Analysis of Tuesday's trades:

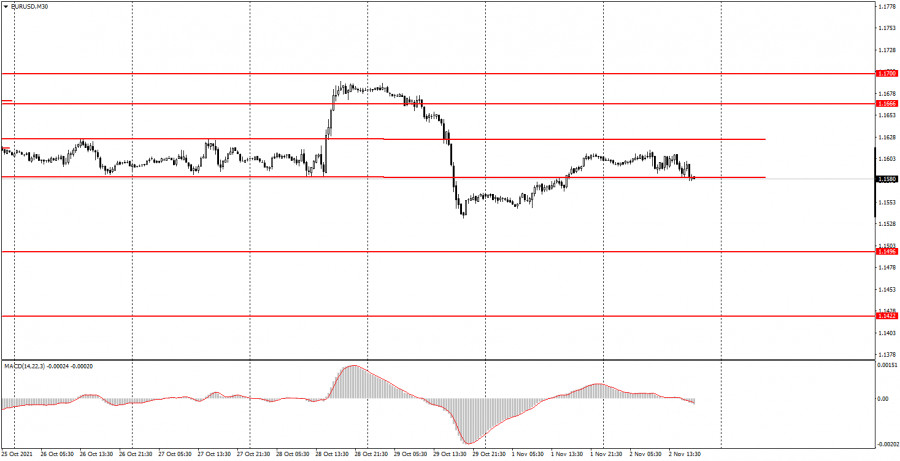

EUR/USD 30M Chart

On Tuesday, November 2, EUR/USD went 38 pips from the low to high which is characteristic behavior of this pair. In addition to low volatility that has become a frequent occurrence, the pair returned to a sideways channel where it had been stuck for several days before breaking out of it at the end of the last week. Today in late trades, EUR/USD was making attempts to breach the lower boundary of the channel, but the trend remained flat due to low volatility. Given the above factors, we still recommend ignoring the MACD signals. As for the macroeconomic statistics, the only event that was worth attention on Tuesday was the Services PMI from the eurozone. The index reading came in a bit lower than expected, so this report caused little reaction from market participants.

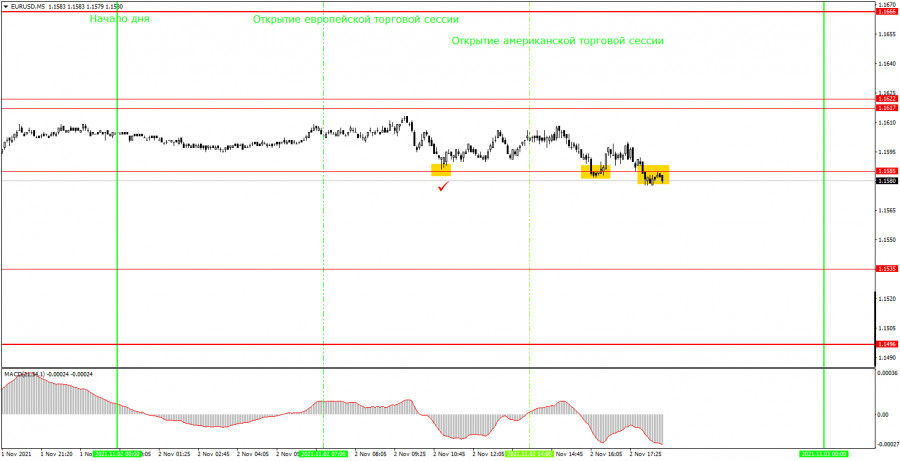

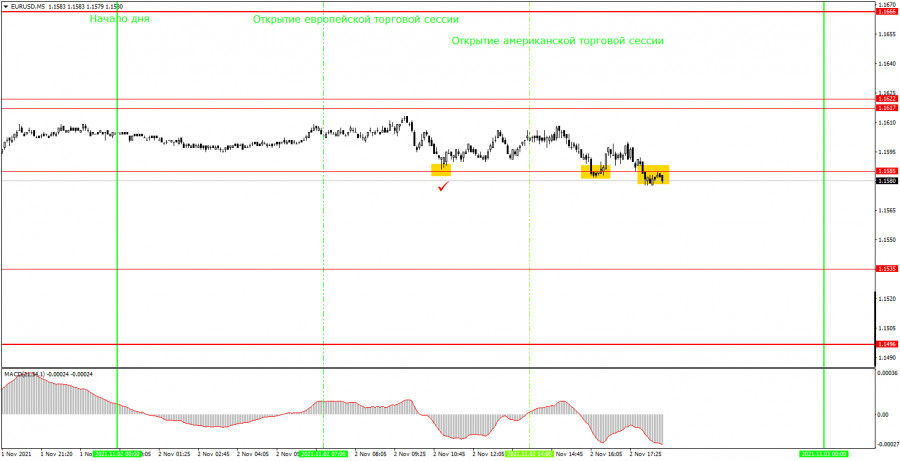

EUR/USD 5M Chart

As seen on the 5M time frame, the movement was rather sluggish on Tuesday. Most of the time, the pair was fluctuating between 1.1585 and 1.1617, i.e. in a 30-pips channel. It even failed to break the channel's upper boundary. In addition to bad dynamics, there were almost no trading signals. Those signals that were formed turned out to be false. Unfortunately, it often happens in a flat trend. Let us remind you that the optimal place to set a Take Profit is 30 pips away from an opening price. Is there any chance that it will be triggered given that the pair moved by just 40 pips? But let us get back to the trading signals that were formed after all. The first one appeared during the European session - it was a buy signal after the price rebounded from 1.1585. Then the price managed to rise by about 16 pips that were barely enough to set a Stop Loss. So, when the price moved lower, my buy trade was closed with no losses. The next signal was formed near the same level of 1.1585 as the price rebounded from it again. But this time, it moved by just 10 pips, so I had to close my buy deal manually after the price went below 1.1585. The last sell signal was useless, as it became clear that the pair is trading flat and two false signals were formed near 1,1585.

Trading plan on Wednesday, November 3

As seen on the 30M time frame, volatility fell to the recent levels, and there is neither any definite trend nor a sideways channel. So it is rather difficult to define the current movement. Trading on the 30M time frame is still inconvenient, and the MACD signals are still better to be ignored. It would be a sound idea to wait for the formation of a trend line or a sideways channel. On the 5M time frame, the key levels for November 3 are 1.1535, 1.1585, and 1.1617 – 1.1622. The Take profit should be set at a distance of 30-40 pips as usual while the Stop loss can be placed at 15 pips away from a current price. On the 5M timeframe, the nearest level can serve as a target unless it is located too close or too far. Otherwise, use the Take Profit. The economic calendar on Wednesday is full of important reports. The United States will unveil the Non-farm Payrolls data and the Services ISM index. At the same time, the EU unemployment report will see the light. Later in the day, the Federal Reserve will announce its decision which will be the key event of the day.

The basic principles of the trading system

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to the Take Profit level or the nearest target levels, then all consequent signals near this level should be ignored.

3) In a flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is a good measure of volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

The MACD indicator (14,22,3) is a histogram and a signal line that signal to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.