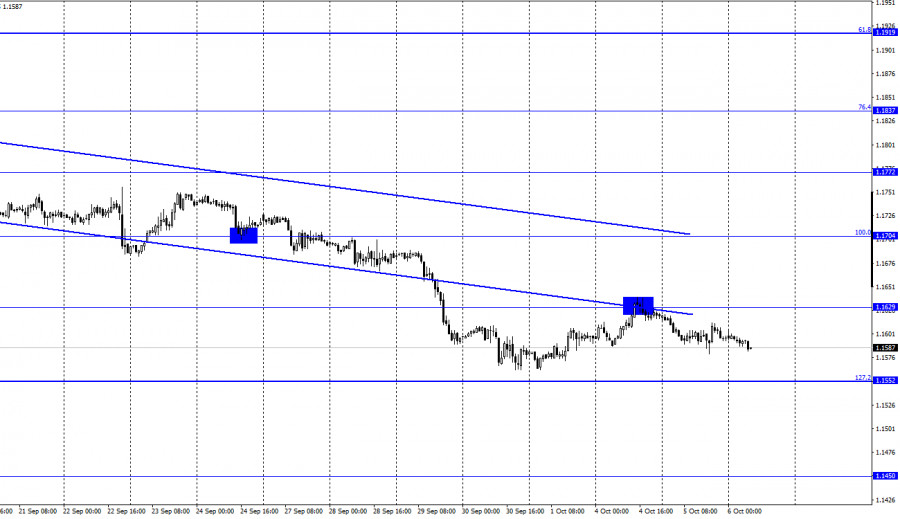

EUR/USD – 1H.

The EUR/USD pair continued the process of falling after rebounding from the level of 1.1629 in the direction of the corrective level of 127.2% (1.1552). Thus, at this time, the mood of traders remains "bearish", which is also evidenced by the downward trend corridor on the hourly chart. The rebound of the pair's exchange rate from the Fibo level of 127.2% will allow traders to count on a reversal in favor of the EU currency and some growth in the direction of 1.1629. Closing below the level of 1.1552 will increase the chances of further decline. However, in general, the rather weak activity of traders immediately catches the eye. The euro/dollar pair is barely moving. And this pattern has been observed for quite a long period. Yesterday, the information background was quite interesting. However, traders preferred not to pay attention to it. Nevertheless, let's go through the reports that traders chose to ignore.

The index of business activity in the services sector of the European Union increased from 56.3 to 56.4 points. The EU producer price index decreased from 2.5% m/m to 1.1% m/m. The ISM index of business activity in the US services sector rose from 61.7 to 61.9. However, traders expected a drop to 59.9. Thus, in general, the US dollar grew quite logically, but its growth was 20 points per day. Also, traders are now only very superficially interested in the topic of the national debt ceiling, which has already been reached by the US Treasury Department. Therefore, fierce debates and discussions are currently taking place in Congress on whether to freeze the "debt ceiling" until mid-2022, which will allow Janet Yellen and her department to continue making payments and avoid a technical default. Although this topic is very important for the markets and the US currency, so far I cannot say that the traders of the foreign exchange market are worried about this. The dollar continues to show growth, which is especially clearly seen on the 4-hour chart below. Thus, so far, traders generally do not pay much attention to the information background.

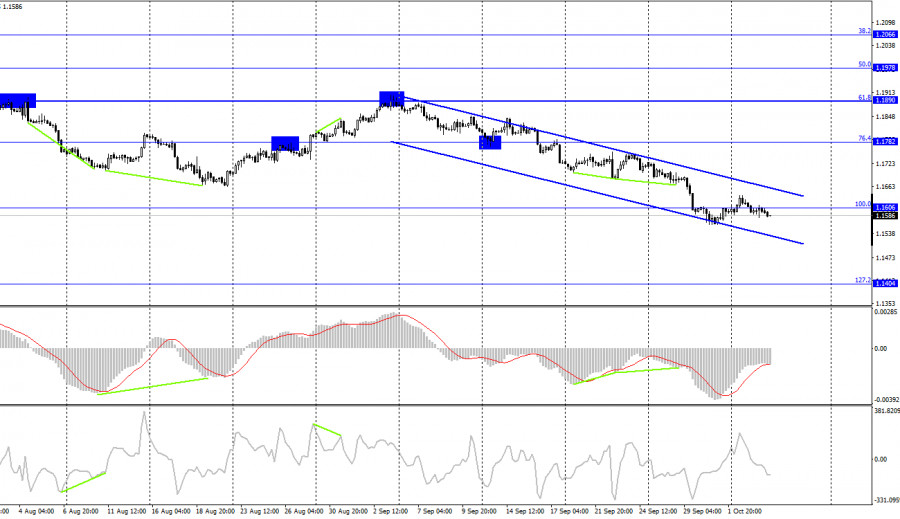

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a new close under the corrective level of 100.0% (1.1606). Thus, the process of falling can be continued in the direction of the next Fibo level of 127.2% (1.14040. Emerging divergences are not observed in any indicator today. The pair's quotes continue to be in a downward trend corridor, which indicates the preservation of the "bearish" mood among traders.

News calendar for the USA and the European Union:

EU - change in retail trade volume (09:00 UTC).

US - change in the number of employees from ADP (12:15 UTC).

On October 6, the calendars of economic events of the European Union and the United States contain only one entry each. Moreover, both are not the most important. The ADP report, which reflects the state of the US labor market, may affect the mood of traders today. Especially if its meaning is unexpected for them.

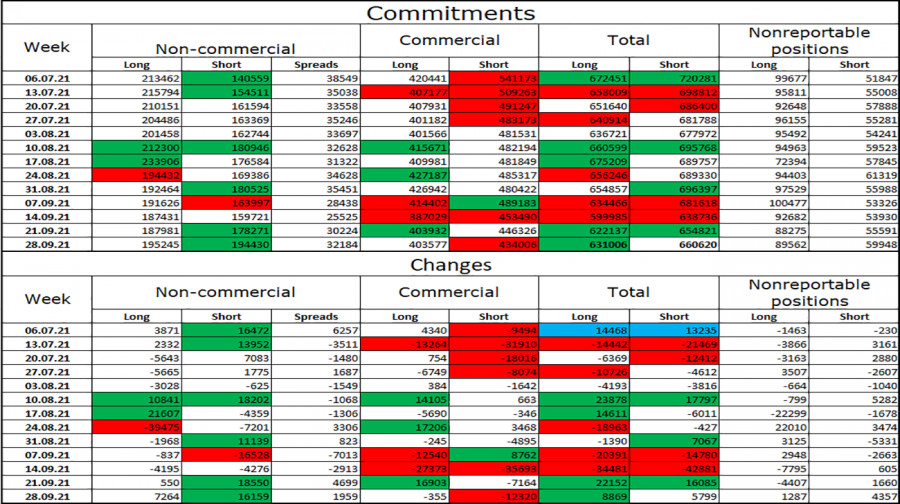

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders changed very much. Speculators opened 7,264 long contracts on the euro and 16,159 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 195 thousand, and the total number of short contracts - to 194 thousand. Over the past few months, the "non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may continue.

EUR/USD forecast and recommendations to traders:

I recommend new purchases of the pair when rebounding from the level of 127.2% (1.1552) on the hourly chart with a target of 1.1629. I recommended selling the day before yesterday, if there is a rebound from the level of 1.1629 on the hourly chart, with a target of 1.1552. Now, these deals can be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.