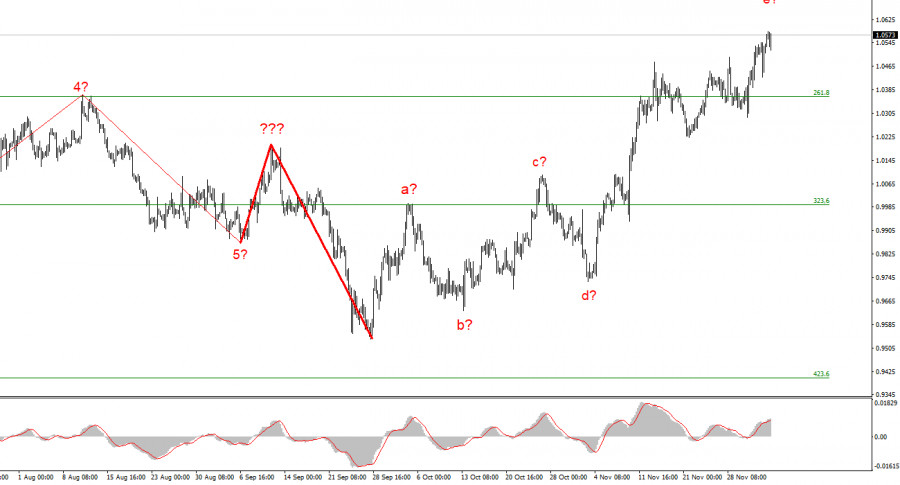

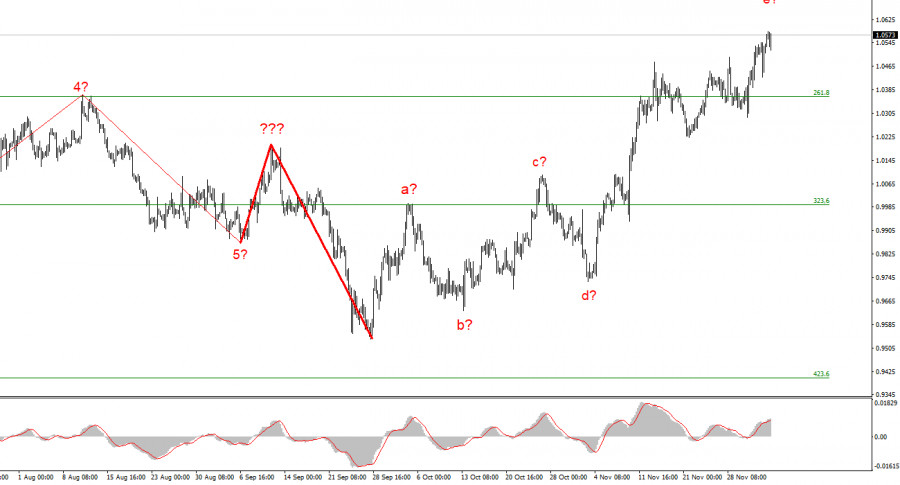

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be quite accurate, but the entire upward portion of the trend is starting to get more complicated. It has already assumed a clear corrective and somewhat prolonged form. We have obtained a complex correction structure of a-b-c-d-e waves. Since wave e is much higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. Therefore, I am preparing for a new, significant decline in the instrument. The market will be ready to sell when a new attempt to breach the 1.0359 level, which corresponds to 261.8% Fibonacci, is successful. However, the recent rise in the instrument's quotes suggests that the entire wave e may end up longer and that the most recent instrument decline is not the first wave of a new descending section. Consequently, the scenario involving the first two waves of a new downward trend segment is rejected. Because there is no increase in demand for US currency, the wave pattern starts to become muddled and complex.

Who is interested in the EU's business activity indices?

On Monday, the euro/dollar instrument gained 60 basis points. No matter what, there is still a growing demand for the euro. Neither on the wave markup nor the news background. I tend to hold fast to the belief that the market will determine right and wrong on its own. However, the current increase in the tool is so odd that I want to avoid drawing any future conclusions from it. The value of the European currency is increasing because more people are buying it. And since the news background does not influence this, why they purchase it is unknown. Three unimportant reports were published today in the European Union, and Christine Lagarde spoke at a dinner event. Lagarde's speech still needs to be discovered, and all three of the EU's reports were unreliable. Therefore, I cannot conclude that European statistics caused Monday's increase in the instrument.

It's always possible to determine the causes of a movement, but this shouldn't be done. There is clear data, accurate news context, and no reasonable market response. According to this comprehension, even though it ought to have ended long ago, the European currency can continue to develop a wave e and an upward section of the trend. Last week, the market increased its buying based on Powell's speech, strong payroll numbers, and a complete disregard for European inflation. Whatever the news background, the value of the euro continued to increase. So, beginning with the current wave marking, a downward trend section should be constructed. We can see a completely different picture in reality. The United States will release business activity indices today, but I don't anticipate any new information. Although the data will undoubtedly be released, the market may need to pay more attention. And if it turns out that they are weak.

Conclusions in general

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The likelihood of this scenario increasing is that the trend's upward portion could become even more extended and complicated.

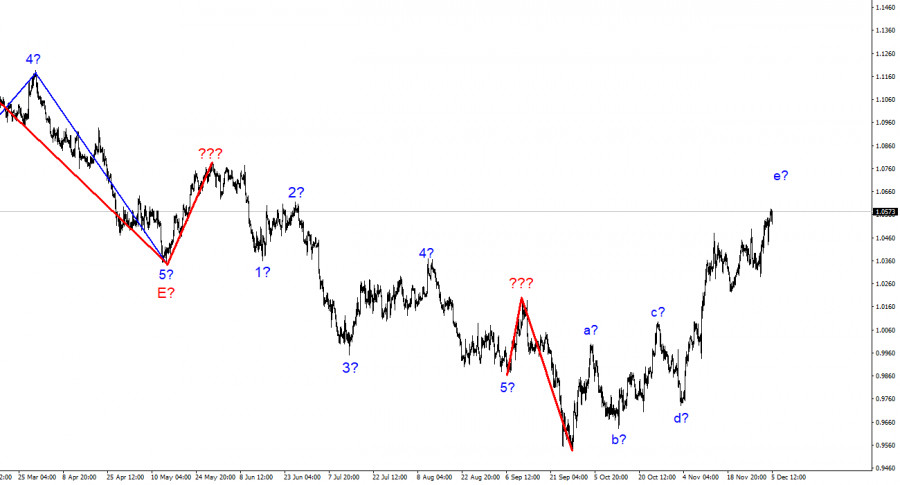

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After this section is completed, work on a downward trending section may resume.