What to expect today on Forex7

Greetings, dear traders!

On December 29, the euro/dollar pair resumed an upward movement. However, it will hardly alter the long-term outlook for the pair, At least, technical indicators remain unchanged. I would like to note that the greenback felt even despite a rise in US Treasury yields. I draw attention to this fact in previous articles on EUR/USD. The fact is that the government bond yields do not always support the US dollar, boosting its upward movement. In the second half of yesterday's trading, the greenback dropped across the board. At the moment of writing this article, the US currency is winning back some of its losses.

Now, let's move on to the economic calendar and see what events may influence EUR/USD. To begin with, yesterday's data on pending home sales in the United States came out significantly worse than expected. The reading totaled 2.2%, while economists had projected a figure of 0.6%. As there are no other fundamental factors, this negative report also pushed the US dollar lower. Today, investors will focus their attention on the initial jobless claims report as well as the Chicago Purchasing Managers' Index, scheduled for 16:30 and 17:45 MSK, respectively.

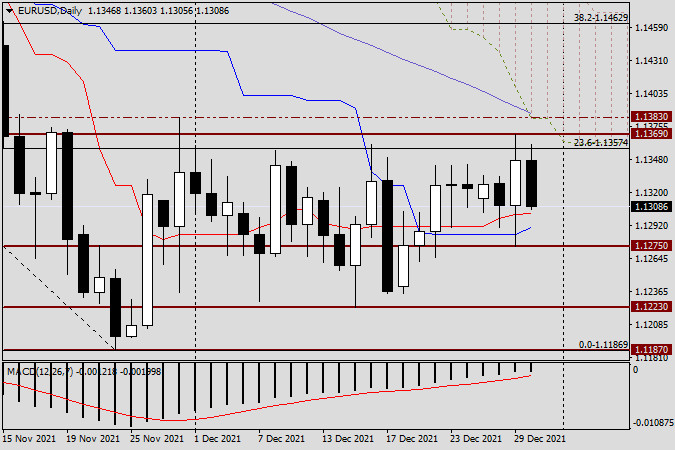

Daily

In every article, I pay attention to the Tenkan and Kijun lines of the Ichimoku indicator. As clearly seen on the EUR/USD daily chart, it was the red Tenkan and the blue Kijun that stopped the attempts of bears to take the upper hand. They provided support to the pair. As a result, the pair revered upward from the strong level of 1.1275. It finished yesterday's trading session above the important level of 1.1300, rising higher. The euro/dollar pair has been trading around this level for some time. Bears are trying to push the quotes below 1.1300. However, bulls always return the pair above this level. Today, it is likely that bears will try to push the pair gain below these lines of the Ichimoku indicator below the blue Kijun line, which is moving at 1.1290. However, to exert pressure on the pair, bears need to drag the pair below the support level of 1.1275, the low of yesterday's trading.

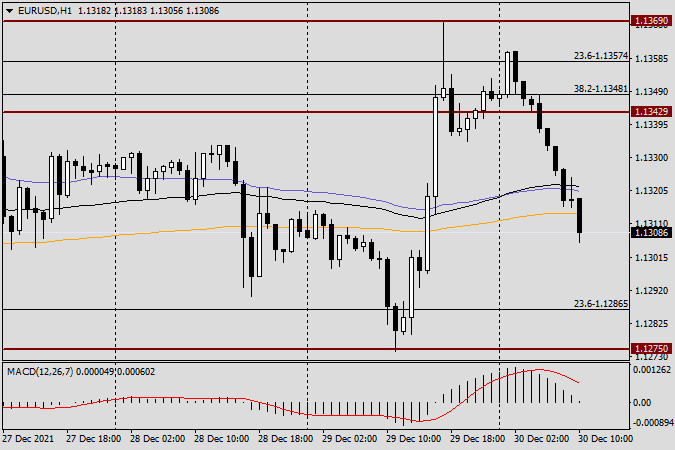

H1

As a result, my trading tips to open short positions in the area of 1.1370-1.1383 turned out to be correct. I also recommended opening long positions if the price tumbled below the 1.1300 mark. It always brings joy when your forecasts come true, especially in such an unpredictable and thin market. What to expect today? Today, it is better to open long positions from the 1.1290-1.1280 price zone after the candlestick signals appear on the 1H or the 4H charts. It is a little late to open short positions now. Please, bear in mind that these are my predictions. not a precise forecast. However, those who want to sell the EUR/USD pair should wait for a rebound to the 1.1320-1.1330 area and the bearish candlestick. Place your short positions with small targets of about 25-30 pips. I recommend pacing approximately the same targets for long positions as well.

Good luck!