To open long positions on EUR/USD, you need:

Unfortunately, nothing interesting happened in the EUR/USD pair yesterday and in the afternoon. Given the low volatility and trading volume due to the holiday in the US, the euro bulls did not manage to reach the nearest resistance at 1.1234. Released data on GDP growth rates in Germany in the third quarter returned the pressure on the pair in the first half of the day, and did not allow the bulls to update the level of 1.1234. However, we did not reach the 1.1188 support either. From a technical point of view, nothing has changed, and it is unlikely to change today.

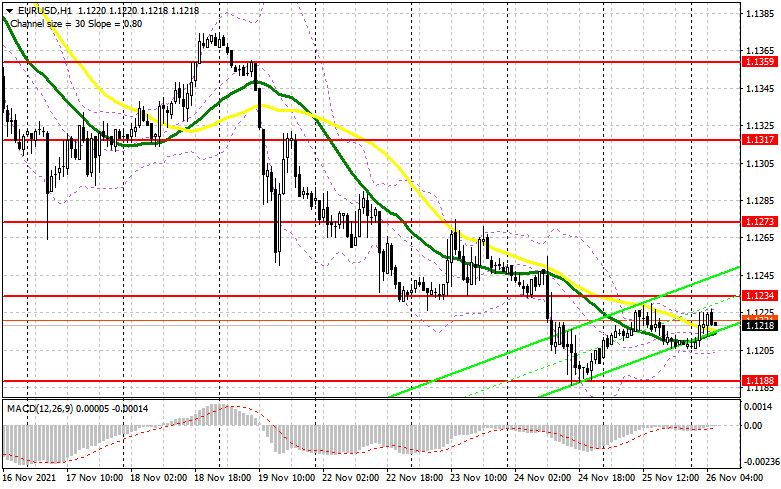

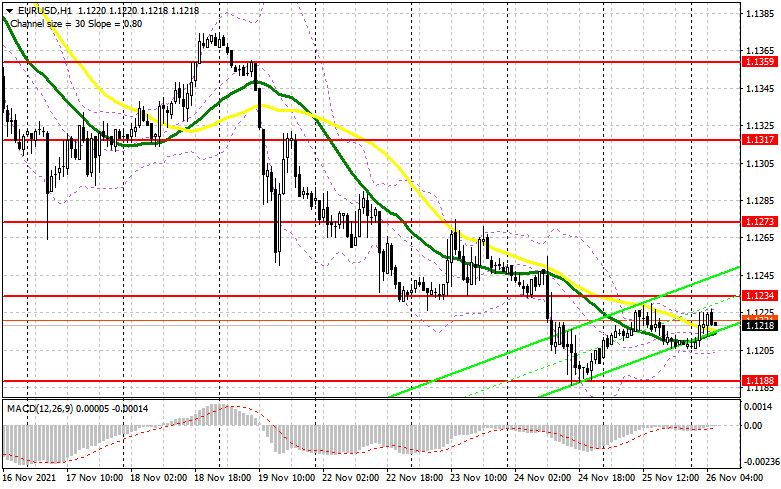

Most likely, the euro bulls will try to come up with something at the resistance level of 1.1234, but it will not be so easy to break above this range without good fundamental statistics. Given that European Central Bank President Christine Lagarde spoke almost every day this week, her interview today will be of little interest to the market. The data on the change in the M3 aggregate of the eurozone money supply and the volume of lending to the private sector are not significant for the foreign exchange market, so there is very little hope for them either. The bulls' main task in the first half is to protect the immediate support at 1.1188. Only the formation of a false breakout there will lead to creating the first entry point into the market against the downward trend observed this week. An equally interesting goal is to return to the resistance of 1.1234, which was not reached yesterday. A breakthrough and a downward test of 1.1234 will provide an excellent entry point to the market with the euro rising at 1.1273 and 1.1317. The next target will be the 1.1359 high, where I recommend taking profits. In case EUR/USD falls to 1.1188 and we receive weak fundamental statistics for the euro area, it is best not to rush to buy. I advise you to wait for the pair to fall and the formation of a false breakout at a new low like 1.1155. You can open long positions in EUR/USD immediately on a rebound from 1.1118, or even lower - from 1.1081, counting on a correction of 15-20 points within the day.

