No matter how much gold tried to break above $1,815–$1,820 per ounce, the bulls' attempts looked extremely unconvincing. The growth of the precious metal was used for sales, and there is little doubt that XAUUSD quotes will return below the psychologically important mark of 1,800 in the near future.

Having reached an all-time high in 2020 thanks to the colossal monetary expansion of the Fed and other central banks, gold is poised to mark its first red zone close in three years in 2021. The reason is the withdrawal of cheap liquidity by regulators or, in other words, the normalization of monetary policy. If not for Omicron and the associated fears of a slowdown in the global economy, the precious metal would have sunk significantly deeper. However, sellers have an opportunity to catch up in 2022.

Despite the fact that the daily number of coronavirus cases around the world does not get tired of rewriting historical highs, mortality is far from peak levels. According to research by British scientists, the probability of hospitalization with Omicron is 50-70% lower than with Delta. The U.S. is not going to introduce new restrictions, so one should not expect a significant slowdown in the U.S. economy in the first quarter. If so, then the dollar will very soon come to its senses thanks to the divergence in economic growth.

Dynamics of the U.S. dollar and gold

The U.S. dollar's weakness at the end of the year was more related to the Santa Claus rally in the stock market than to the new COVID-19 strain. Lasting five days before Christmas and two days after, stock index gains, occurring in 1 in 4 out of 5 cases, are associated with improved global risk appetite and are forcing investors to sell safe-haven assets such as the U.S. dollar. However, in January everything should return to normal.

It is difficult to count on a serious correction of the EURUSD if the ECB does not think about raising rates, and the Fed intends to do it three times in 2022. The share of the euro is 57% in the structure of the USD index, so the weakness of the single European currency opens the way for the strengthening of the dollar and the fall of XAUUSD quotes. Unless, of course, the yield of U.S. Treasury bonds makes adjustments to such a scenario. In 2021, it grew significantly less than expected, which kept the precious metal afloat. The situation risks changing next year.

The monetary expansion of the People's Bank of China, dissatisfied with the slowdown in China's GDP, is fraught with an increase in demand for commodities and a further acceleration of inflation. The global economy is returning to the inflationary regime of the 1970s, and this circumstance forces the Fed and other central banks to adhere to aggressive monetary restrictions. Debt rates will rise not only in the United States but throughout the world, which creates serious problems for the bulls on XAUUSD.

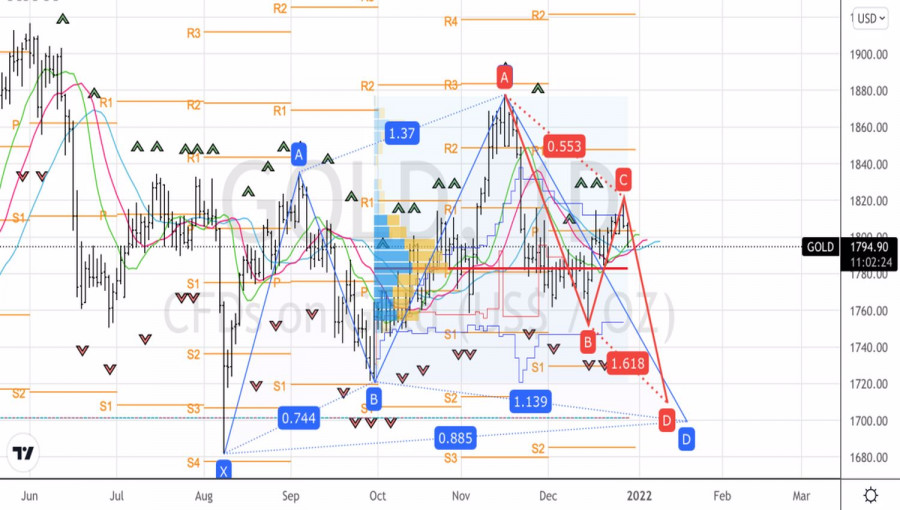

Technically, the 161.8% and 88.6% targets for the AB=CD and Shark patterns, located in the $1,700–$1,710 per ounce region, remain relevant. The recommendation is to sell gold.

Gold, Daily chart