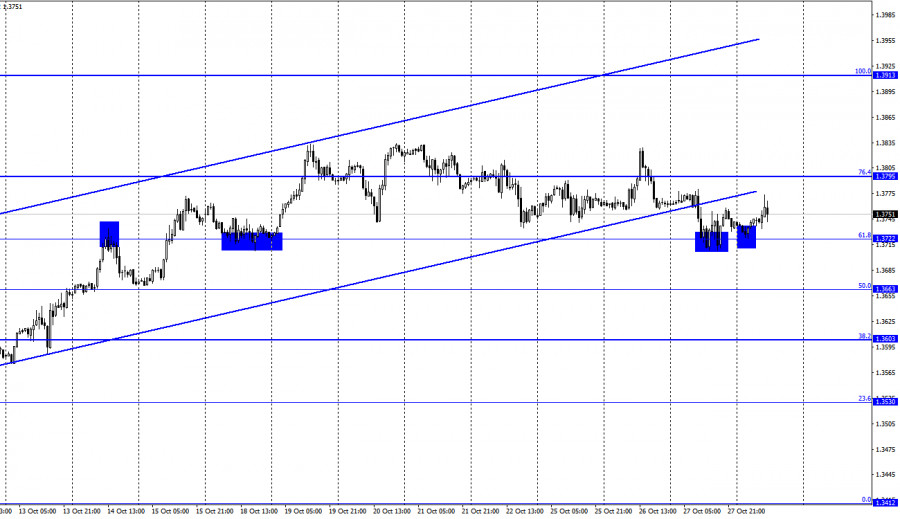

GBP/USD – 1H.

Hello dear traders! On the hour chart, the pair GBP/USD fell to the correction level of 61.8% at 1.3722 and rebounded from it three times. Consequently, the growth is likely towards the correctional level of 76.4% at 1.3795. The pair's fixation under 1.3722 will favor the US currency and further fall towards the correctional level of 50.0% at 1.3663. Earlier the quotes closed under the uptrend corridor, expecting further pound's decline. There will be no information background in the UK today. However, a major report will be released in the US, which may affect the traders' mood. The ECB meeting does not concern the UK and the pound, so the GDP report is the only key event of the day. Moreover, it is the only significant event for the GBP/USD pair this week.

The graphical analysis shows that the falling of the quotes may continue. However, at the same time bear traders are not going to sell. Today's GDP report may give them clues. Besides, US economic growth should be stronger than traders expect. It will be easy to achieve, as forecasts predict 2.6-2.7% Q/Q in the third quarter. Notably, the growth totaled 6.7% in the second quarter. However, the coronavirus pandemic is again making its adjustments. Besides, the US economy is slowly getting on track of its usual economic growth. 2.6%-2.7% for the quarter is the average GDP rate. However, we may expect slightly higher figures today. At the same time, if the real value of the report is below the forecast, the British pound may resume growth and close above the correction level of 76.4% again. However, I expect a further decline of the quotes, as the pair crossed the two ascending corridors in both charts. The UK news does not exert influence on traders' mood now, though the problematic issue regarding the negotiations with the European Union and the lack of staff may put pressure on the pound in future.