To open short positions on EUR/USD, you need:

The bears still control the market, although they have loosened their grip after yesterday. Trading is carried out in the area of moving averages, which indicates more of the sideways nature of the market without a definite direction. The most optimal scenario for opening short positions will be the formation of a false breakout in the resistance area of 1.1234, which we did not reach yesterday. With this option, the bears hope to return EUR/USD to the 1.1188 area. Only bad data on the eurozone and dovish statements from Lagarde can help return pressure on the euro, and a breakdown and test from the bottom up the level of 1.1188 will lead to a signal to open short positions with the prospect of a decline to the 1.1155 area. The next target will be the support at 1.1118, where I recommend taking profits. However, do not forget that the US has a shortened trading session today, so volatility should not be expected. If the euro grows and the bears are not active at 1.1234, it is better to wait with short positions. The optimal scenario will be short positions when a false breakout is formed around 1.1273. You can open short positions immediately on a rebound from the highs: 1.1317 and 1.1359, counting on a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for November 16 revealed that both short and long positions increased. However, there were more of the former, which led to the return of the negative delta. And although it continues to balance in one range near the zero mark for quite a long time, this does not help euro bulls in any way. The risk of another surge in the spread of coronavirus and the lockdown of the EU countries has led to a return of pressure on the European currency, which has not yet managed to recover from the continuation of super-soft monetary policy by the European Central Bank, even against the backdrop of inflationary growth. Judging by what is happening, the ECB leaders have taken a fairly correct position. Austria has already returned to quarantine restrictions and strict isolation measures, and the German authorities are considering this - a very strong signal for the further weakening of the euro against the dollar. Meanwhile, in the US, the fact of high inflationary pressure continues to support the US dollar. Many investors are counting on an earlier increase in interest rates from the Federal Reserve next year and are already winning back the market in this direction. The latest November COT report indicated that long non-commercial positions rose from 192,544 to 198,181, while short non-commercial positions also jumped from 188,771 to 202,007. By the end of the week, the total non-commercial net position regained its negative value and amounted to -3,826 against 3,773. The weekly closing price dropped significantly, to the level of 1.1367 against 1.1587.

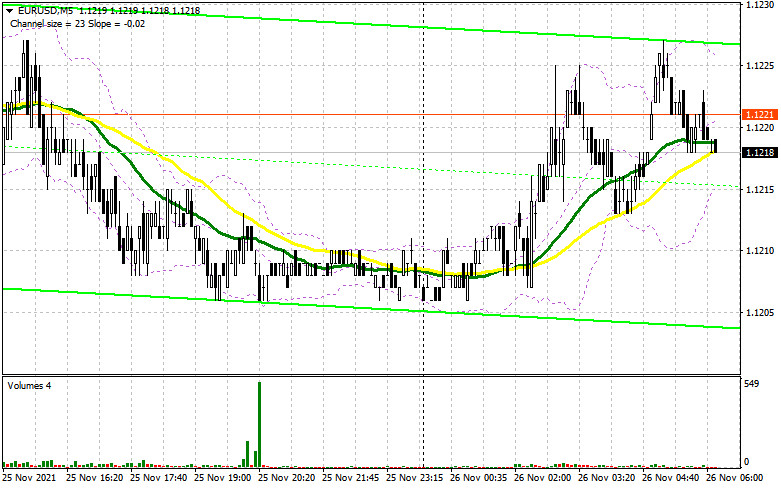

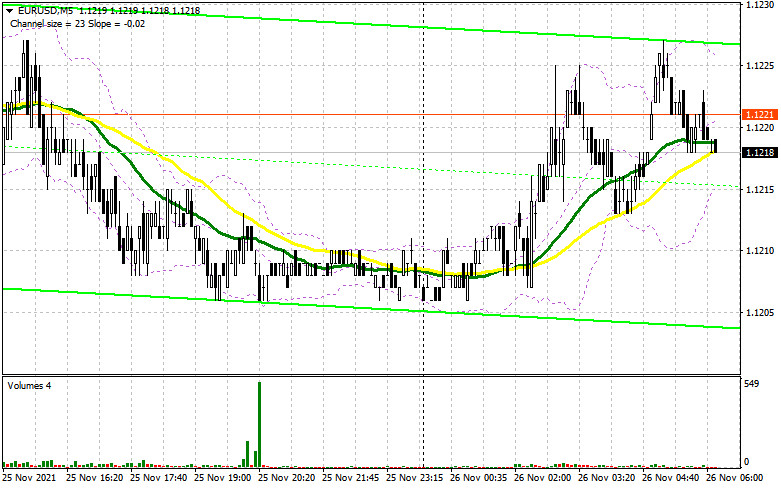

Indicator signals:

Trading is carried out in the area of 30 and 50 day moving averages, which indicates the sideways nature of the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Volatility is very low, which does not provide signals to enter the market.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.