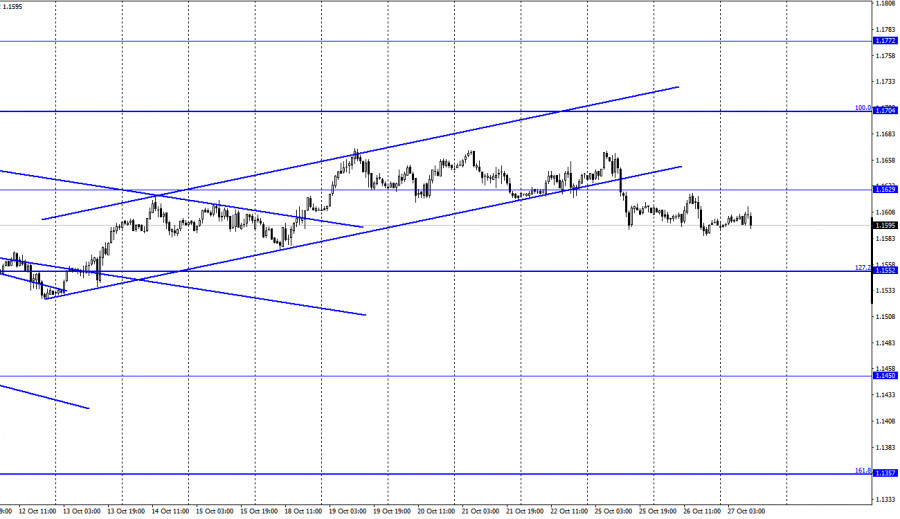

EUR/USD – 1H.

The EUR/USD pair on Tuesday traded strictly below the level of 1.1629, below which it closed a day earlier. Thus, the fall in quotes can be continued in the direction of the next corrective level of 127.2% (1.1552). The rebound of quotes from this level may work in favor of the EU currency and the resumption of growth. However, given the current activity of traders, it may take several days even to reach this level. The information background of yesterday was empty. No economic information came from the USA and the EU. Today, the situation is unlikely to change for the better, since the calendar of events is empty again. However, Washington reported yesterday that US Treasury Secretary Janet Yellen and Vice Premier of the State Council Liu He held a constructive dialogue on cooperation between the two countries. In particular, a trade deal was also discussed.

It is very important for both countries since the countries have been in a state of trade war during the presidency of Trump. It was Trump who unleashed this war and imposed huge duties on most goods from China, arguing that China sells much more to the United States than it buys from the United States. Thus, the trade balance is skewed in favor of the PRC, and the country itself is simply "profiting at the expense of the Americans." Since then, several rounds of trade negotiations have been held and some of the duties have been canceled. An agreement was also signed, according to which China must buy agricultural products and other categories of goods in the United States for a certain amount per year. However, most of the duties in both directions continue to operate. Under the administration of President Biden, negotiations with China have not yet been conducted. However, they may be "taken off pause" in the near future. However, this process will not be fast, so it is hardly worth waiting for an immediate reaction of traders to the negotiations that have not yet begun.

EUR/USD – 4H.

On the 4-hour chart, the quotes closed under the corrective level of 100.0% (1.1606) and failed to continue the growth process. Thus, the fall in quotes may now resume in the direction of the corrective level of 127.2% (1.1404). Brewing divergences are not observed in any indicator today. A new closure above the Fibo level of 100.0% will allow us to count on some growth, but now all the movements of the pair are very weak.

News calendar for the USA and the European Union:

US - change in the volume of orders for long-term goods (12:30 UTC).

US - balance of foreign trade in goods (12:30 UTC).

On October 27, the calendar of economic events in the European Union is empty again, and in the United States, two reports will be released that may cause a reaction from traders. However, given the weak trading over the past few months, I would not count on a strong reaction from traders either.

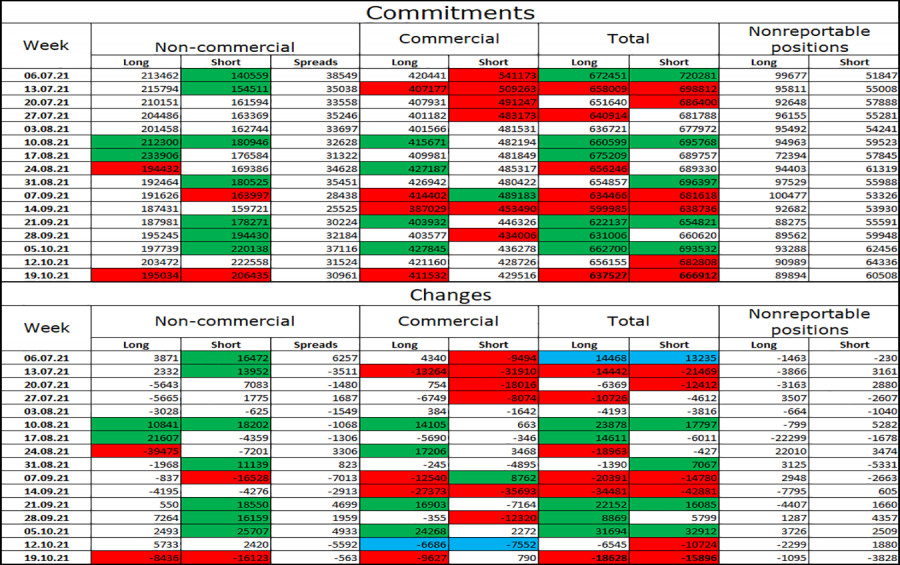

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders changed towards "bullish". Speculators closed 8,436 long contracts on the euro and 16,123 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 195 thousand, and the total number of short contracts - to 206 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last two weeks, the European currency has shown weak growth. Thus, the current strengthening of the "bullish" mood may be a one-off.

EUR/USD forecast and recommendations to traders:

Traders do not trade the pair too actively. I do not recommend buying the pair again yet, since there are no buy signals. I recommended selling the pair earlier, as there was a closure under the descending corridor on the hourly chart, with a target of 1.1552. Now, these transactions can be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.