Analysis of Thursday's trades:

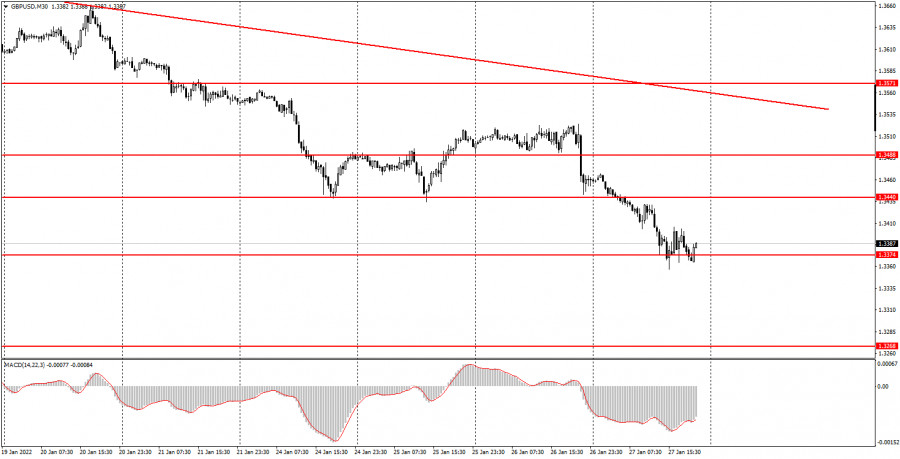

30M chart of GBP/USD

On Thursday, January 27th, GBP/USD continued moving downwards following the FOMC monetary policy meeting. As I already mentioned in my previous articles, the Fed took a rather harsh stance towards its inflation policy. It means that the American financial regulator intends to fight inflation in 2022. Just to remind you, December last year demonstrated a galloping 7% pace of price growth hitting the 40-year record high. In response to that, the Federal Reserve plans to hike rates and reduce its balance sheet which amounts to 9 trillion dollars through the QE program. Any cases of monetary policy tightening will be favorable for the American currency. Meanwhile, the bearish trend in GBP/USD remains intact as indicated by the downward trend line. A break of 1.3374 (1.3366) may push the pound sterling lower. Actually, the current decline looks quite natural given the recent bullish run of the British currency.

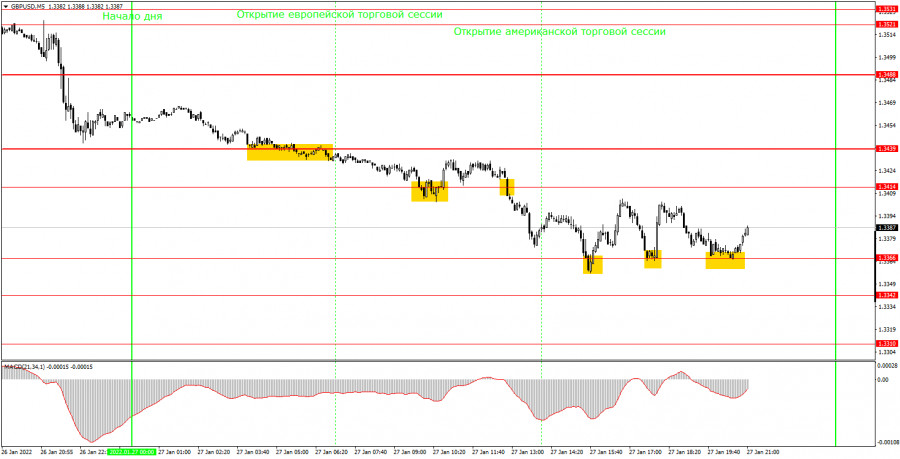

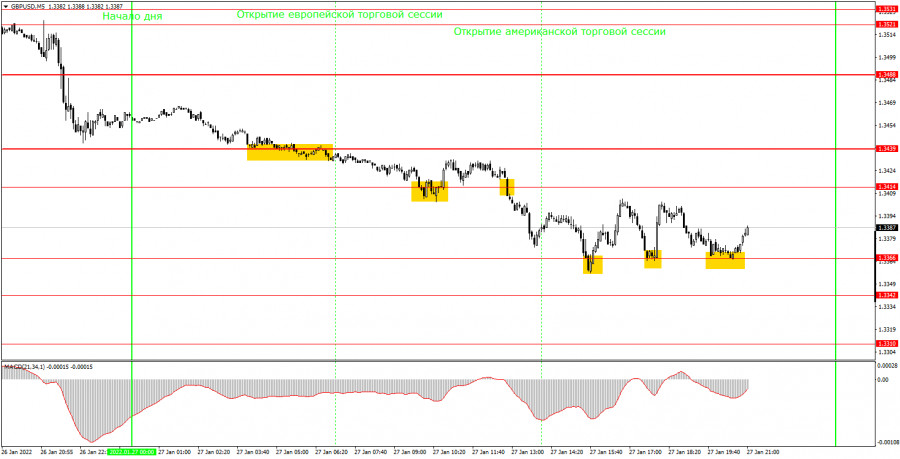

5M chart of GBP/USD

On the 5M time frame, the GBP/USD movement was nothing peculiar though there were some trading signals. As seen on the 30M time frame, the prevailing trend is bearish, so it is reasonable to go short. The first sell signal appeared at the European session opening, and it was worthwhile to use this signal. However, the downtrend was short-lived as the price rebounded from 1.3414. It was a case for closing sell orders and opening buy ones of half the volume. Alternatively, we could refrain from buying because there was a high chance of the US dollar growth following the FOMC decision. Anyway, the cable breached the level of 1.3414 by the beginning of the American session which served as another sell signal. That breakdown led the rate to lower levels, thus giving profits of 25-30 pips to beginning traders. Theoretically, a rebound from 1.3366 could serve as a buy signal. But in practice, the first signal was formed after the publication of the GDP report and it was not the right moment for opening a trade. The second signal was formed when the pair pulled away from 1.3366 by 25 pips, but this signal was not valid. The third buy signal was delayed, so there was no use of it as well.

Trading plan for Friday, January 28:

As seen on the 30M time frame, the bearish trend continues as expected. The downward trend line is far from the current price, so even if there will be some correction, the bearish trend will remain intact. In case bears fail to break the level of 1.3374 and 1.3366, there will be a high possibility of correction. On the 5M time frame targets lie at 1.3268, 1.3310, 1.3342, 1.3366, 1.3406, 1.3439, and 1.3488. Tomorrow, the UK economic calendar lacks any significant events. At the same time, no significant events are expected in the United States, so the volatility in the pair is likely to be limited to 20-25 pips. It is also possible that we will witness upward correction.

The basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break)/ The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read a chart:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in trading over a long period of time.