At the start of a new trading week, the euro-dollar pair fell under a wave of sales. Bearish sentiment is due to three main factors: the release of Chinese data, the publication of Bloomberg on the fate of the European economy and the increase in geopolitical tensions against the background of the visit of the American delegation to Taiwan.

All these fundamental factors "merged together," determining the growth of anti-risk sentiment in the foreign exchange market. Dollars have become the beneficiaries of the current situation, strengthening their positions across the entire spectrum of the market. The external fundamental background drowned out the concern of greenback supporters about the slowdown in inflation growth in the United States. Last week's key releases temporarily faded into the background due to the mass flight from risks. The status of a protective asset once again allowed the greenback to stay afloat, despite serious "holes." And given the fact that the EUR/USD pair is completely subject to the dollar, the bears of the pair won situational support, which helped them return to the 1.0200 mark.

And yet, in my opinion, it is too early to talk about the "victorious return of the greenback." Failed inflation releases will still make themselves known—in particular, with the help of Fed representatives, who, on the eve of the September meeting, will discuss the pace of monetary tightening through the prism of a slowdown in the consumer price index, producer price index, and import price index. It is highly doubtful that most of the Fed members will remain aggressive, especially against the backdrop of a technical recession recorded in the United States. And this fundamental factor will serve as a kind of sword of Damocles for the dollar, which has been strengthening its position for many months due to the strengthening of hawkish expectations.

However, today the sellers of EUR/USD are, as they say, "in good shape." Due to the flight from risks, the greenback reminded of itself, allowing the bears to partially regain lost positions.

During the Asian session on Monday, China published a block of macroeconomic statistics. In particular, it became known that the volume of investment in fixed assets of China increased by 5.7% in annual terms (the forecast was at the level of 6.3%). This is the weakest result since December 2021. The volume of industrial production in China increased by only 3.8% against the forecast for growth of 4.5%. The retail trade also showed a sad result: sales grew by only 2.7%, while experts predicted an increase of 5.0%. The slowdown in Chinese macroeconomic indicators worried investors, after which the demand for the safe dollar increased.

Investors were also worried about a new round of geopolitical tensions between the US and China. And again because of Taiwan. Another delegation of American legislators visited the island. And although this trip was not furnished with such a stir as the visit of Nancy Pelosi, it did not pass without a trace. China's Defense Ministry today announced new military exercises and patrols around Taiwan "in response to collusion between Taipei and Washington." According to the Chinese military, the visit of US congressmen to the island "violates the sovereignty and territorial integrity of China."

The European currency, in turn, today reacted to the resonant publication of the Bloomberg agency. According to a published study, the risk of a recession in the eurozone has reached its highest level since November 2020—the probability of an economic downturn for two consecutive quarters has increased from 45% to 60%. Economists polled say the German economy is likely to stagnate from this quarter as Germany is "one of the most prone to cut Russian natural gas supplies."

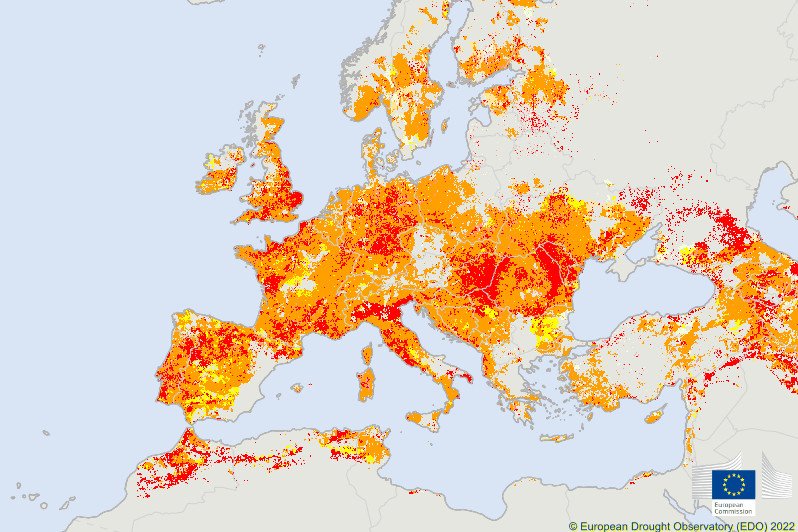

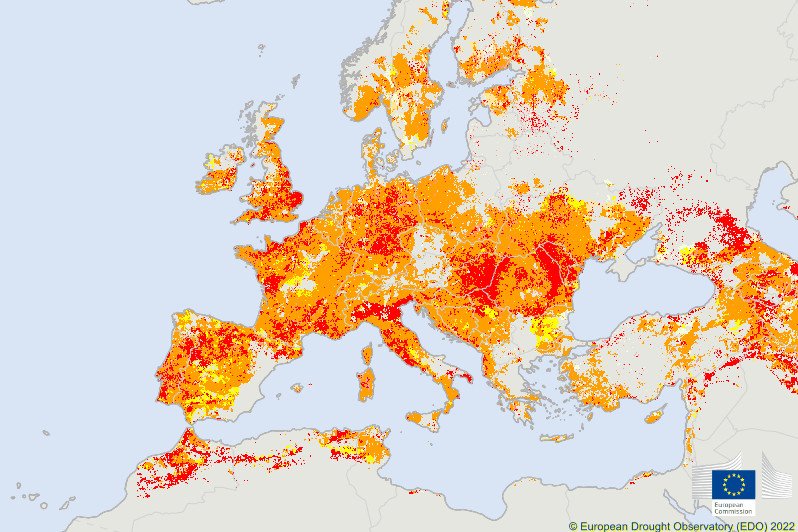

Drought also played a role. For example, in France—the EU's key agricultural power—last month was the driest month on record. In July, only 9 millimeters of rain fell there, which is ten times less than usual. Italy was also under the "sunstroke," and the longest river of the country (Po) almost dried up. Experts say the current drought in Europe could be the worst in 500 years, with "dramatic consequences" for industry, freight transport, energy and the food industry. According to the head of the European Commission's Joint Research Center, this year's climate losses are "tens of billions of euros."

Thus, at the moment, the fundamental background contributes to the downward pullback of the EUR/USD price, specially since the buyers of the pair could not gain a foothold in the area of the 3rd figure last week. At the same time, in my opinion, it is too early to talk about the resumption of the downward trend, given the slowdown in a number of US inflation indicators. Several representatives of the Fed are expected to speak this week, who can "cool the ardor" of the EUR/USD bears by commenting on the latest releases. In particular, Governor Michelle Bowman is expected to give a speech on Wednesday, and Kansas City Fed President Esther George on Thursday. They have the right to vote in the Committee, so their rhetoric will certainly affect the price action.

Summarizing the above, let me assume that sellers of EUR/USD have a "power reserve" up to the support level of 1.0150 (Kijun-sen line on the daily chart). Selling below this target looks risky, as the dollar is in a hypothetically vulnerable position. If the Fed officials start talking about slowing down the pace of monetary tightening (finally abandoning the idea of a 75-point rate hike at the September meeting), the greenback will be under pressure, including against the euro.