Bitcoin and ether are breaking rather dangerous levels, targeting the next local lows that can protect them against further declines. However, before analyzing the technical picture of these trading instruments and discussing the future prospects of movement, it is time to mention that the US Internal Revenue Service is going to focus on the cryptocurrency market and its unpaid revenues.

IRS raging

According to the agency's head of criminal investigations, the IRS could seize billions of dollars worth of cryptocurrency next year. All of the investigations are directly related to tax fraud, as well as a number of other crimes.

According to the IRS annual report released yesterday, $3.5 billion worth of cryptocurrency was seized during fiscal 2021, totaling about 93% of all assets seized by the division this year. IRS Chief of Criminal Investigations Jim Lee said that he expected the trend of cryptocurrency seizures to continue in fiscal 2022. He added that with more advancements in this sphere cryptocurrency was evidently involved in a number of crimes and some measures should be taken in that case.

The IRS noted that the unit had seized billions of dollars worth of bitcoins and other cryptocurrencies and tokens that had been used in e-fraud, money laundering, drug distribution, as well as tax evasion schemes. Besides, the report also includes $1 billion stolen from Silk Road, an online bitcoin exchange that was shut down in 2013. The unit also prosecuted a former Microsoft Corp. software developer who used cryptocurrency to hide $10 million he embezzled from the company.

The division is opening an Advanced Collaboration and Data Center in Northern Virginia in 2022 to further develop and oversee this area. Notably, the US Congress recently gave the IRS more power to monitor cryptocurrency transactions. The new law will require cryptocurrency brokers to record transactions and report them to the IRS so that tax authorities will obtain more data about the transactions.

CBDC attracts interest

Moreover, a report from the International Monetary Fund is noteworthy. It acknowledged that the recently launched Central Bank of Nigeria's national digital currency (CBDC) is generating interest from many global organizations, including central banks. However, the fund warns that CBDC carries risks to monetary policy implementation, cybersecurity, operational resilience, and the integrity and stability of the financial system.

The report says that digital naira, unlike cryptocurrencies, involves strict access rights controls by the central bank. Therefore, this asset class arouses considerable interest. Besides, unlike volatile cryptocurrencies, CBDC is tied to physical naira. According to the IMF, due to these characteristics the Central Bank of Nigeria hopes that its CBDC will bring numerous benefits to the Nigerian economy.

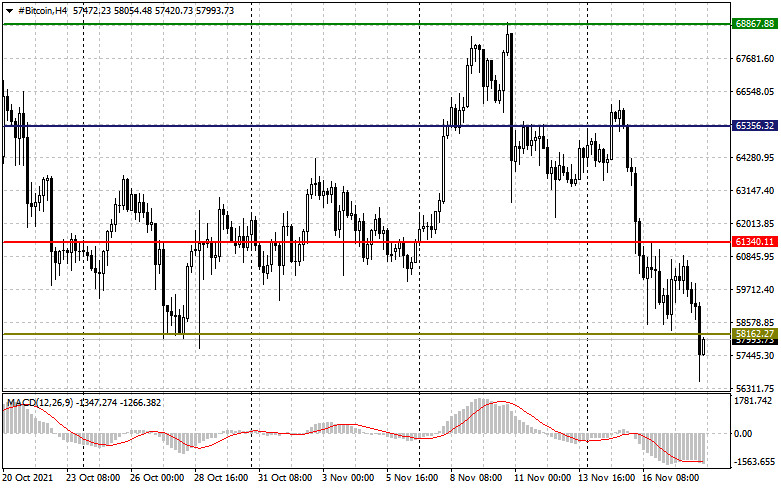

As for technical picture of bitcoin

There are obvious problems with the level of $58,160, which on October 17 buyers of risky assets managed to protect. Its break would constitute a real threat to the bullish rally, observed since July this year, after the bitcoin crash in May. A breakout of $58,160 will open an easy way to the 100-day moving average, passing around $53,000. Slightly above that average there is a level of $54,444 and the moving average will most likely pass there as well until the moment of this range's renewal. Therefore, at the moment it is not necessary to rush to buy the first world's cryptocurrency. It is better to find the way and consider the best point to enter the market. It will be possible to note alignment of the situation in favor of buyers only after the rate will consolidate above $61,300.

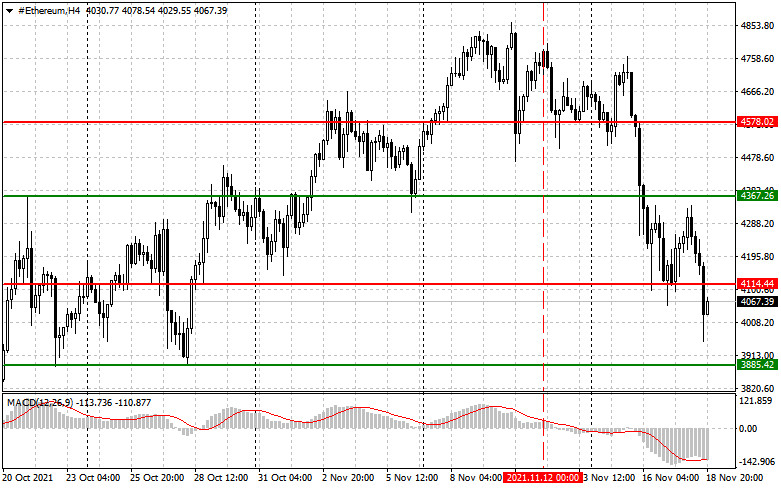

As for technical picture of ether

A breakout of support at $4,114 may only worsen the situation on the market, which will lead to another wave of decline to the area of $3,885 and open a way to $3,600. I advise entering the market from these levels as in case there are major players on the market, the bounces from these levels will most likely be instant. It is possible to admit stabilization of the rate after the ether will firmly fix above the resistance at $4.360, which will allow it quickly return to $4.580.