On Tuesday, the euro had been dropping for the whole day. The pound sterling began moving only after the opening of the US trade. Notably, the Christmas holiday is in full swing in the UK. It means that demand for the pound sterling remains high. However, the euro is also in great demand. Yet, the pound sterling is a real leader. The US dollar was supposed to have started its upward correction since the middle of last week. Sooner or later it will happen. Yesterday, a correction seemed to have finally begun. Unfortunately, the greenback did not gain much from this movement. It showed just an insignificant rise.

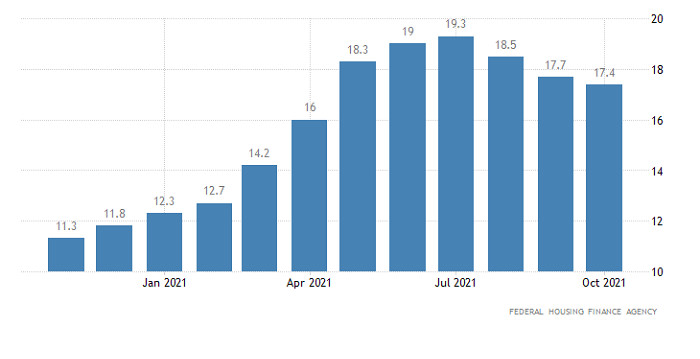

At the same time, the trajectory of the euro clearly indicates that traders simply ignored the US house price index data. The figure turned out to be strong as it decreased to 17.4% from 17.7%, while economists had expected a deeper drop to 16.8%. It is hardly surprising that market participants have ignored this data as it has no significance. This index has a smaller impact on inflation even in comparison to the producer price index.

US House Price Index:

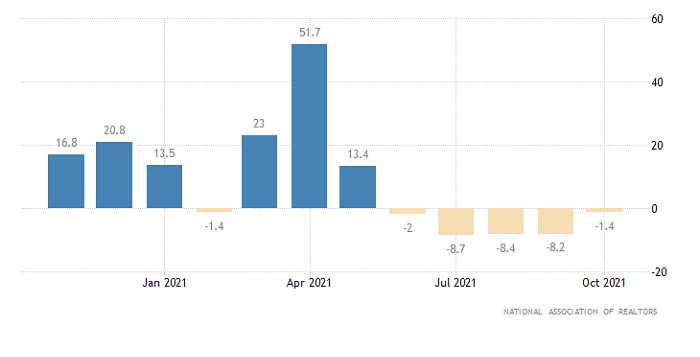

Today, traders are also unlikely to take notice of the Us macroeconomic reports. The US pending home sales are expected to drop by 6.4% compared to a decrease of 1.4% in the previous period. These figures indicate the high likelihood of a decline in home sales, which is a negative factor. However, it is just predictions, not a precise forecast. The Pending Home Sales Index tracks home sales when a contract has been signed but the sale has not yet closed. Such contracts were signed at the end of the month and the property has not been registered yet. This is why this indicator does not really affect the overall dynamic of the real estate market. Hence, traders will focus more on technical indicators, as well as inertial movements. The US dollar is oversold. So, it is likely to grow further. However, it is trading sluggishly.

US Pending Home Sales:

The EUR/USD pair is moving within the 1.1225/1.1355 sideways channel. The channel narrowed significantly within the upper limit. Despite the stagnation, the pair is moving buoyantly within the channel. It may signal market uncertainty.

The Alligator indicator has a sequential intersection with three moving averages (MA) on the 4H chart. It confirms the formation of the narrow range. On the daily chart, the indicator has an intersection with MA. However, the overall trend is downward.

For the eighth week in a row, the RSI D1 indicator has been moving in the lower area (30/50), showing that the downward trend prevails.

Outlook:

Traders should pay attention to the sideways channel where the same pattern has been seen for a long time (constant price reversals). Thus, stagnation within the upper limit will primarily indicate the possibility of a price rebound to 1.1265-1.1225.

The complex indicator analysis gives a sell signal on short-term and intraday charts due to the price rebound from the upper limit of the narrow range. Technical indicators signal a downward movement in the medium term.