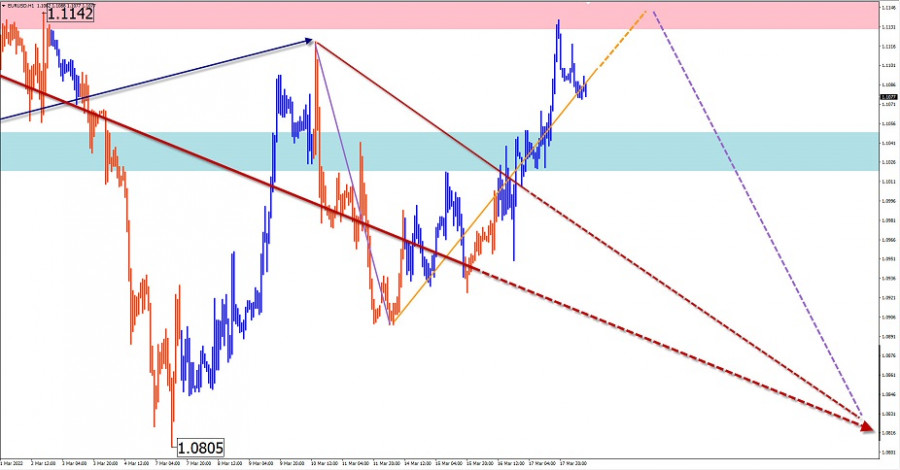

EUR/USD

Analysis:

A downtrend continues on the European currency chart. The last unfinished section in the main direction is counting down from March 9. Since the end of last week, quotations are pulling back up, forming the middle part of the wave (B). At the time of analysis, the price has reached the lower boundary of the potential reversal zone of the large timeframe.

Outlook:

In the next day, the upward movement vector is expected to complete, the formation of the reversal and the resumption of the price decrease. In case of a change of course an increase in volatility and a short-term piercing of the upper border of the estimated resistance is not excluded.

Potential reversal zones

Resistance:

- 1.1130/1.1160

Support:

- 1.1050/1.1020

Recommendations:

The buying potential of the euro market has been exhausted. It is recommended to refrain from trading in the pair until there are confirmed sell signals around the resistance area.

USD/JPY

Analysis:

The Japanese yen has been steadily weakening against the US dollar since the beginning of last year. The latest incomplete section of the rising wave has been reporting since March 4. By now, the quotes have reached the lower border of the strong large scale reversal zone.

Outlook:

In the near term, the movement vector is expected to shift predominantly sideways, between the closest areas of counter direction. After the pressure on the resistance, we can expect the formation of a reversal and a pullback of the price downwards.

Potential reversal zones

Resistance:

- 119.10/119.40

Support:

- 118.40/118.10

Recommendations:

On the current day, trading activity on the Japanese Yen market may lead to losses. It is recommended to refrain from entering the pair's market until the retracement phase is completed.

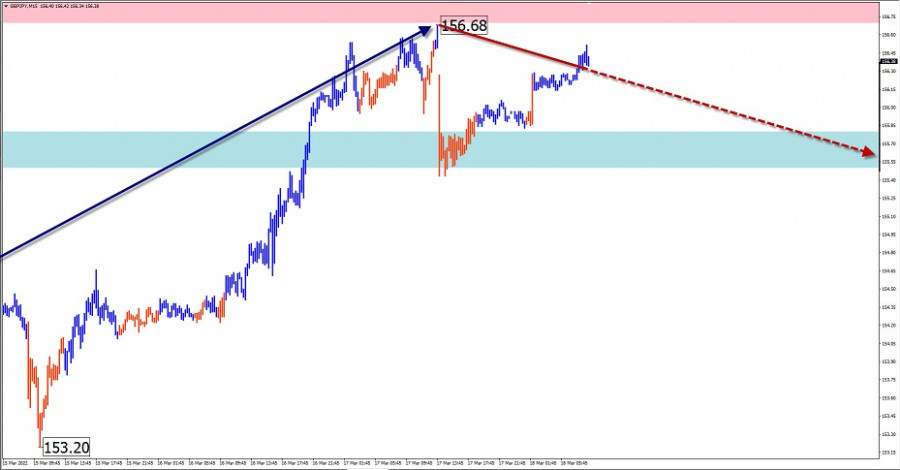

GBP/JPY

Analysis:

The bullish wave level of the March 4 pound/yen chart reached the reversal potential, giving rise to a new wave of the pair's global trend. At the time of analysis, the price has reached the lower border of the powerful weekly scale potential reversal zone.

Outlook:

During the next trading sessions, the quotations are expected to move in the price corridor between the nearest counter zones. In the first half of the day descending course of price movement is more likely. A renewed pressure on resistance is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 156.70/157.00

Support:

- 155.80/155.50

Recommendations:

In flat conditions, trading the cross is riskier and could become loss-making. It is recommended to refrain from trading in the instrument until there are confirmed buying signals in the area of estimated support.

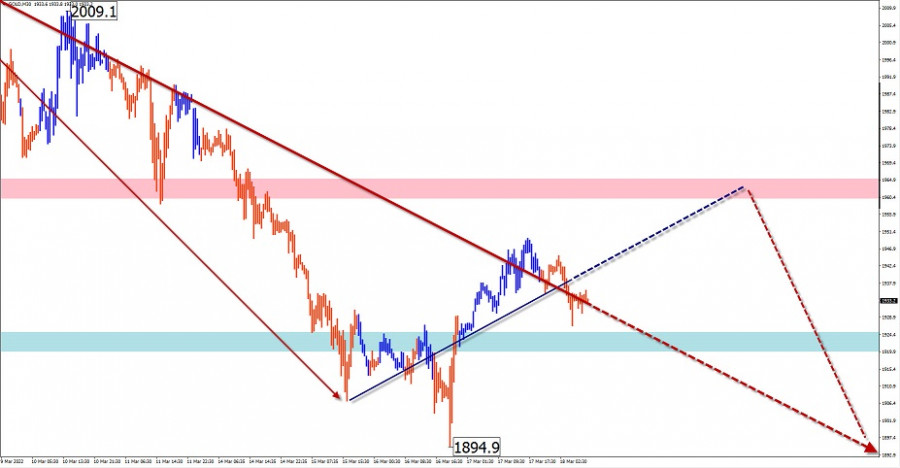

GOLD

Analysis:

After a strong upside phase since March 8, gold is correcting downwards. Since the beginning of this week, an intermediate pullback is forming on the chart. Strong support at $1850/oz could be a likely downside target.

Outlook:

An upward movement of gold is more likely in the first half of the day, with the price rising all the way up to the estimated resistance. At the end of the day or tomorrow, the probability of a reversal and resumption of the downtrend increases.

Potential reversal zones

Resistance:

- 1960.0/1965.0

Support:

- 1925.0/1920.0

Recommendations:

There are no buying conditions in the gold market today. Trading the instrument is not recommended until there are confirmed reversal signals in the resistance area.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analysed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!