The markets were optimistic back in September, which was based on several reasons:

- Vaccination will stop the spread of COVID-19

- Inflation growth is temporary and will end as we get out of the covid crisis

- Production cycle is recovering, raw material prices are rising, which means global demand is also growing

These factors made it possible to predict global GDP growth, which should have a positive effect on the currency market, where defensive currencies were under pressure, and raw materials had good potential to rise.

Apparently, everything is going a little differently, or rather, quite differently, and the sharp rise in inflation in the United States is just one of the signs that 2022 will be much more gloomy for world markets than it was assumed quite recently. There are several reasons for this.

- Vaccination did not lead to a victory over the coronavirus. A number of countries are considering tightening restrictive measures bordering on a full-fledged lockdown, despite the high percentage of vaccinated. Despite the harsh measures designed to create unbearable conditions for the unvaccinated, the cases are not decreasing but increasing. Several studies confirm that vaccinated transmit the virus no worse than unvaccinated, which means another lockdown. This trend affects the pace of recovery of the global economy and will open the question about the approach of normalization of monetary policy.

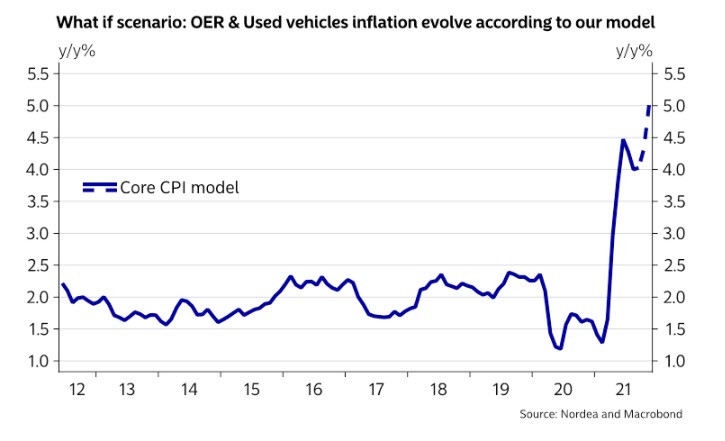

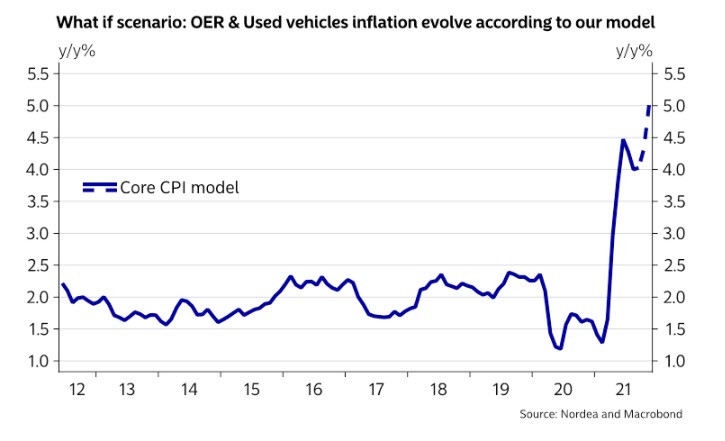

- The surge in US inflation significantly exceeds forecasts and does not correspond in any way to the Fed's position on the temporary nature of price increases. Nordea analysts conducted their own study of the nature of inflation and concluded that the current dynamics in favor of a further increase in inflation, rather than its gradual weakening, among the main reasons called outstripping wage growth, rising prices for used cars and housing rents, as well as a feedback loop of energy and food prices, when rising gas prices lead to a sharp rise in price or even a shortage of fertilizers. According to Nordea analysts, these reasons will lead to an increase in US core inflation next year of more than 5%. The total inflation will be above 6%.

