The US dollar is gaining in value

Hello, dear colleagues!

In today's review of the main currency pair in the forex market, we will summarize the results of the previous trading week in order to predict the further direction of the quotes. Before moving on to the technical analysis, let's talk about the fundamental factors that had an impact on the dynamics of EUR/USD. In my opinion, there are two main reasons that contributed to the strengthening of the US dollar against the common European currency. The first one is the US Federal Reserve's report on financial stability. This report clearly demonstrated that the US central bank is ready to make changes in its monetary policy, if necessary. Most likely, the regulator will have to tighten policy, since surging inflation does not seem a temporary phenomenon anymore. Moreover, the producer price index is forcing the Fed to revise its monetary policy somewhat. The imbalance between supply and demand is currently one of the main factors for rising inflation.

This week's macroeconomic calendar is bereft of any important releases from the United States. However, the euro area is set to publish revised data on GDP for the third quarter, and European Central Bank President Christine Lagarde will deliver a speech. As for today, data on the euro zone's unadjusted trade balance will be released. Besides, Christine Lagarde will speak. Among today's US reports, it is worth noting the New York Federal Reserve's Empire State Manufacturing Index. Well, now let's move on to technical analysis.

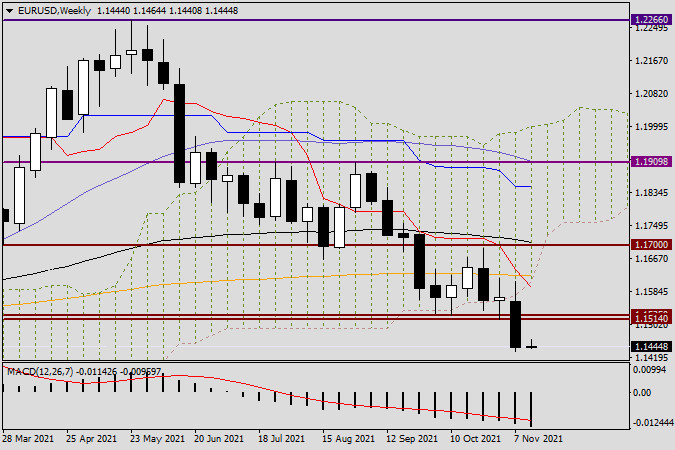

Weekly chart

According to the weekly chart, the euro/dollar pair overcame the key support zone of 1.1525-1.1514 as well as the psychological level of 1.1500. They were broken so easily that it can be assumed that the pair will undoubtedly continue losing ground. Earlier, the pair fell from the Ichimoku cloud indicator. This also points to a possible continued downtrend. The weekly chart shows that the euro/dollar pair has every chance of extending losses. However, the pair's bearish movement is likely to be limited by the support level of 1.1165. Then, bulls will strive to return the quote to the area of the Ichimoku cloud indicator so that it could break through the red Tenkan line and the orange 200-day exponential moving average. However, this still cannot guarantee a continued rally or an upward reversal. Furthermore, bulls will have to overcome the key and strong levels of 1.1700 and the black EMA 89, that is, the level of 1.1714.

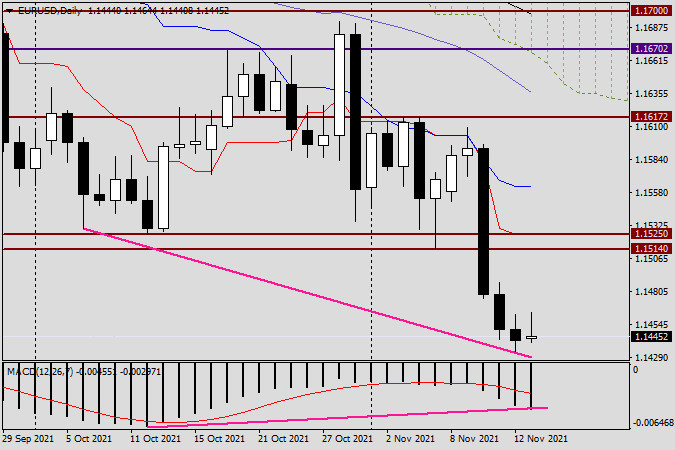

Daily chart

According to the daily chart, I think it is worth taking into account Friday's Doji candlestick and the bullish divergence of the MACD indicator. Besides, given that the main currency pair has made a significant downward movement, breaking through levels of 1.1500, 1.1514, and 1.1525 without any corrections, I think it would be a wise decision to wait for a pullback to the area of 1.1490-1.1525. After reversal patterns form, it will be possible to go short with fairly decent targets. Tomorrow, I will try to give you more detailed information on entry points. Thus, the main trading idea for EUR/USD implies short positions after corrective pullbacks towards the most important psychological and technical level of 1.1500.

May your trading be lucrative!