While the EURUSD bulls were on the attack, encouraged by the 7-day rally in the S&P 500, which ended in a 55th all-time high in 2021, their opponents were taking profits. The factors of the start of the Fed's monetary policy normalization in November and the increase in the federal funds rate at the end of 2022 have already been taken into account in the quotes of dollar pairs, which creates the preconditions for curtailing long positions on the USD index and contributes to the strengthening of the euro against the U.S. dollar. The problem is that the regional monetary unit still lacks its own drivers to take breath away from the correction.

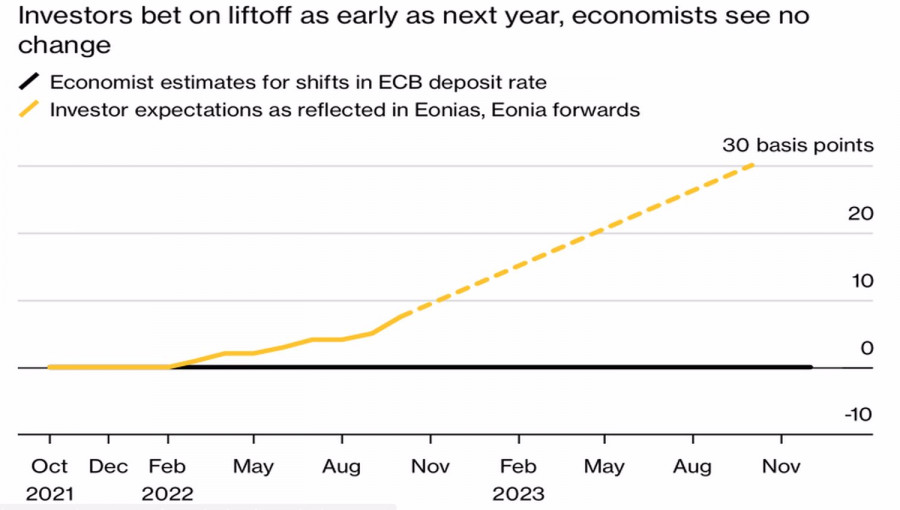

The acceleration of global inflation did not leave the "bulls" on EURUSD indifferent either. If the Bank of England, the Reserve Bank of New Zealand, not to mention the regulators of developing countries, are ready to act faster than expected, why shouldn't the ECB follow the path of monetary restriction? The markets began to lay expectations of a rate hike in the eurozone in 2023 and even in 2022, which led to an increase in European bond yields and to the strengthening of the euro.

Dynamics of expectations of changes in ECB rates

If the Bank of England is referring to the history of the energy crisis, why shouldn't the ECB do the same? In fact, Christine Lagarde and her colleagues' forecasts for inflation are more modest than those in the UK. In addition, judging by the slowdown in composite business activity in October from 56.2 to 54.3, the currency bloc is entering the fourth quarter with its worst performance since April. The effect of the opening of the economy is in the past, and the seasonal increase in the number of COVID-19 infections may become the basis for the "dovish" rhetoric of the ECB at its meeting on the 28th.

Dynamics of European business activity

Investors do not expect anything from the next meeting of the Governing Council, but they will catch signals about the fate of the Pandemic Emergency Purchase Program (PEPP), as well as watch Christine Lagarde knock the pride off the bulls on EURUSD. In recent days, financial conditions in the eurozone have worsened, including due to the growth of Eurozone bond yields due to expectations of normalization of the monetary policy of the European Central Bank. Lagarde is likely to remain committed to the mantra of the temporary nature of high inflation during the press conference. This will mean that the ECB is really thinking about what to replace PEPP in March.

ECB's monetary policy is very likely to remain ultra-soft for a long period of time, which makes the potential for corrective movement in EURUSD limited and suggests the stability of the downward trend. Another thing is that its recovery requires more aggressive Fed actions than the market currently assumes. Until they are there, the chances of the main currency pair consolidating will grow by leaps and bounds.

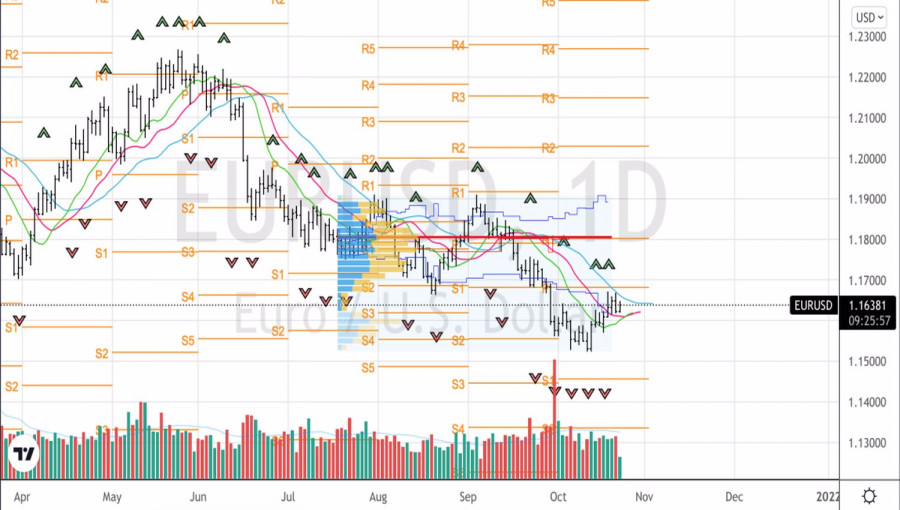

Technically, going beyond the short-term trading range of 1.1615-1.1675 creates the preconditions for short-term purchases on the breakout of its upper border or sales in case of a successful assault on the lower one. At the same time, traders should set moderate targets in the region of 70-100 points.

EUR/USD, Daily chart