EUR/USD

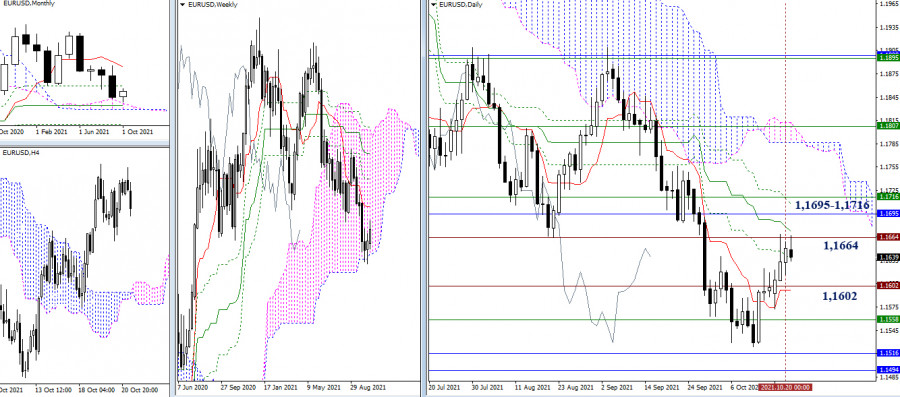

The euro surged to the historical level of 1.1664 and indicated a slowdown in this area. The daily medium-term trend (1.1673) descends to help the encountered resistance level. The formation of a full-fledged rebound will return the pair first to the area of 1.1602 (historical level + daily Tenkan) and then to the level of 1.1558 (the lower border of the weekly cloud).

However, if the pullback does not succeed, and the pair breaks through the level of 1.1664 after deceleration and consolidation, then the next important border for the development of the bullish mood will be the area of 1.1695 - 1.1716 (monthly Fibo Kijun + weekly Tenkan + daily Fibo Kijun).

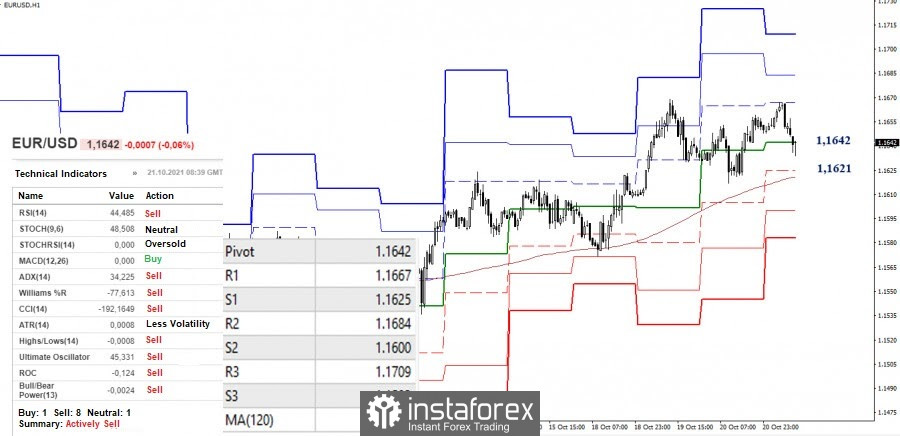

The downward correction was developing earlier in the smaller timeframes. Technical indicators have tuned in to support the bears who are now testing the central pivot level of 1.1642. After the breakdown, the main pivot point will be the support of the weekly long-term trend, which is currently at 1.1621. The next supports for the classic pivot levels are at 1.1600 and 1.1583.

In the event that a rebound occurs from the encountered supports and bullish positions are restored, the interests will be directed to upward targets again. They are set at 1.1667 - 1.1684 - 1.1709 (resistance of the classic pivot levels) today.

