The whole world does nothing but talk about cryptocurrencies, and this is not only a new wave of FOMO but also a new stage in the formation of the crypto industry.

Antifragility in all its colors: the crypto market is constantly being restricted, but it continues to grow, gaining widespread popularity of users, forcing regulators to work shoulder to shoulder with it.

The recently approved Bitcoin ETF, as well as the change in SEC policy, are proofs. In fact, regulators are trying not only to take full control of the new area of finance but also to use it to their advantage.

Recently, the chairman of the United States Federal Deposit Insurance Corporation (FDIC), Jelena McWilliams, said during the Money 20/20 conference that American regulators are focused on creating clear guidelines for regulating banks' interaction with the crypto industry.

It should be understood that regulation is not so bad. The emergence of a regulatory framework is better than a widespread ban, which will ultimately harm the new industry.

In my analytical reviews, I have repeatedly written about the intentions of payment systems to adapt their technical processes to cryptocurrency. So, the payment giant Mastercard announced that it will soon announce support for cryptocurrencies in its network. This will give banks and merchants the opportunity to integrate cryptocurrencies into their products. We are talking about bitcoin wallets, credit and debit cards for accruals in cryptocurrencies, as well as loyalty programs, in which points can be converted into digital assets.

In fact, we are on the verge of mass adoption of cryptocurrencies in everyday life.

Against such a positive background, Tesla, in a report to the US Securities and Exchange Commission, hinted that it may soon resume the practice of accepting cryptocurrency as a means of payment for its products. Let me remind you that last time it became leverage for buyers, which led to the ubiquitous cryptocurrency market.

What is happening on Bitcoin and Ethereum trading charts?

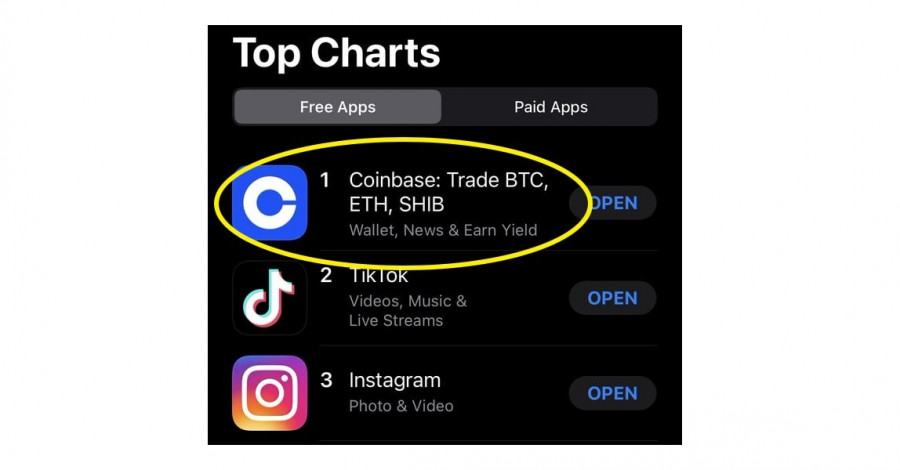

Last week, Bitcoin managed to update its all-time high, reaching the price level of $67,000. This is an absolute record since the existence of the first cryptocurrency. The excitement is so great for cryptocurrencies that the app of the leading crypto-exchange COINBASE has climbed to number one in the Top Charts of the App Store.

This signals that we are on the wave of FOMO* (loss of profit syndrome*), which is good for cryptocurrencies' growth, but at the same time, it can portend big corrections in the market.

At the moment, we already have signs of a correction after the update of the all-time high, but the bullish excitement persists in the market. At this stage, long positions are still considered if the price is held above $64,000. This will result in updating the $67,000 high.

As for Ethereum, a local breakout of the historical maximum of May 12 was noticed, but the quote managed to overcome it by only a few dollars. After that, a rollback occurred with the formation of a flat in the 3,888/4,375 range. In fact, there is no correction, and market participants are still aiming at updating the highs. In this situation, the most appropriate strategy is considered to be a breakout of one or another border of the established range. In the case of considering the upper border, we are talking about the prolongation of the upward trend, where there is a high chance of touching the next psychological level of $5,000.

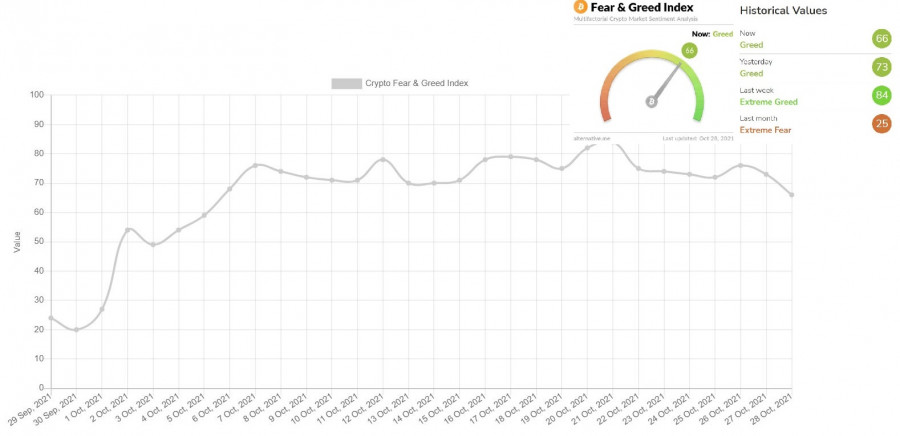

The index of emotions (aka fear and greed) of the crypto market is at the level of 66 points, which is slightly below the FOMO level. This is due to the corrective move in Bitcoin.