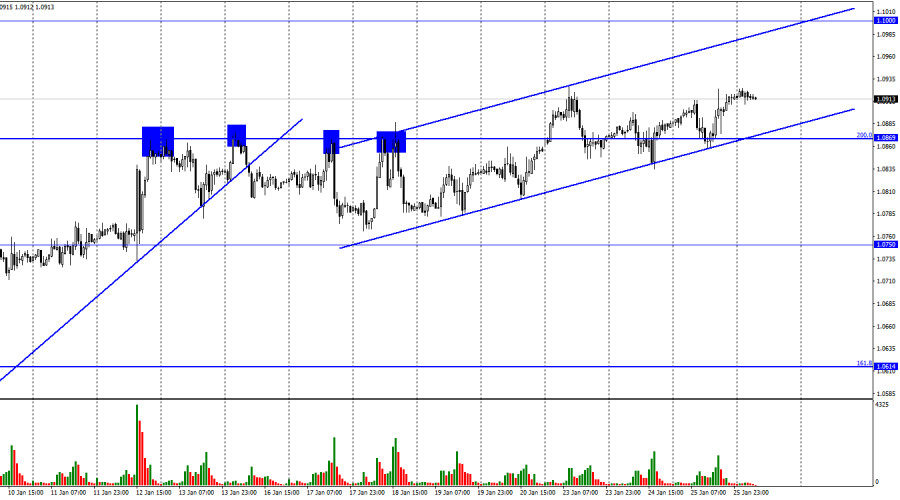

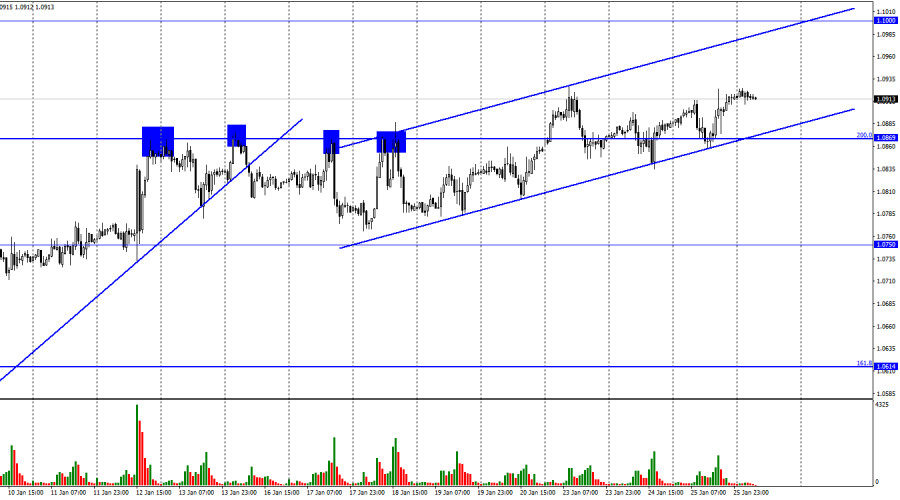

Yesterday, the EUR/USD pair reversed in favor of the euro and started a new expansion in the direction of the level of 1.1000 after rebounding from the bottom line of the ascending trend corridor. The upward trend corridor describes traders' attitudes as being "bullish." If the rate of the pair is fixed below it, it will favor the US dollar, and some of the prices will decrease in the direction of the level of 1.0750.

Yesterday, the information background was essentially nonexistent, but this did not stop bull traders from conducting their business as usual. The ECB presidents' comments, which have included several "hawkish" pronouncements during the past week and a half, have helped boost the euro. Christine Lagarde specifically mentioned the necessity to keep tightening the PEPP multiple times. A similar term was used by Joachim Nagel, another member of the ECB Board of Directors, yesterday. In an interview with a French publication, he stated that the regulator should keep tightening monetary policy to keep pricing pressure on the economy under control. His remarks contained nothing new, and traders increased the current euro exchange rate by 0.50% in February as a result of Lagarde's statements. Even while many analysts are already questioning whether the "bullish" pressure on the pair is too great, bull traders continue to trade since we occasionally hear that the ECB will keep raising the rate. I believe that the European currency has the potential to expand further. Especially at this time when there is a rising trend corridor. In January, the bears could begin their trend, but they did not seize it. They are therefore delaying the sale of the pair until a more advantageous time.

