The GBP/USD currency pair traded casually for most of Wednesday's trading session. Recall that in this piece, we do not consider the market fluctuations that occurred following the release of the Fed meeting's results, as there is no point. Asian traders can move the pair significantly from its present levels by the morning, and European traders will likely want to analyze the Fed's actions. Therefore, we are not contemplating them until the middle of the day, when the market is expected to have calmed down. In contrast to the euro/dollar pair, the pound/dollar pair remained above the moving average line as of Wednesday evening. And this is nearly the first significant deviation in the movement of currency pairs over the past few months. In the past, the euro and the pound have moved practically equally, but this week there was a correlation that is still hard to understand. If it occurred against significant European Union or British events, then everything would be evident, as EU data have no bearing on the British pound and cannot be represented on the euro/dollar currency pair's chart. However, this week, until Thursday, neither the EU nor the United Kingdom witnessed any noteworthy events. Why did the pound withstand the new temptation to fall, although there is no euro?

From our perspective, this is a mundane occurrence. Although both pairings have traded almost identically for an extended period under nearly identical fundamental and geopolitical factors, they remain distinct pairs. Therefore, they may occasionally exhibit distinct movements. Second, the pound remains less inclined to decline against the dollar than the euro. It is worth noting that the Bank of England has already raised the key rate five times and will do so again next week for the sixth time. This element also functions as a background, so the pound does not always decrease when the euro does.

Boris Johnson could become the next NATO Secretary General.

Currently, there is almost no news from the UK. Election discussions and speeches by Rishi Sunak and Liz Truss continue, but no macroeconomic facts are available. Tuesday evening's abrupt termination of the debate as a result of the presenter's fainting is the sole noteworthy event. In theory, when a new prime minister is elected, everything becomes more or less obvious. The victor of every election round, Rishi Sunak, appears weaker in debates and speeches than his opponent. According to several analysts, Sunak is a skilled financier, and it would be preferable for him to return to the position of finance minister to continue managing the Treasury. However, the role of the prime minister involves more than just the economy. First, this is the party's public persona. The Prime Minister must enjoy broad support among the electorate. Second, the Prime Minister is generally responsible for international policy. It is evident from the example of the European Union, where everyone appears to be in the same boat, but only some countries actively support Ukraine.

Consequently, the position of the United Kingdom in any international negotiations will depend on who succeeds David Cameron. However, Boris Johnson has already ruined relations with the Kremlin for decades, and the future Prime Minister is unlikely to abandon the United States. Therefore, nothing may change drastically, but politics being what it is, this is no place for trifles.

Boris Johnson may be unemployed for a brief period. There is already speculation that Johnson will succeed NATO Secretary General Jens Stoltenberg, whose term expires the next year. Johnson can benefit from his fervent support for Ukraine and his overtly "anti-Russian" stance. It is what is required at this moment to be in a position of leadership inside the military bloc. Johnson's behavior as Prime Minister has raised so many doubts that NATO is unlikely to want a troublemaker and someone who is continually embroiled in problems to lead the organization. There is no doubt, though, that Johnson will remain visible.

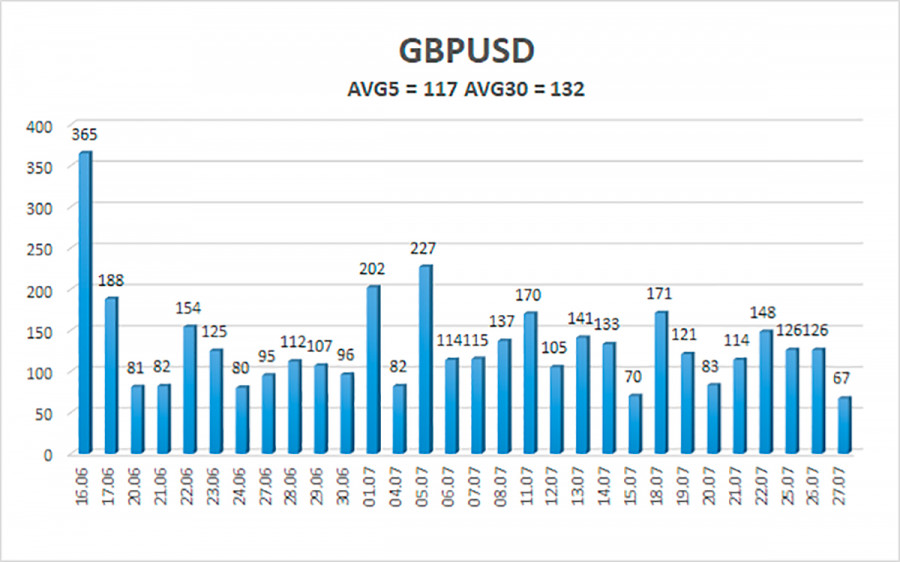

The average five-day volatility of the GBP/USD pair is 117 points. This value for the pound/dollar combination is "high." Therefore, on Thursday, July 28, we anticipate movement inside the channel, constrained by the levels of 1.1922 and 1.2155. The downward reversion of the Heiken Ashi indicator signifies a fresh attempt to resume the long-term negative trend.

Nearest support levels:

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest resistance levels:

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

The GBP/USD pair remains positioned above the 4-hour moving average, indicating a favorable trading opportunity. You should thus maintain purchase orders with goals of 1.2085 and 1.2146 until the Heiken Ashi indicator turns bearish. Opening sell orders below the moving average line with targets at 1.1922 and 1.1842 is recommended.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.