There was a massive sell-off in EUR / USD on Thursday morning brought by risks raised by new Covid outbreaks. Apparently, infections have soared in many European countries, reinvigorating fears of investors.

Meanwhile, US data released yesterday were ignored by the market as they generally coincided with the forecasts of economists. The exception was the labor market, which continued to show impressive figures despite an increase in the number of coronavirus infections.

Sadly, supply chain disruptions persist not only in the US, but also around the world. Latest reports indicate that the situation caused noticeable slowdown in manufacturing activity and increase in inflationary pressures. Reportedly, ports and warehouses in the US are now full of goods that cannot reach consumers, which threatens not only the sales and holiday shopping season of the country, but its economy as a whole. President Joe Biden and his administration have been vigorously fighting to address these disruptions, but so far they are yet to succeed. Many private sector problems remain unresolved, resulting in partial paralysis and operational disruptions.

Unsurprisingly, Republicans are using this unfortunate situation to accuse Biden of poorly managing the economy. The huge volume created by delayed consumer demand caused by the pandemic is currently flooding the economy, which is already creaking under the weight of high demand, low investment and labor shortages.

For example, an import of a 40-foot container from Asia now costs $ 25,000, while two years ago it did not even exceed $ 2,000. US ports are also faced with an incredible amount of supplies, forcing ships to wait long on the high seas to unload. The Port of Los Angeles, which together with nearby Long Beach Port, is the busiest in the country.

Aside from that, there are problems with the current wage of truck drivers as it is not enough to compensate for the exhausting work. But the White House focused instead on ramping up licenses, so now an average of 50,000 drivers licenses and permits are issued each month, up 14% from the 2019 level and well above the 2020 level.

How this will help solve problems in supply chains is uncertain, but the sooner order is brought in the industry, the more active will be the recovery of the world economy. Resolving the issues will also have a positive impact on inflationary pressures.

Talking about macroeconomic statistics, the European Commission reported on Thursday that consumer confidence in the Euro area fell less than expected in October. It dropped to -4.8 points, from -4.0 points in September.

Meanwhile, Istat reported that industrial production in Italy remained unchanged in August, showing a flat after rising 0.8% in July. Confidence has not changed either, as Insee reported that manufacturing confidence remained stable at 107 points.

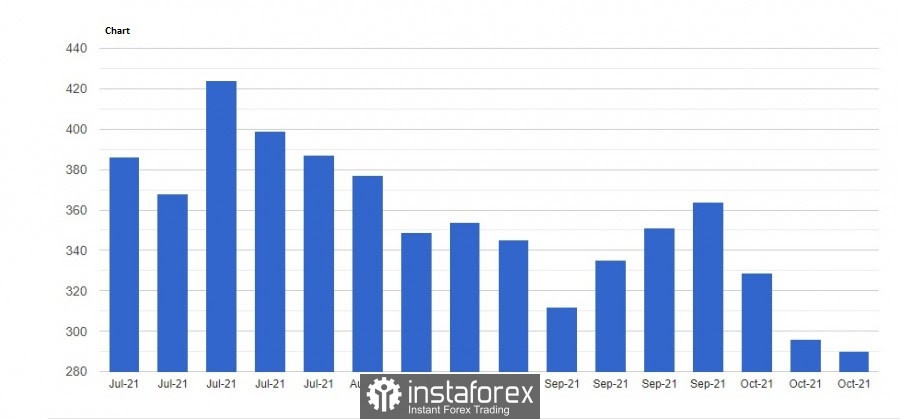

With regards to the labor market, US saw a 6,000 decrease in jobless claims, recording a total of only 290,000 in the reporting week. The less volatile four-week moving average also fell to 319,750.

The index of leading US indicators also rose slightly in September, climbing 0.2% after rising 0.8% in August and 0.9% in July. The increase is said to be brought by declining fears over the coronavirus, but fears of rising inflation and supply chain disruptions continued to impede strong US economic growth.

Technical analysis on EUR/USD

A lot currently depends on 1.1620 because a breakout will cause a drop to the base of the 16th figure and possibly, to 1.1570. But a rise to 1.1650 will provoke a rally to 1.1670 and 1.1720.