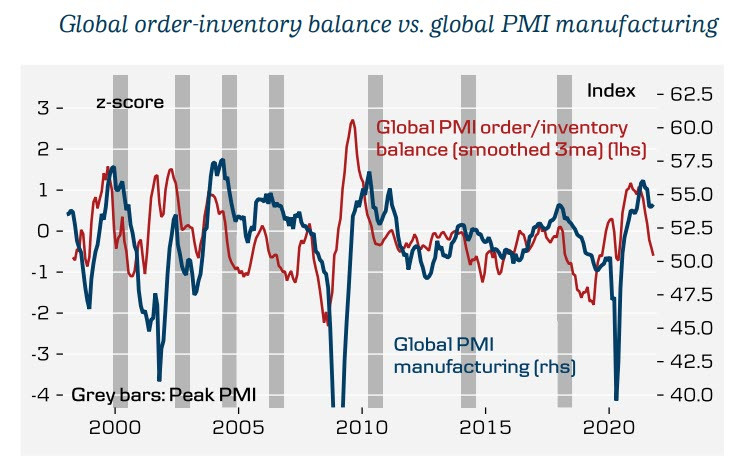

- The global production cycle is slowing down, which threatens the recovery of the economy as a whole. Danske Bank monitors a number of macroeconomic indicators, from which it follows that it is not necessary to count on high economic growth rates. One of these indicators can be seen below – the ratio of new orders to inventory goes down sharply, which, as the historical data show, always precedes a drop in production PMI.

According to analysts at Danske Bank, the global production cycle will reach the bottom in about 9 months. This means that the probability of further growth of commodity currencies becomes noticeably lower in the perspective of six months.

Shortly after the inflation report was published, Senator Manchin tweeted that inflation is not transitory, is getting worse, and that the District of Columbia can no longer ignore the inflation tax.

What is the result? Apparently, the chances of passing a bill in the US Congress on additional spending of $ 1.7 trillion on infrastructure have become less, since their implementation will increase the already high inflationary pressure. The CBO data for 2021 does not inspire strong optimism yet. The federal budget deficit is 12.1%, which is slightly better than 15% in 2020, but very far from the docklike 4.7%. Moreover, income tax receipts turned out to be slightly higher than forecasts, otherwise, the deficit would have been even higher.

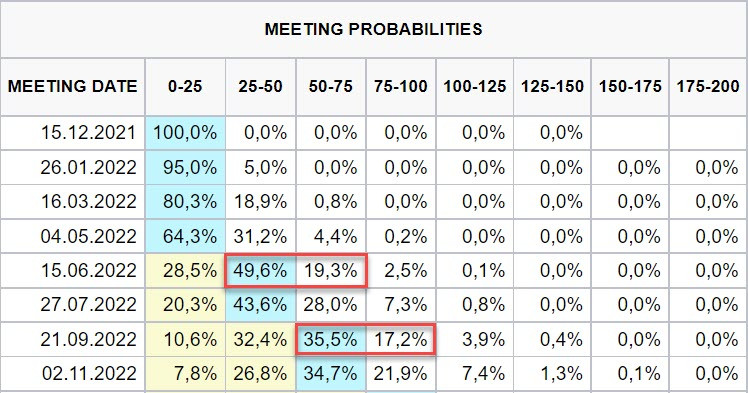

The rising inflation may force the Fed to raise the rate sooner rather than later. CME futures give more than 50% probability of the first rate hike in June 2022 and more than 50% of the second increase in September. This is significantly earlier than the Fed itself predicts.

Here, it becomes clear how large players see the prospects of the currency market. The US dollar will remain in the status of a currency leader, so it is unlikely to fall in the medium term. Meanwhile, the growth of commodity currencies is slowing down, despite still high commodity prices, as the slowdown in the production cycle and the threat of tightening monetary policy will force players to avoid risks. In turn, protective assets will continue to grow, so an increase in interest in the yen, the franc, gold is expected with a target at the level of $ 2,000 per ounce. Cross-pairs like AUD/JPY or GBP/CHF will be under pressure.