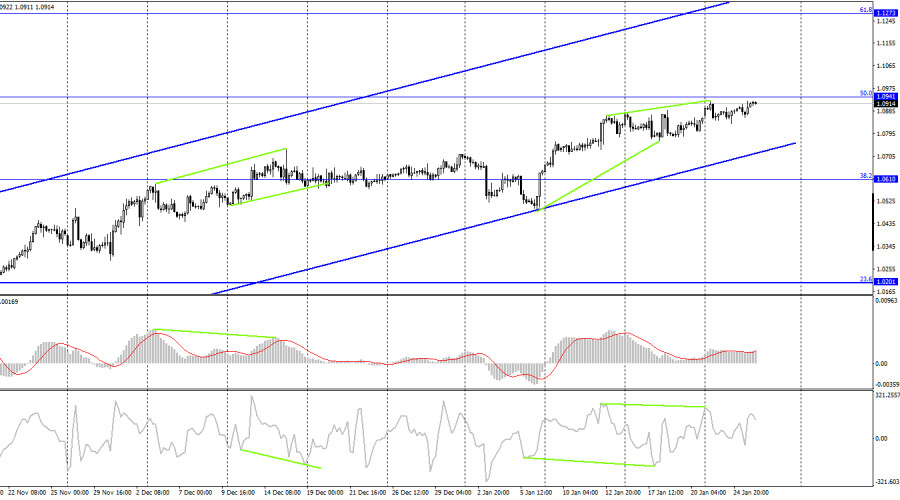

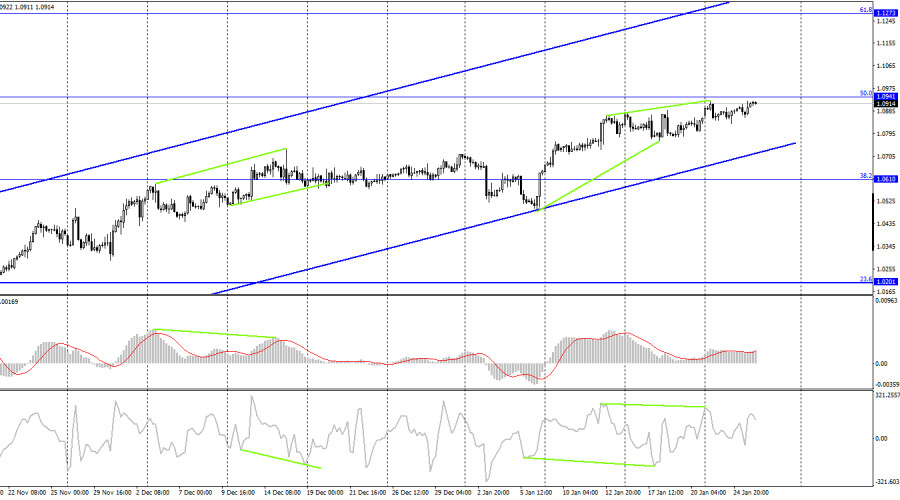

The pair had a new turnaround in favor of the euro on the 4-hour chart, and it is now advancing toward the corrective level of 50.0% (1.0941). The US dollar will benefit from the quotes rising from this level, while some will decline in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish." Before the closure beneath the corridor, I do not anticipate a significant decline in the value of the euro. The CCI indicator's "bearish" divergence may favor some decline of the pair in the next few days.

Report on Commitments of Traders (COT):

During the previous reporting week, traders opened 2,346 short contracts while also closing 10,344 long contracts. Large traders' bullish attitude is still present but has dipped slightly. Currently, 228 thousand long contracts and 101 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's expansion has been steadily increasing over the past few months, just like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

US – basic orders for durable goods (13:30 UTC).

US – GDP for the fourth quarter (13:30 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

The European Union's calendar of economic events is completely vacant on January 26. However, three significant reports will be made public simultaneously in the USA. The afternoon today may see the effects of the information background on traders' attitudes.

Forecast for EUR/USD and trading advice:

On the 4-hour chart, sales of the pair are feasible if it recovers from the level of 1.0941 with goals of 1.0869 and 1.0750. With goals of 1.1000 and 1.1150, new purchases of the euro currency are feasible when the 4-hour chart closes above the level of 1.0941.