When to open long positions on EUR/USD:

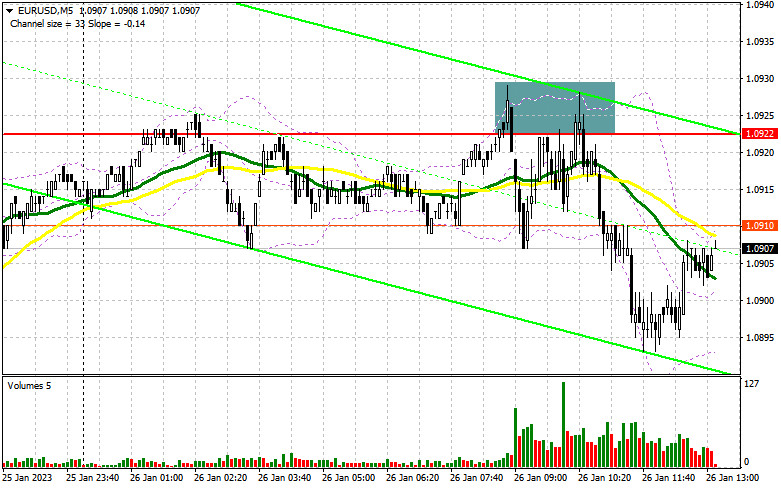

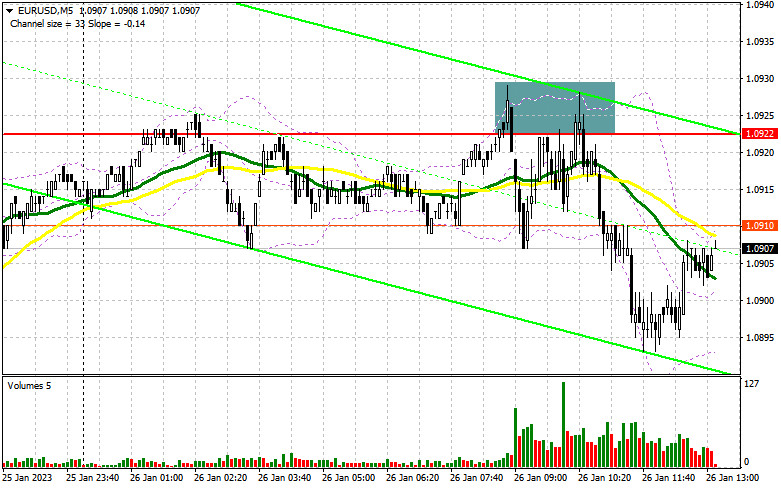

In my morning forecast I highlighted the level of 1.0922 and recommended making market entry decisions with this level in mind. Let us have a look at the 5-minute chart and figure out what happened. With no fundamental statistic data being released, the euro increased to 1.0922, as mentioned in the morning forecast. EUR performed a false breakout of that level and fell down by 20 pips. The fundamental situation remains unchanged in the second half of the day.

