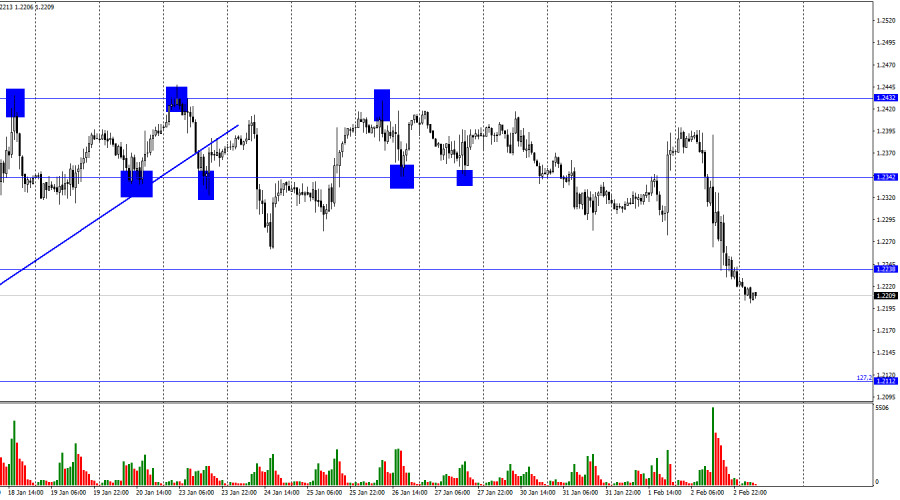

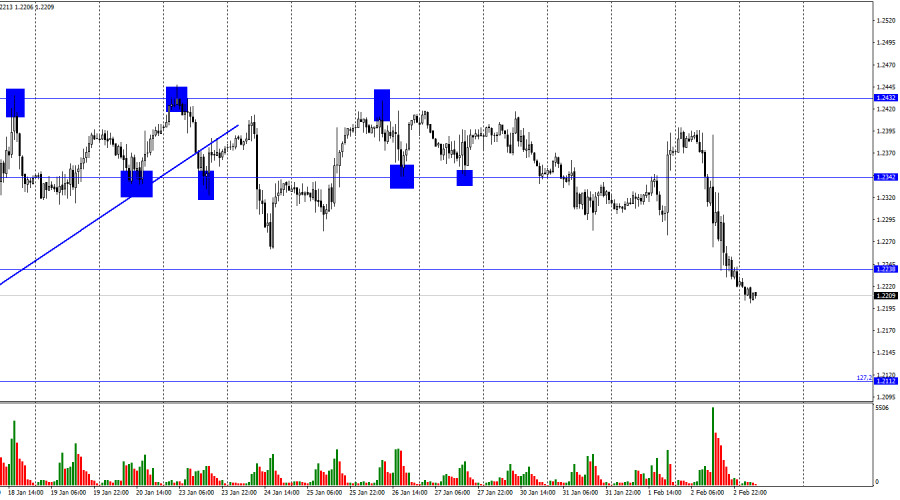

The GBP/USD pair reversed in favor of the US dollar on Thursday, anchoring first at the level of 1.2342 and then at 1.2238, as shown on the hourly chart. As a result, the decline in quotes can continue in the direction of the following corrective level of 127.2% (1.2112). Still, bear traders continued to dominate the market.

At yesterday's Bank of England meeting, the interest rate was increased by an additional 0.50%. This choice was anticipated, and traders had already planned it out in January. Thus, the reasons for the general decline in the value of the British pound on Wednesday were the same as those for the decline in the value of the euro and the dollar. Let me remind you that the choices that traders were anticipating were taken by all three central banks. And this implies that earlier versions of these solutions were developed. The market received no "dovish" signals from the Bank of England. On the contrary, it predicted that the rate would continue to rise while implying that the PEPP's tightening pace would slow. My belief is that since it was also known beforehand, this indication could not have contributed to the British pound's fall. The British regulator's rate has already reached 4%, so it is clear that it will not continue to increase much indefinitely. Although the ECB and the Fed have already slowed down the pace of tightening twice, the Bank of England has begun to prepare to slow down the rate hike pace.

The Fed will start to slow the pace of rate hikes, which is the only reason why the British pound has been rising in recent months. Now that the Bank of England is probably going to follow the Fed, the value of the US dollar can increase. More significant reports are due today, and they might have a big impact on how traders are feeling. As a result, by evening, the dollar might either decline once more or increase considerably more. My opinion is that the US dollar will naturally increase, but too few positive US statistics could cause it to decline.