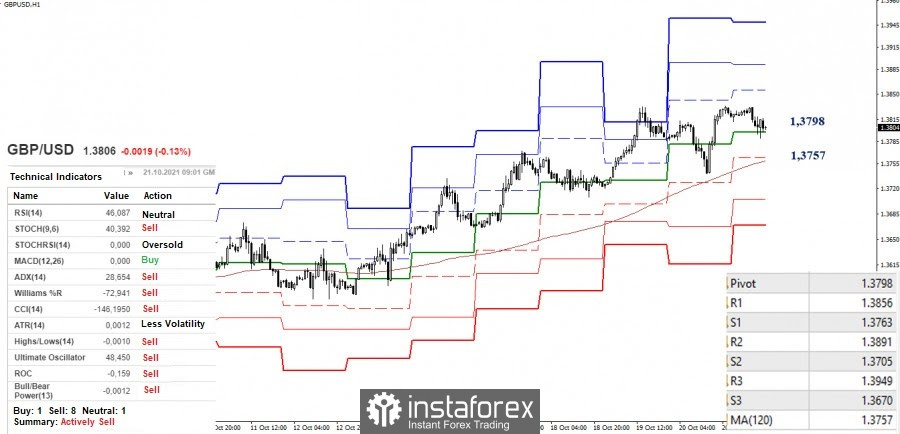

GBP/USD

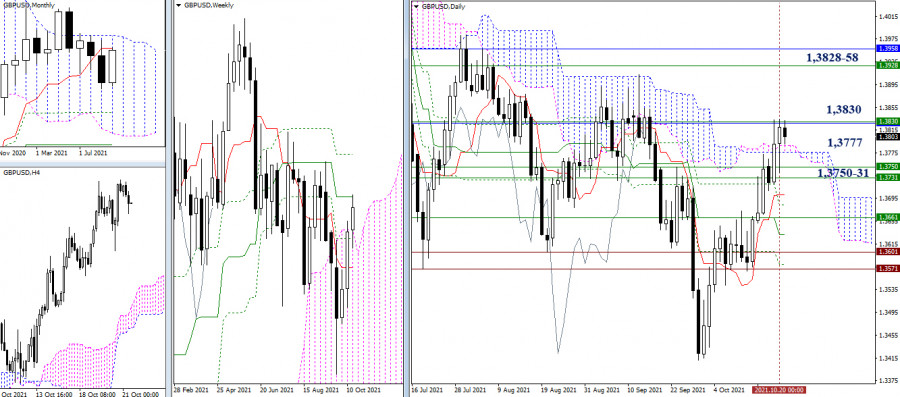

Bullish traders have been testing the resistance level of 1.3830 for several days (weekly medium-term trend + monthly short-term trend). Its breakdown will lead to the implementation of growth to the following pivot points 1.3928-58 (the final level of the weekly dead cross + the upper limit of the monthly cloud). The failure of the bulls to test the level of 1.3830 and the inability of the daily cloud (1.3777) to support bullish interests will return the pair first to the unification of the weekly levels of 1.3731-50. A consolidation below will form a bearish rebound from the resistances encountered (1.3830), as a result of which a new assessment of the situation will be required.

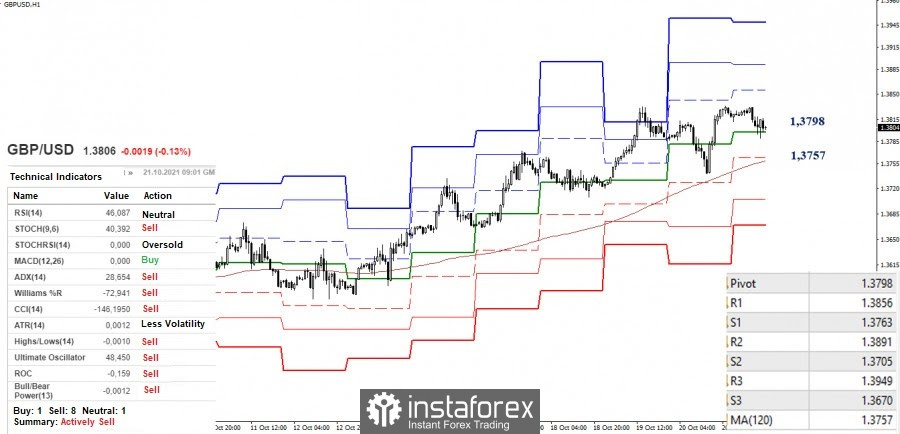

The main advantage in the smaller timeframes continues to be on the bullish side, but the opponent is developing a downward movement. At the moment, the support of the central pivot level (1.3798) is being tested. It should be noted that the result of interaction with the support of the weekly long-term trend (1.3757) will matter. Keeping this level determines the main advantage on the same timeframes.

In case of a breakdown and reversal of the MA (1.3757), the preponderance of forces will allow the bearish mood to strengthen. Other intraday support levels are seen at 1.3705 and 1.3670 (classic pivot levels). On the contrary, if a rebound is formed and growth continues, the relevance on the hourly chart will return to the resistances of the classic pivot levels (1.3856 - 1.3891 - 1.3949).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.