As expected, yesterday's publication of the minutes of the last meeting of the Open Market Committee (FOMC) of the US Federal Reserve confirmed the opinion that the number of "hawks" in the ranks of the Fed has increased. More and more monetary officials of the Fed are calling for a faster curtailment of the quantitative easing (QE) program. The main reason that pushes to tighten its monetary policy is still persistently high inflation. Let me remind you that earlier the American Central Bank considered such an inflationary growth to be a temporary phenomenon. However, it seems that he was mistaken with this assessment of inflationary pressure in the country. What can I say if even the president of the Federal Reserve Bank of San Francisco, Daly, who traditionally adhered to a soft "dovish" position, now, given high inflation, joined the ranks of the "hawks" and also spoke out for the early curtailment of the QE program?

In general, as expected the day before, the FOMC protocols supported the US dollar, which continued its growth against the single European currency. Yesterday's macroeconomic statistics from the United States of America came out in a somewhat contradictory format, but this did not prevent the continued growth of the "American" rate. Today, I recommend paying attention to the report of the European Central Bank (ECB) on monetary policy, which will be published at 12:30 London time, and an hour after that, ECB President Christine Lagarde will speak. I do not rule out that European monetary officials will follow the example of their colleagues from the United States and demonstrate a somewhat tougher position than before. At least it would be quite logical and reasonable. It is time for us to look at the EUR/USD price charts to assess the prospects of the main currency pair of the Forex market.

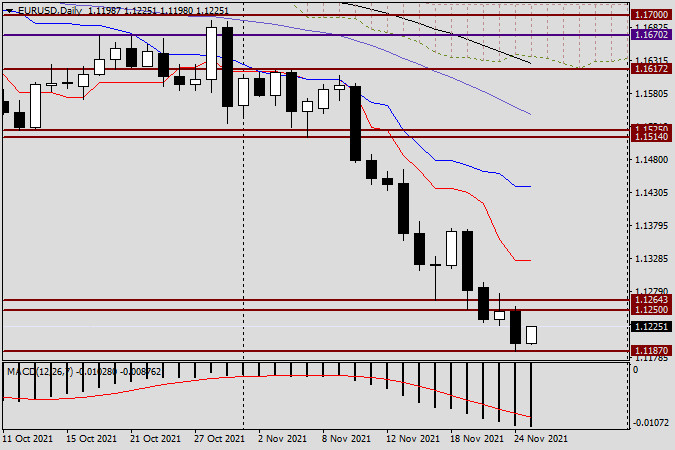

Daily

As a result of yesterday's decline and the closing of trading on November 24 under the strong and significant technical level of 1.1200, further bearish prospects have become even more obvious. It is also worth noting that yesterday's attempts by euro bulls to return the quote above the previously broken support levels of 1.1250 and 1.1264 were doomed to failure. As before, the broken levels, and yesterday they became the 1.1250 mark, now act as strong resistance levels and start the course higher. However, despite the undeniable bearish sentiment on the euro/dollar, at the time of completion of this article, the bulls continue to struggle and try to return trading on the pair above the landmark level of 1.1200. Right now, EUR/USD is trading near 1.1224, but the ECB-related events listed above may affect the completion of trading and their final closing price.

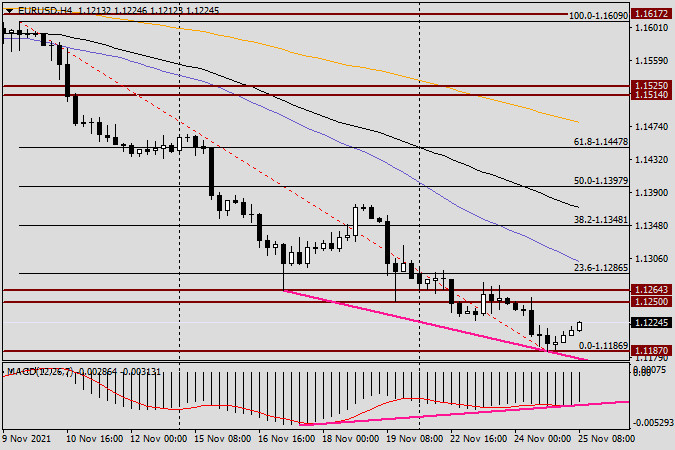

H4

It has been a long time since we have considered the four-hour EUR/USD chart. If you take a closer look at this timeframe, you should pay attention to the bullish divergence of the MACD indicator, which signals that the pair is oversold. Given the already rather long and rather weak decline in the quote, it may be time for a correction. If this is exactly what happens, the pair may return to the previously broken support levels of 1.1250 and 1.1264, where, from a technical point of view, it may again meet strong resistance from sellers and turn towards its main bearish trend. Estimated prices for potential sales: 1.1230, 1.1250, and 1.1265. If today's session ends above the last mark, it is quite possible to continue the growth, which at the moment is more likely to be corrective. As for possible purchases, unambiguous signals have not yet matured for them, first of all, this concerns the reversal patterns of candle analysis.