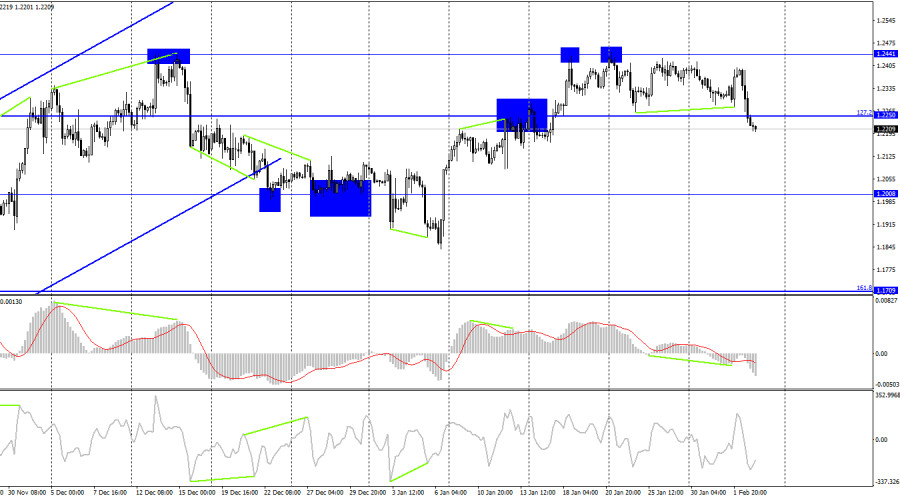

On the 4-hour chart, the pair reversed in favor of the US dollar and anchored below the corrective level of 127.2% (1.2250). The quotes can continue to fall until they reach the 1.2008 level. Emerging divergences are currently undetectable by any indication. The British pound will benefit if the rate of the pair closes over 1.2250 and resumes rising toward the level of 1.2441.

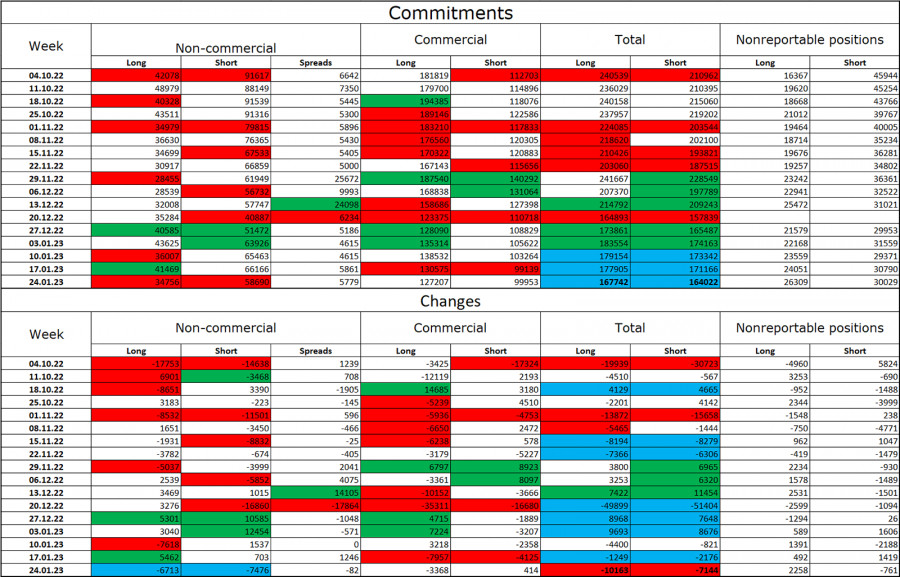

Report on Commitments of Traders (COT):

The "non-commercial" group of traders has been trading in a less "bearish" manner than they were a week ago. The number of long contracts held by investors declined by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British over the last few months, but today the number of long and short positions in the hands of speculators is nearly double once again. As a result, the outlook for the pound has once again declined, but the pound is not eager for the pound to decline and is instead concentrating on the euro. An exit from the three-month ascending corridor was visible on the 4-hour chart, and this development may have stopped the pound's growth.

The following is the UK and US news calendar:

United Kingdom – Index of business activity in the service sector (09-00 UTC).

US – average hourly wage (13:30 UTC).

US – change in the number of people employed in the non-agricultural sector (13:30 UTC).

US – unemployment rate (13:30 UTC).

US – ISM Purchasing Managers' Index for the non-manufacturing sector of the USA (15:00 UTC).

The US economic event calendar is full of extremely significant events for Friday, and traders in the UK are unlikely to react to a single report. The information background may once again have a significant impact on how traders feel today.

Forecast for GBP/USD and trading advice:

If quotes are fixed on the hourly chart below the level of 1.2238 with a target of 1.2112, sales of the British pound are possible. When the price of the pair fixes above the level of 1.2238 on the hourly chart with a target of 1.2342, purchases of the pair are possible.