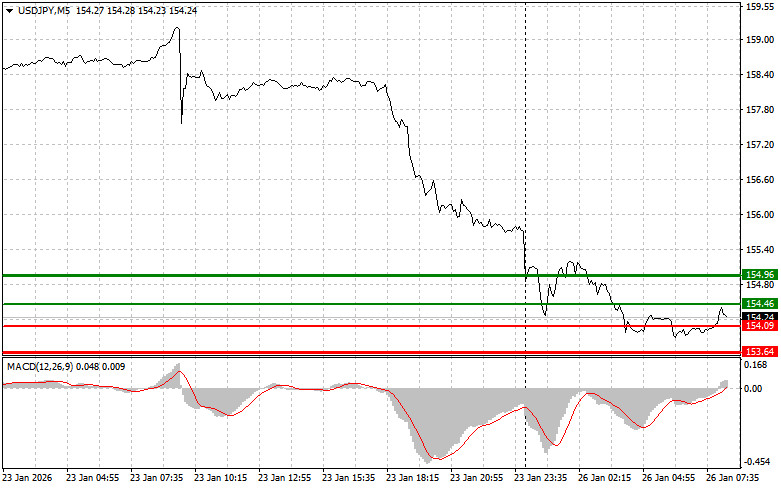

Scenario #1: I plan to buy USD/JPY today when it reaches the entry point around 154.46 (green line on the chart), with a target for growth to 154.96 (thicker green line on the chart). At the level of 154.96, I intend to exit the market and open sell positions in the opposite direction (aiming for a movement of 30-35 pips in the opposite direction from the level). It's best to return to buying the pair on corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting its rise from there.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 154.09 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. An increase can be expected towards the opposing levels of 154.46 and 154.96.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY today only after the 154.09 level is updated (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the level of 153.64, where I intend to exit the market and immediately buy in the opposite direction (aiming for a movement of 20-25 pips in the opposite direction from the level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting its decline from there.

Scenario #2: I also plan to sell USD/JPY today if the price tests 154.46 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline can be expected to the opposing levels of 154.09 and 153.64.

What's on the Chart:

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.