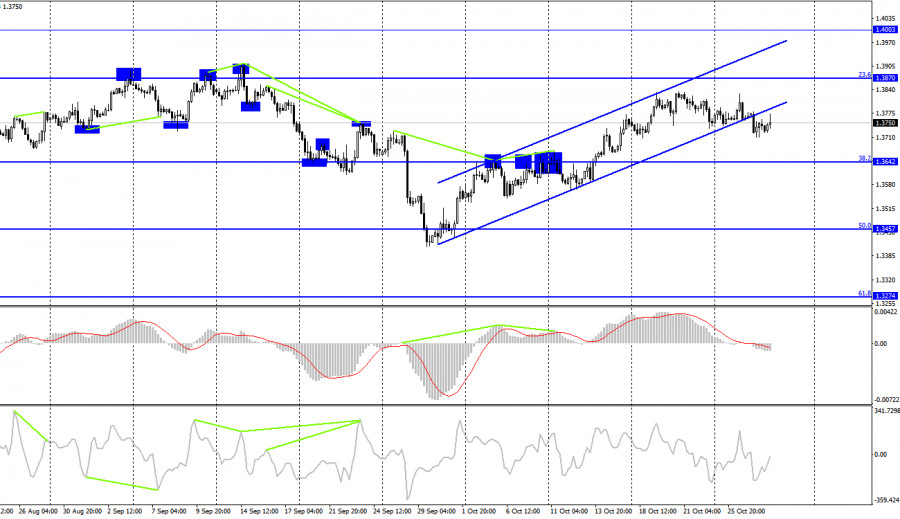

GBP/USD – 4H.

On the 4-hour chart, GBP/USD has consolidated under the uptrend corridor. Consequently, the fall of the quotes may continue towards the correction level 38.2% at 1.3642. There are no divergences as well as signals to buy or signs of fall completion today. Traders' mood has changed to bearish, shown by two charts now.

US and UK news calendar:

US - Quarterly GDP Change (12-30 UTC).

On Thursday, the US information background will be relatively strong as only one GDP report will be released. This report is influential, but if the real value coincides with traders' expectations, it will be hard to expect a strong move.

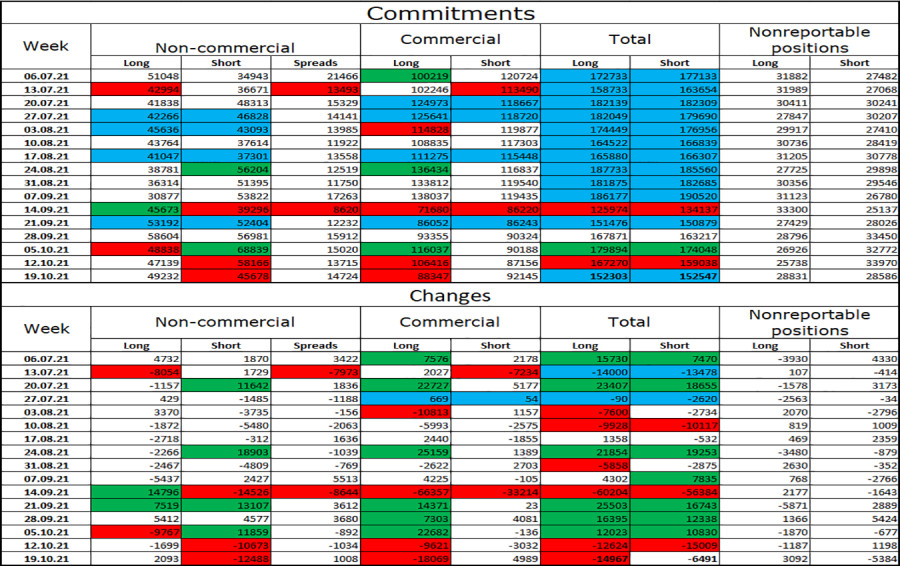

COT report (Commitments of traders):

The latest COT report on the British pound, dated October 19, showed that the mood of major market players has become much more bullish. During the reporting week speculators opened 2093 long contracts and closed 12488 short contracts. Thus, the number of long and short contracts held by major players was almost equal. At the moment, non-commercial traders' mood is neutral, indicating that more attention should be focused on the chart pattern and signals. In recent weeks major players do not have any clear trading strategy. Now they increase buying and then increase selling. The total number of long and short contracts is the same for all categories of traders.

GBP/USD forecast and recommendations for traders:

I do not recommend new buying of the pound now, as the quotes have just started to fall and the pair has closed below two trend corridors. I recommend new sales if there will be a rebound from the 1.3795 level on the hourly chart or a close under the 1.3722 level with targets 1.3722 in the first case and 1.3663 in the second.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.