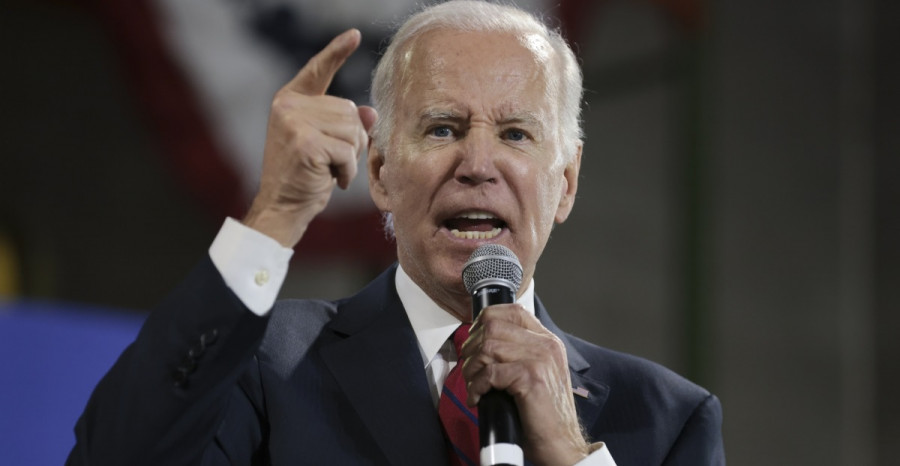

Additionally, US President Joe Biden blasted the Republicans, alleging that they want to use the debt ceiling as leverage in economic negotiations, as the markets were getting ready for the first central bank meetings of the year. Republicans in the House of Representatives who have recently gained power are attempting to get voters' attention by highlighting the current debt ceiling issues. Biden, who is anticipated to run in 2024, is attempting to save his reputation by disputing the existence of any issues with the US national debt.

At a gathering with union members in Springfield, Virginia, Biden declared, "I will not allow anyone to exploit the national debt of the United States as a trump card." The US always makes good on its debt obligations.

He and the opposition are currently engaged in a heated argument and are unable to reach a consensus on how to raise the debt ceiling. Such confrontations are not unusual, and he has received little notice this year. Politicians will undoubtedly agree to its expansion sooner rather than later because, if the issue is not resolved, it will trigger an economic catastrophe that will affect the entire world. Market participants no longer hold the view that the debt ceiling won't be raised.

Republicans want to raise the debt ceiling in exchange for spending reductions, including those to social security and Medicare benefits. Kevin McCarthy, the Speaker of the House of Representatives, was urged by Biden to bring up the issue without compromising on any of the proposed conditions because they are non-negotiable.

We are headed on the right path, according to Biden. "Now we have to defend our achievements that politics has given us over the years, defend them from Republicans in the House of Representatives," he continued. Biden slammed the Republicans in his address for simply wanting to hike costs for the common people and cut taxes for the wealthy.

According to the most recent statistics, the United States' gross domestic product increased by 2.9% year over year in the fourth quarter of last year. As rising interest rates continue to put the economy's growth at risk, some indications suggest underlying demand is decreasing. Only 2.1% of personal consumption increased, which was less than expected. We now make available information on American earnings and spending, which will also have an impact on future inflation rates.

The main topic of Biden's upcoming campaign for reelection will be the state of the economy. To validate economic success, the White House is already "pushing" for the lowest jobless rate in 50 years. Additionally, according to the data, inflation (the ongoing political responsibility of Joe Biden) is decreasing, which is good news for the president-elect. As a result, it seems to me that the issue of the national debt ceiling will be resolved in the near future and that paying attention to it is not necessary.

Regarding the technical analysis of EUR/USD, there is still demand for the single currency, and there is a potential that monthly and annual highs will continue to be updated. To do this, the trading instrument must remain above 1.0860, which will cause it to move to the vicinity of 1.0930. You can easily get through this point to reach 1.0970 when an update to 1.1007 is imminent. Only the collapse of support at 1.0860 will put more pressure on the pair and drive EUR/USD to 1.0805, with the possibility of dropping to a minimum of 1.0770 if the trading instrument declines.

Regarding the GBP/USD technical picture, the demand for the pound is declining. Buyers must sustain their advantage by remaining over 1.2350. The only way to increase the likelihood of a further recovery to the area of 1.2430 and, ultimately, a greater movement of the pound up to the region of 1.2490 and 1.2550, is for the resistance at 1.2440 to fail. After the bears seize control of 1.2350, it is possible to discuss the trading instrument's pressure returning. The GBP/USD will be pushed back to 1.2285 and 1.2170 as a result, hitting the bulls' positions.