An extremely volatile and unsuccessful trading week for the US dollar ended last Friday. Market participants mainly focused on Powell's statement about the possibility of slowing down the pace of tightening of the Fed's policy at the meeting on December 13 and 14. Now, the probability of a 50 basis point rate hike in December is estimated by market participants at 80%, according to the CME Group.

Tomorrow, market volatility will increase again, and by the first half of the Asian trading session, at 03:30 (GMT), the decision of the RBA on the interest rate will be published.

In order to move into the bull market zone, the AUD/USD pair first needs to break into the zone above the 0.6840 key resistance level, and much in the further dynamics of this pair will depend, among other things, on tomorrow's RBA decision.

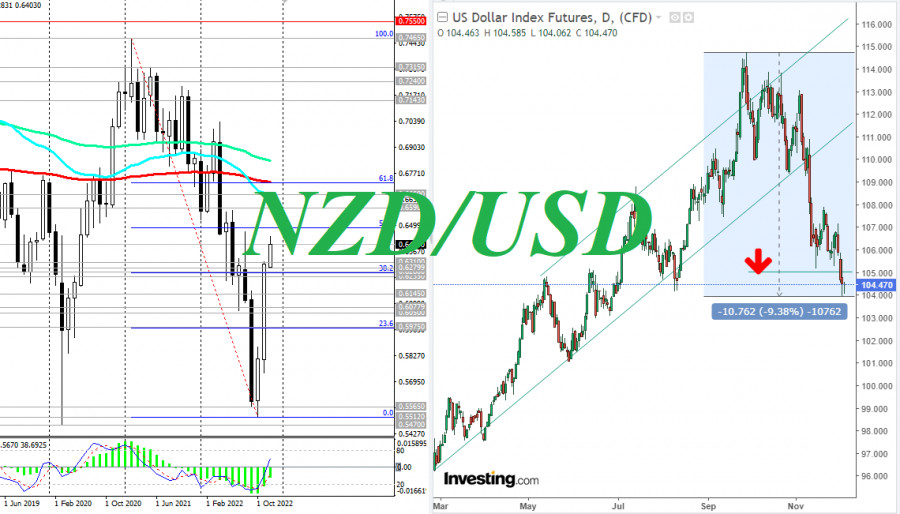

Meanwhile, the "brother" of the Australian dollar among the currencies of the Asia-Pacific region, the New Zealand dollar, is successfully developing positive dynamics against both the Australian dollar and the US dollar. Fed Chairman Jerome Powell gave an additional bullish impulse to the NZD/USD pair when, speaking at the Brookings Institution in Washington last week, he said that the US Central Bank could reduce the pace of interest rate hikes as early as December. And although Powell also said that the fight against inflation is far from over, it is still unclear how high and for how long interest rates will need to be raised. Sellers of the US dollar regarded this as a signal to act and actively sell USD.

If Powell has already hinted that he does not rule out a slowdown in the pace of monetary tightening, then the RBNZ continues to sound tough statements on this score.

Following the results of the meetings held in October and November 2021, the Reserve Bank of New Zealand (for the first time in seven years) raised the key interest rate to 0.50%, then to 0.75%. In February and April 2022, the interest rate was raised again to 1.5% to ease inflation and contain rapidly rising home prices, then to 2.0% and 2.5%. The current RBNZ interest rate is 4.25%.

The RBNZ has previously said that the economy no longer needs the current level of monetary stimulus, and now the regulator continues to move towards even higher interest rates, raising them by 0.50% at each of its meetings since April 2022. At a meeting in November, RBNZ leaders raised the interest rate by 0.75% (the largest increase in the RBNZ key rate in history), also signaling the intention to implement even more aggressive monetary tightening in the coming months to combat persistently high inflation. The bank also raised its forecast for a peak rate to 5.5% by September 2023, also expecting it to remain at this level until 2024.

Some economists expect the RBNZ rate to be raised to 5.25% as early as the first half of next year: the record pace of price appreciation in New Zealand is of concern to the central bank. In addition, there are signs of increased wage pressure, while inflation expectations have not decreased. "The RBNZ is facing a real risk of an inflationary spiral, although this is exactly what it hoped to avoid due to the relatively early start of interest rate hikes," economists say.

The RBNZ continues to show an inclination to continue tightening its monetary policy, while signals from the Fed are already beginning to come in that the pace of tightening may soon slow down.

Considering only these two factors, which are very strong in themselves, we should expect, if not further growth of the NZD/USD pair, then at least the continuation of its bullish dynamics.

As for the news drivers, which in the near future may again increase volatility in the NZD/USD pair, attention should be given to today's releases (at 14:45–15:00 GMT) of PMI indices for the US and tomorrow—(after 14:00 GMT) Dairy Price Index from Global Dairy Trade (GDT). The bulk of New Zealand's exports are dairy and animal foods (27% as of 2020). Therefore, the decline in world prices for dairy products has a negative impact on NZD quotes, as it signals a decrease in export earnings coming to the New Zealand budget.

Conversely, an increase in the dairy price index has a positive effect on the NZD. In this case, a slight increase (by +0.2%) is expected, which should support the NZD quotes.

From a technical point of view, NZD/USD has broken through the key resistance levels 0.6310 and 0.6235 and continues to move towards the resistance levels 0.6590, 0.6660. If the US dollar continues to weaken (and today its DXY index remains below the 105.00 level for the third trading day in a row, which many economists so hoped that it would hold), then achieving these targets (0.6590, 0.6660) will be a matter of a couple of months.