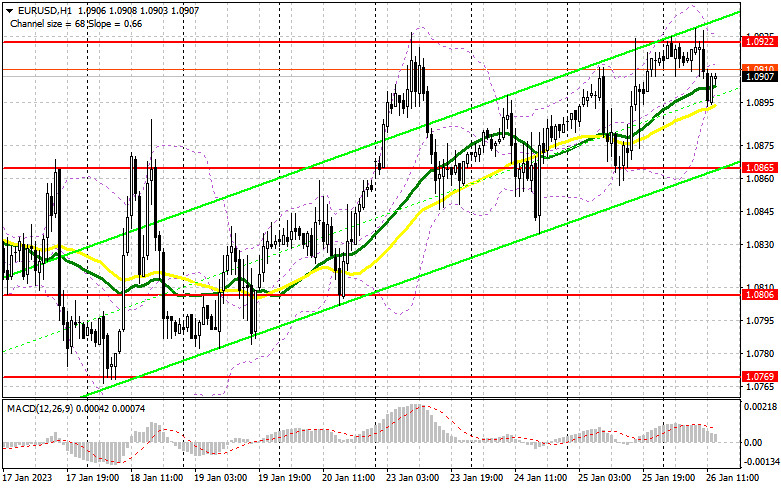

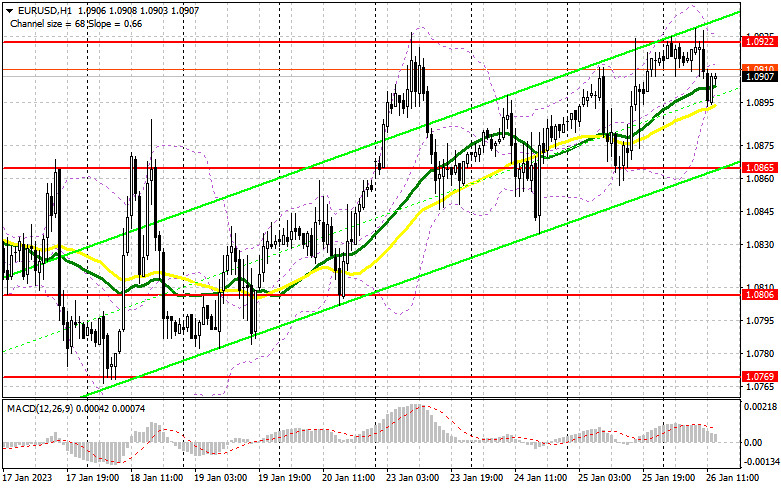

A number of key data releases will be published during the American session, such as the durable goods orders and trade balance data. The most important report would be the US GDP data for the fourth quarter of 2022. If it ends up stronger than expected, EUR/USD will slide down significantly. A number of bearish traders have entered the market when the pair was around 1.0922 this morning, expecting this scenario to occur. The US dollar will also find support from positive initial jobless claims data as well higher than expected new home sales data for December 2022. For this reason, only a decline to 1.0865 and a false breakout of that level will create a buy signal, which should be realized rather quickly. The target will be the morning resistance level of 1.0922, which the pair failed to surpass today. A breakout and a downward retest of this range will be possible if the American economic data is weak, which will suggest that a recession will occur by the end of the year. This will create an additional entry point for long positions, and the pair could surge to 1.0969 afterwards. A breakout of that level will also trigger the stop-loss orders of euro bears and will create an additional buy signal. From there the pair may possibly go to 1.1006, where I will take profits. If EUR/USD declines and buyers are idle at 1.0865, or if the pair does not move up significantly after a false breakout, I advise to close long positions. The next support level of 1.0806 will be key . Only a false breakout of that level will create a buy signal. I will open long positions immediately if EUR/USD bounces off the low at 1.0769 or even 1.0728, targeting an upwards intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

So far, the bears have been doing well and are now aiming to control the support level of 1.0865. Strong US data and robust economic growth in Q4 2022 could trigger a small spike in market volatility, which would favor the US dollar. A breakout and an upward retest of 1.0865 will create a sell signal, pushing the pair back to 1.0806. A consolidation below this range will trigger a more significant correction to the area of 1.0769, which will signal that the bear market has returned. I will take profits at that level. If EUR/USD goes up during the American session, I recommend considering going short on the pair near the morning resistance level of 1.0922, similar to what I mentioned above. A false breakout of that level there will create a sell signal. If the pair does not decline sharply from 1.0922, and the data disappoints traders, short positions should be opened at the new resistance level of 1.0969, after the pair performs an unsuccessful consolidation and a false breakout. I will sell the EUR/USD immediately if it bounces off the high at 1.1006, aiming for a downside correction of 30-35 pips.

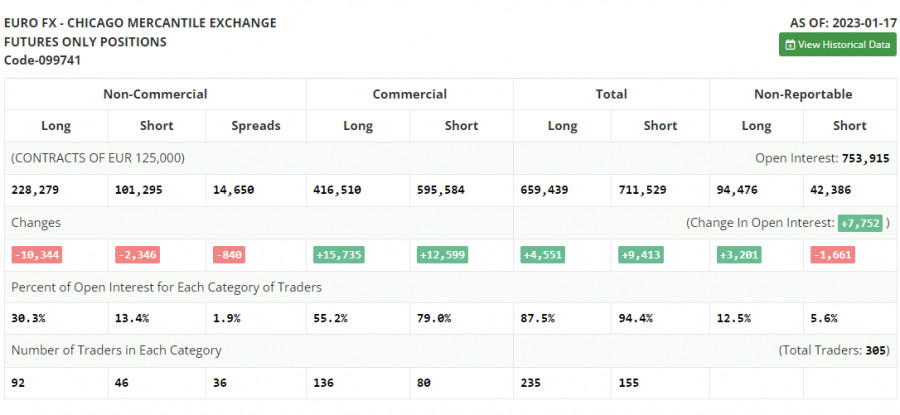

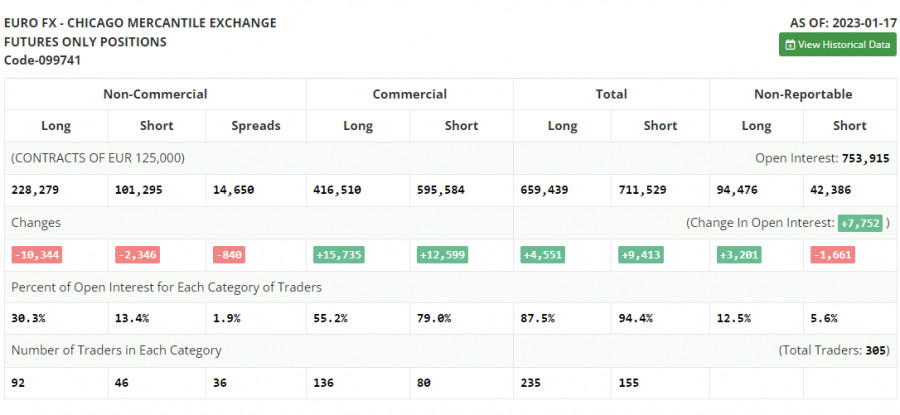

Commitment of Traders (COT) report:

The Commitment of Traders (COT) report for January 17 showed that both long and short positions declined. Obviously, traders are starting to take a wait-and-see attitude again after euro's strong growth in the run-up to the Fed meeting next week. Rather weak US fundamental data, particularly lower retail sales in December last year, suggest that the situation is getting worse and further aggressive Fed policy may hurt the economy even more. On the other hand, inflation continues to decelerate, allowing the regulator to reconsider the pace and the target range of interest rates. At the same time, the euro is getting support from statements by European Central Bank officials about the need for further aggressive rate hikes to beat inflation, thus helping EUR/USD to renew its monthly highs. The COT report showed that long non-commercial positions declined by 10,344 to 228,279, while short non-commercial positions fell by 2,346 to 101,295. At the end of the week, total non-commercial net positions decreased to 126,984 versus 134,982 a week prior. All this suggests that investors though believe that the euro will continue to rise, but are waiting for more clarity from central banks on future interest rates. The weekly closing price rose to 1.0833 from 1.0787.

Indicators' signals

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, indicating that market participants are uncertain.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If the pair rises, it will encounter resistance at the upper boundary of the indicator near 1.0922.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders.