The euro/dollar pair is testing the resistance level of 1.0760 (the upper line of the Bollinger Bands indicator on the four-hour chart), after overcoming which traders will move to the next price barrier - the 1.0800 mark (the upper line of the Bollinger Bands on the daily chart). The current price increase is due to both the weakening of the dollar and the general strengthening of the single currency. Renewed risk appetite, a strong inflation report from Germany, and the preliminary results of the EU summit (in the context of the sanctions confrontation with the Russian Federation) - all these fundamental factors helped buyers of EUR/USD to test the above price threshold. The US currency was forced to retreat - there are no relevant arguments for the resumption of the southern trend. The market has already included a planned tightening of monetary policy (a 50-point rate hike in June and July) in current prices, while further prospects look vague, especially after the publication of the minutes of the last Fed meeting.

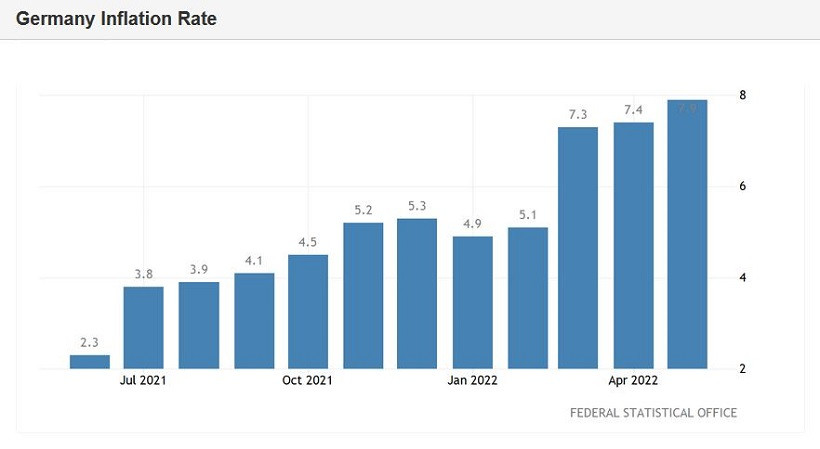

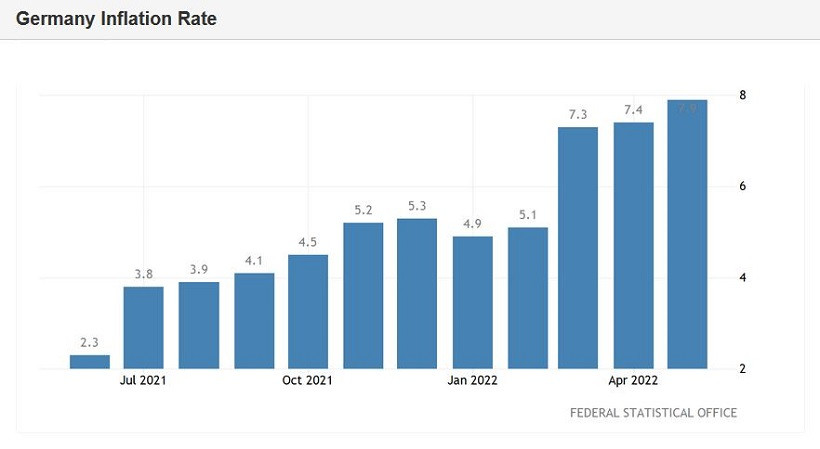

But let's start with the German statistics. The data released today reflected a significant increase in inflation in Germany, which, as you know, is the "locomotive" of the European economy. All components of the release were released in the green zone. In annual terms, the overall consumer price index came out at around 7.9%, with growth forecast to reach 7.6%. This indicator has been growing consistently since February 2021, but in the spring of this year, it began to gain momentum sharply, exceeding the 7 percent mark and thereby updating the 48-year record.

Every month, the indicator also exceeded the forecast values, ending up at 0.9% in May. The harmonized consumer price index similarly exceeded forecasts, both in monthly and annual terms. It is worth noting that German data quite often correlates with pan-European ones, so we can assume that the May inflation growth in the eurozone (the release is scheduled for May 31) will also be a breakthrough - once again.

The EUR/USD pair was indirectly supported by political news. Today, it became known that the EU countries could not agree on an oil embargo on Russian oil. The ambassadors of the member states of the European Union did not agree on the sixth package of sanctions for Russia, which included a ban on Russian oil. The ambassadors of the EU countries gathered on Sunday before a special two-day EU summit, which will begin in Brussels tonight. As some experts have suggested, Hungary will agree to a proposal that includes a ban on Russian oil that is transported by sea, while preserving the supply of oil that is transported through the pipeline. The discussion of this issue with the Hungarian side was continued on Monday, but Budapest insisted on its position.

It should be noted here that, according to Bank of America analysts, in the event of a sharp reduction in Russian oil exports, Brent may rise "significantly above" the $ 150 per barrel mark (today the price fluctuates in the range of 116-119). But according to the calculations of the Financial Times, the rejection of Russian energy resources will require the EU to spend approximately 195-200 billion euros. By the way, it is not only "black gold" that is getting more expensive: an abrupt increase in prices is recorded for both oil and gas, wheat, and non-ferrous metals. Therefore, today's (preliminary) results of the EU summit provided indirect support to the euro, since the Europeans de facto did not provoke a rally in the oil market. Concerns about stagflation eased somewhat (at least "at the moment"), and this fact allowed EUR/USD buyers to update the monthly high at 1.0780.The news from China also provided some support to the pair. Beijing and Shanghai are gradually lifting radical quarantine restrictions. In particular, the Chinese authorities have allowed 240 financial institutions in the 25-million-strong Shanghai to resume their work since June 1. Previously, almost 900 firms from about 1,700 large financial companies of the megalopolis were included in the "white list".

However, despite the record growth of German inflation, as well as despite the increased craving for risky assets, buyers of EUR/USD could not even get close to the resistance level of 1.0800, let alone consolidate in the area of the 8th figure. Moreover, at the start of the American session, the pair returned to the 1.0760 mark. This suggests that traders doubt the prospects of the northern movement - they recorded profits as soon as they approached the border of the 8th price level.

In such conditions, longs look risky. Market participants have not yet decided on the vector of price movement. It's one thing to impulsively reach a certain level, and it's a completely different thing to hold the occupied positions, claiming further growth. As you can see, the resistance level of 1.0760 turned out to be "too tough" for EUR/USD bulls, so it is advisable to go into purchases only when the price is fixed above the target of 1.0800. But sales will be relevant if sellers can push through the support level of 1.0700 (the average line of the Bollinger Bands on the four-hour chart). At the moment, it is better to take a wait-and-see position, given the high degree of uncertainty - the pendulum can swing both towards the north and towards the south.